This week’s Bitcoin climbs above $110,000, rekindled a new round of bullish calls. The price reached $110,150 on July 3rd, and was traded a little in the past The $108,000 level Lastly I checked and showed a small DIP of 0.41% over 24 hours, but increased by 1.20% over 7 days.

Related readings

This stable move has drawn voices from social media and sparked debate about whether Bitcoin is really at a low price or at risk of falling below important levels.

Undervalued at $110,000

According to Altcoin Daily, $110,000 of Bitcoin is “Underrated,” analysts argue there’s plenty of room to run. Fans support his bold claims. A $1,000,000 Dream Go down the road.

$110,000 Bitcoin is undervalued! (Screenshots of this)

– Altcoin Daily (@altcoindaily) July 3, 2025

Other users pushed back and asked how on-chain data or metrics backed up this view. They point out that no actual breakouts have been confirmed until Bitcoin clears the resistance at $110,500.

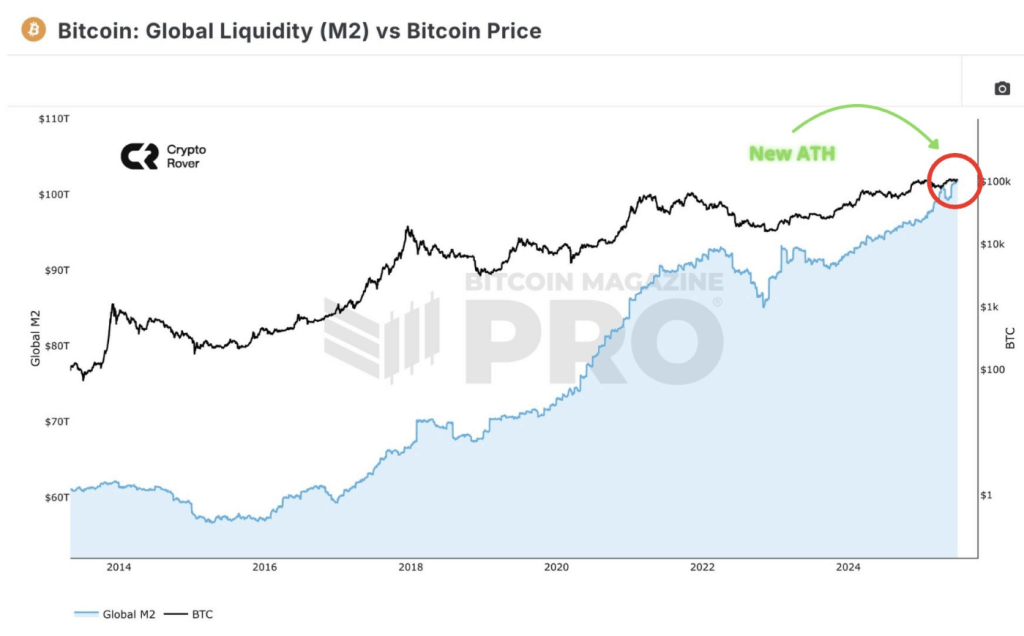

Global liquidity is increasing based on reports from Market Trackers. Market observers can take it and push Bitcoin high saying there is more cash floating around.

Rising liquidity often burns a major movement in risky assets. Still, traders are focusing on futures funding rates and miners’ sales pressures, looking for clues when pullbacks are being brewed.

Global liquidity has become a new ATH.

Bitcoin continues! pic.twitter.com/gh1kl2d1zw

– Crypto Rover (@rovercrc) July 3, 2025

Mixed view online

Some followers argue that inflation and new tariffs could weaken Bitcoin rallies. Others should note that the central bank purchases time before hiking at any rate.

The back and force of social media reads like a mini warroom, with short comments and deep threads floating around. There are many voices, but there are few difficult answers.

The bulls of the past run

Altcoin Daily was also not shy about past calls. Just a few days ago, they said that once Bitcoin exceeds $150,000, investors hope to buy more at a lower price. Such hindsight talk can be upsetting, but the charts and macro calendars here and now are the same.

Executives call hedge

Based on the comments of Matt Hogan, Chief Investment Officer of BitwiseNow may be a good time to buy Bitcoin. Hougan pointed to Ray Dalio’s warning about US debt. This is swelling above $7 trillion in annual spending on $5 trillion in revenue.

With each household on the hook for around $230,000, Dario says holding Bitcoin could serve as a hedge against future money risks.

Related readings

Price action on crosshairs

Investors watch both price action and most events. A solid break above $110,500 can draw more buyers. However, if the inflation surprises are turned upside down or tariffs get more intense, the odds can change quickly.

For now, the Bitcoin story is still unfolding. And for the next few days, I was able to say a lot about where it was heading.

Meta featured images, TradingView chart