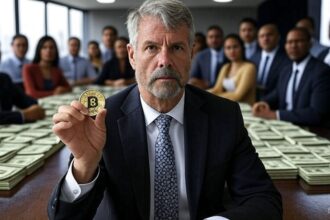

Blockchain Group, a pioneer of French companies in the accumulation of Bitcoin (BTC) as a financial asset for European companies, has announced the acquisition of 60 btc more for 5.5 million euros.

The business will raise its holdings at 1,788 BTC, reflecting its solid commitment to expansion plans in the digital currency market.

The purchase was funded through a variety of strategic operations. Among them, Blockstream CEO Adam Back signed more than 2.1 million shares for 1.16 million euros. 13 What you can get BTC.

French assets manager Tobam has donated approximately 143,000 euros by subscribing to 262,605 shares. Funds allocated for another 13 BTC purchase. Additionally, the company issued more than 1.1 million shares during exercise. warrant BSA 2025-01, financial instruments that grant the right to buy stocks at default prices, capture 600,000 euros to acquire 6 BTC.

Finally, market-type capital expansion (ATM) using Tobam allows you to sell stocks directly in the market at current prices. 41 Injected 4.1 million euros used to buy BTC.

These businesses have strengthened the Blockchain Group’s financial position, reporting a 1,270% Bitcoin yield, equivalent to 508 BTC or 46.7 million euros in 2025.

Strategies also promote the value of their actions (the value of their actions) Ticker The stock market is altbg), which has now turned from 0.31 euros in January to 4.2 euros today. 1,254% growth in 6 months.

Blockchain group bets with Bitcoin reflect global trends. As reported by Cryptootics, more and more companies in Latin America, Asia and Europe are integrating BTC into the Treasury Department as a strategic preparation.

Despite its volatility, the institutionalization of Bitcoin suggests that its adoption is accelerated worldwide.