Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

The soccer price for the Lion and Player is soft. I hate each of my arcu lorem, ultricy kids, or ullamcorper football.

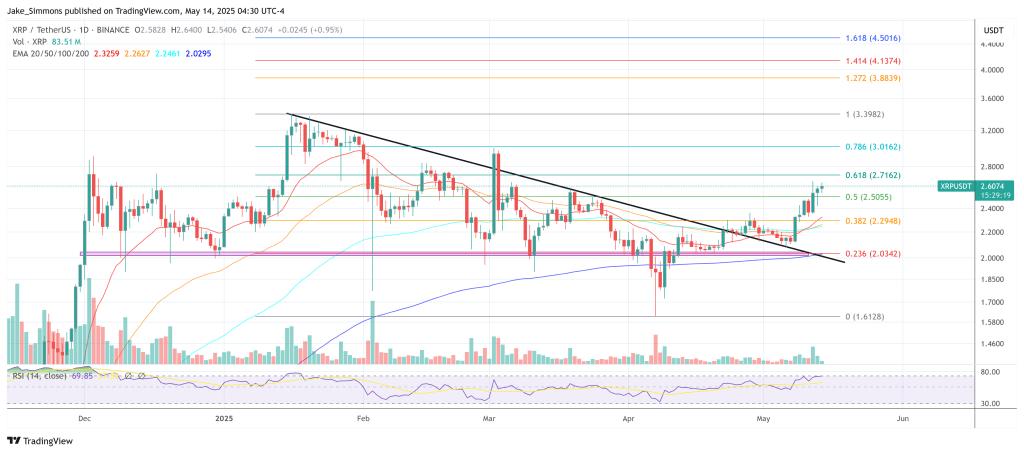

Veteran Wave Engineer BigMike7335 (@michael_ewpro) claims that the XRP token just completed a textbook reversal on his daily chart. In a post accompanying the chart below, the strategist said, “While we’re excited about the coin being added to the ES, XRP has decided to break out.”

XRP breakout confirmed

Bit stamps with daily annotations show The price returns to $2.5717, earning 21% profits over the past seven sessions, and will lift the token decisively through the six-month neckline, above $2.40. Its horizontal barrier, which turns red on the chart, coincides with the top of the cloud, which is thin and is held downward. To conclude Thursday, we placed candles not only on spiders, but also on top of 50-day EMA (orange), 100-day EMA (aqua), and 200-day SMA (dark blue), stacking moving average ribbons into a classic bullish composition.

The thrust is complete Reverse head and shoulders It formed a larger five-wave advance internal wave (IV). April Swinglow was tagged at 0.382 Fibonacci retracement for the entire impulse from November to February for $1.56732. That corrective leg wave “C” created a patterned head with symmetrical shoulders from mid-March to early May. Arithmetic measured from the formation’s $0.80 depth project – the microphone box target is $3.57638, with a white arrow finishing on his chart accurately, and dashed vertical lines can be identified on Wednesday, June 18, 2025.

Related readings

Market profile data on the right flank strengthens the case. The heaviest volume nodes (green and tambour) are between $2.30 and $2.50. In other words, breakout thrusts have already cleared the largest historical order flow zone. Profiles over $2.80 have become dramatically diluted; Previous cycle Upper channel rails are nearly $3.00, and ultimately $3.57.

Momentum measures movement. Daily RSI has recovered 60 lines and is actively rising without entering the territory that was still bought. Meanwhile, the stochastic oscillator punches the signal line and accelerates towards the upper band.

Related readings

The major risk markers remain below: Dashed line support at $1.66027 (the bottom edge of the enlarged wedge until December) is a key key. If you don’t maintain that level, Breakout paper. Until then, the charts have offered bullish traders a classic post-neckline retest scenario, with analysts looking at $3.57 as the wave’s technical endpoint (v).

For now, the XRP Bulls have a structure that ultimately justifies optimism. And, as the big microphone points out, they did it on Tuesday while the rest of the market was distracted by including Coinbase (Coin) in their S&P 500.

At the time of press, the XRP traded for $2.60.

Featured images created with dall.e, charts on tradingview.com