On Thursday, Bitcoin (BTC) prices immersed under $101,000 as US President Donald Trump and the world’s wealthiest man, Elon Musk, shook the US financial markets. However, in the last 48 hours, Maiden’s cryptocurrency has registered over $105,000 rebound climbing before sliding into sideways. Among these developments, popular Crypto analysts using X’s pseudonym KillaxBT outlined multiple scenarios for Bitcoin’s next price action.

Behind Bitcoin rebounds from $100,000

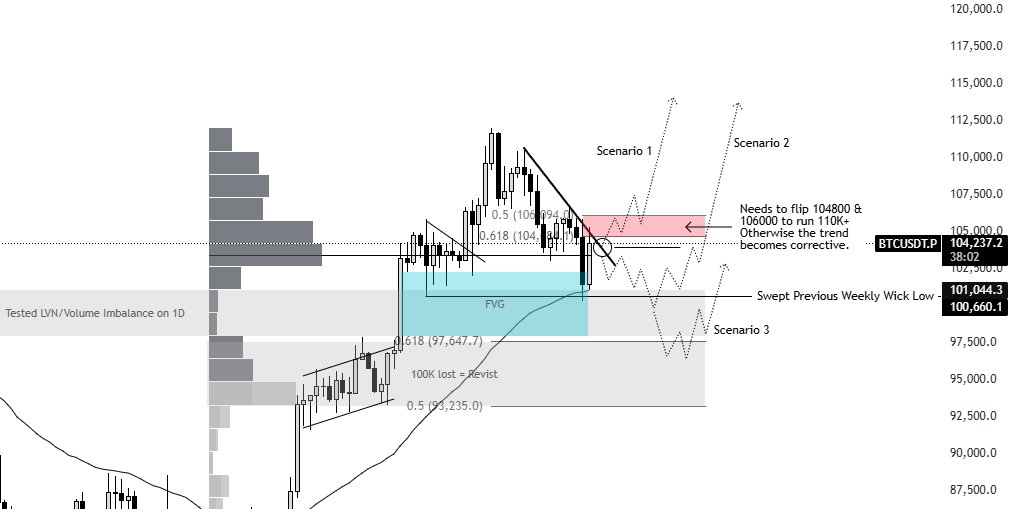

in xPost On June 7th, KillaxBT will provide a deep technical analysis of the Bitcoin market, discussing recent price rebounds and potential developments. After hitting a new all-time high of nearly $112,000 on May 22, BTC fell to the $100,000 price range, an estimated 10% dropping to the $100,000 price range before it became a recent rebound in the last two days.

Killaxbt explains that this rebound was driven by a combination of technical and market factors rather than random. These factors include imbalances in volume filled with prices that are left on the chart.

Additionally, there was a liquidity sweep as the steady decline in Bitcoin caused many stop losses from long positions, where prices below the previous weekly lows. The development created a flush of liquidity for the major players who served as fuel in driving market rebound.

Finally, KillaxBT discussed in a short squeeze setup, and the Bitcoin market was shortened when the Bitcoin market expected an even more downside following an initial price bounce from $100,000. When prices began to rise, these short traders had to buy back to cover their losses.

What’s next for BTC?

Looking ahead, KillaxBT highlights three potential scenarios for BTC. Currently, analysts say they are retesting the resistance zone between $104,800 and $106,000, which coincides with the recent price decline of 0.5-0.618 Fibonacci retracement levels.

In the first scenario, Killaxbt foresees bullish continuity only if it holds above this region of resistance. Such a move could lock the short seller up again and further promote more upward momentum.

However, if Bitcoin is facing rejection in this specified area of resistance, a second scenario would appear, with the price likely to be retested with a lower support level of $100,000. The third final scenario, the worst scenario, includes a price break below the $100,000 major Bitcoin to retest the support zone around the $97,000 price region.

Interestingly, KillaxBT’s personal predictions are hoping that market makers will continue to raise Bitcoin prices, taking advantage of the recent sharp rebounds that have escaped short traders recently. With no clear “safe” long entries yet, analysts suggest that pushing prices further will lock in more short sellers while also forcing bystanders to chase after the rally.

At Press Time, BTC continues trading at $105,600, reflecting a 1.16% increase over the past day.

ISTOCK featured images, TradingView chart