The President of the United States, Donald Trump proposes to terminate government contracts, received by Elon Musk’s company.

Today, Trump published on Truth Social (the social network that directs his own company, Trump Media): “The easiest way to save money on our budget is to close Elon’s grants and government contracts. After these statements, Tesla’s actions – the company that Musk founded and overseen – fell by about 20%.

And Musk was not silent. Through X (the social network he owns), the businessman from South Africa replied: “Go ahead, Allegme is that day.” He then began an explosive charge. Trump appeared in a file related to Jeffrey Epstein and said this is why they weren’t publicly available. Furthermore, in a tweet, Musk suggests that Trump should be rejected.

The link between the two characters had a crack as the president attacked who his advisor was. I deliberately criticised the new fiscal package. Trump said he asked Musk to be “infatuated” with an “electric vehicle order that forced him to buy an electric vehicle that no one else wanted.” Musk denied that version and described it as a “lie.”

Trump first expressed his dislike of masks earlier this Thursday, saying he was “disappointed” by businessmen’s criticism of the bill as he cuts financial credits for electric vehicles.

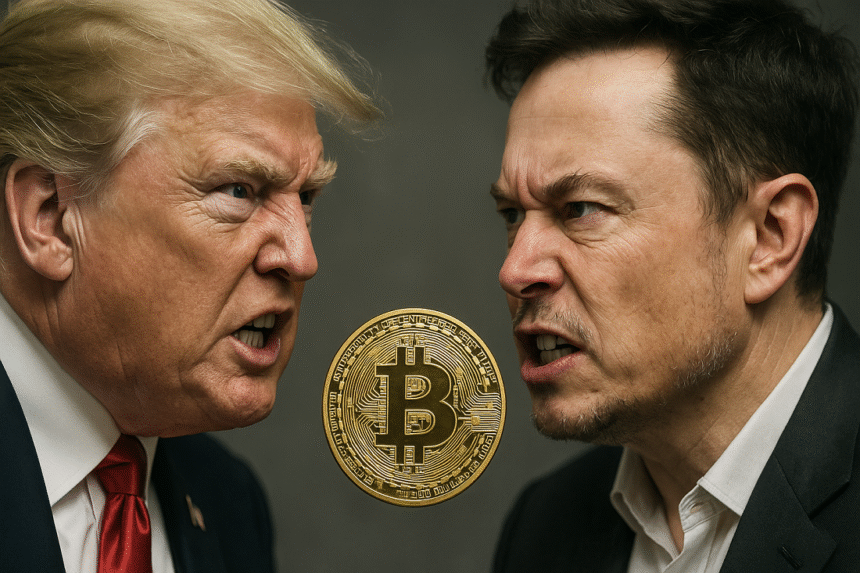

This public and unprecedented conflict between Donald Trump and Elon Musk Generates strong turbulence in the Bitcoin ecosystem. The possibility that Trump was a key promoter of ProBitcoin’s policy has been politically weakened after Musk’s accusations, or faced legal consequences, whining uncertainty among investors. In an environment where government support is leaning market balance, the fear of the ultimate burst of current institutional impulses over Bitcoin begins to be reflected in prices.

In this regard, Bitcoin is dangerously close to the $100,000 zoneas shown in the graph below:

Geopolitical tensions, the possibility of erosion of Trump’s presidential figure, and the collapse of trust in some iconic companies, have urged investors to remove unstable assets such as BTC. The market, which celebrated each Trump wink towards digital currencies, is now at the risk that this support is right at the greatest euphoria.