After a sharp climb last week, today’s Ethereum prices are just below the $2,600 mark. The short-term structure forms a tough range as buyers try to maintain the moving average of the keys while watching the volume signal for potential breakouts that outweigh local resistance.

What will be the price of Ethereum?

Ethusd Price Dynamics (Source: TradingView)

On the 30-minute and 4-hour chart, after a sharp breakout on July 6th, Ethereum Price has consolidated between $2,560 and $2,590. Prices remain above the VWAP and Parabolic SAR Flip levels, approaching $2,572 and $2,565. This suggests continued buyer interest despite the lack of immediate momentum.

Ethusd Price Dynamics (Source: TradingView)

The 4-hour Bollinger Band is slightly expanded, allowing the ETH to stretch higher without immediately rejecting it. Notably, prices exceed EMAs of 20, 50, 100 and 200, and now stack up in bullish alignments between $2,541 and $2,497. This dynamic cluster provides greater support and hints at potential continuity setups.

Why are Ethereum prices rising today?

Ethusd Price Dynamics (Source: TradingView)

The mildly upward bias of today’s Ethereum prices is supported by the preferred combination of momentum and derivative positioning. On the 30-minute chart, the RSI is held at 56.2, showing moderate bullish momentum without over-purchase. MACD is close to neutral crossovers, suggesting integration rather than active sales.

Ethusd Price Dynamics (Source: TradingView)

From Smart Money Concepts (SMC) views, ETH holds the latest BO (structure breakage) and internal chotch levels at nearly $2,540 above, but it forms about $2,600. This provides a bullish context if prices can be closed above $2,590.

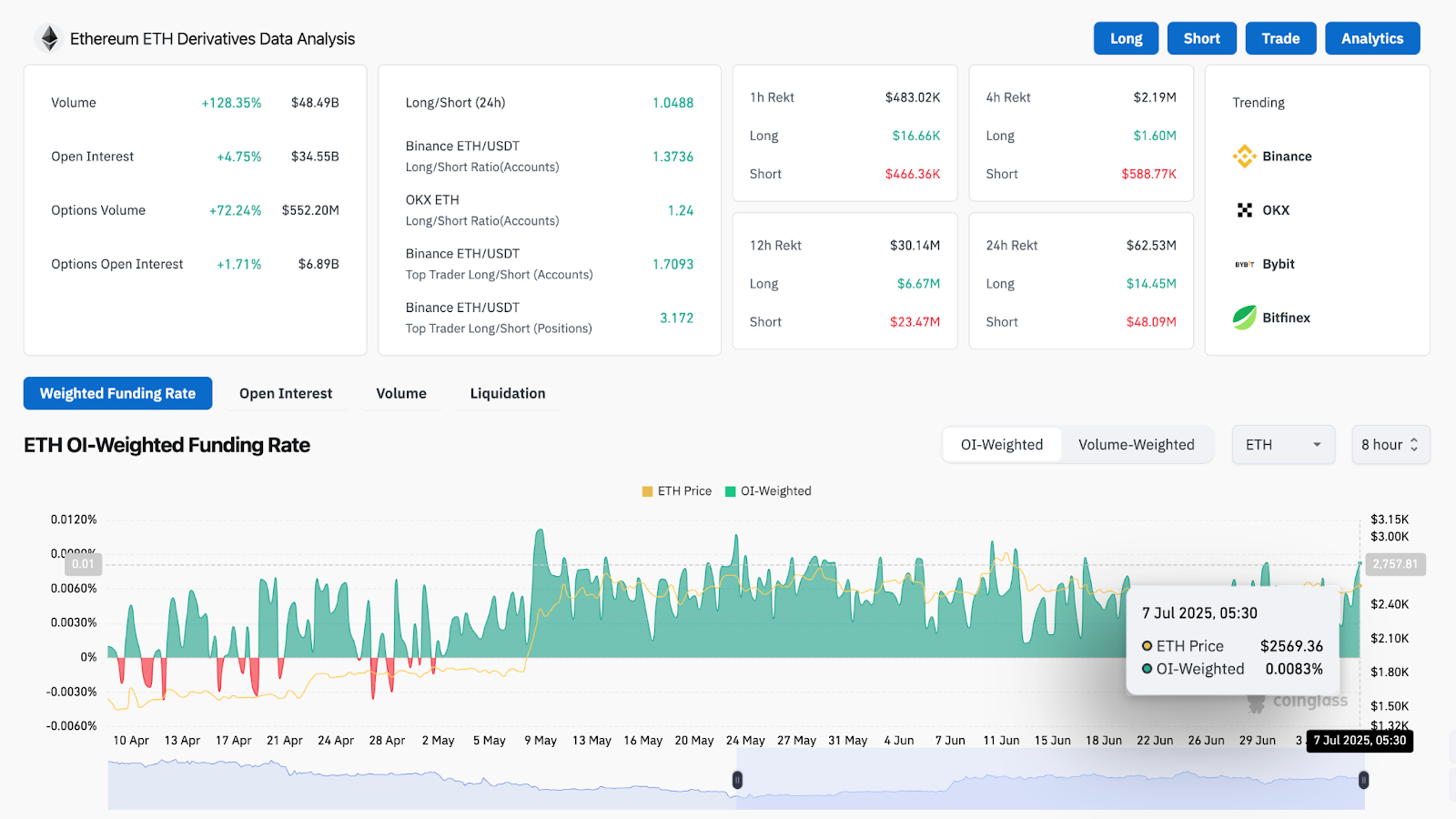

ETH derivative analysis (source: Coinglass)

In the derivatives market, Coinglass data shows a 128% rise in ETH trading volume to $48.49B, with nearly 5% increase in open interest and 72% increase in option volume. The Binance Top Trader Long/Short ratio is significantly skewed (3.17), reflecting long-standing emphasis on positioning and continued rise.

ETH price indicators indicate possible compression breakout

Ethusd Price Dynamics (Source: TradingView)

The daily chart highlights ETH that is integrated on top of the Bull Market Support Band ($2,194-$2,407) that played in June. This historically serves as a macro trend guide, and keeping the price on top of it adds confidence to the current bullish setup.

Ethusd Price Dynamics (Source: TradingView)

Meanwhile, the Fibonacci pivot level on the daily chart shows ETH trading near PF1 0.5 S support (~$2,582) within the ascending channel. Once this base is retained, it is more and more likely to move to R3 ($2,697) and R4 ($2,908).

Ethusd Price Dynamics (Source: TradingView)

From a long-term perspective, the monthly chart reveals that ETH is fighting a key intersection of the trendlines that is close to $2,550. Monthly closures above this zone confirm macro breakouts and unlock towards the next major liquidity pockets: $3,284 and $4,089.

ETH Price Forecast: Short-term Outlook (24 hours)

Currently, Ethereum prices fall into the squeeze zone between $2,565 and $2,595, with some daytime wicks trying to infiltrate higher. A successful breakout with volumes above $2,600 could open doors heading towards $2,697 (R3) and $2,745, leaving pre-supply thick.

On the downside, failing to hold $2,560 could prompt a retest of the EMA cluster to around $2,540 and $2,514. Under that, a deeper pullback could target a support zone of between $2,475 and $2,500, which is tailored to previous VWAP levels and intermediate bollinger support.

Given the tightening range, bull derivative bias, and macro support recovery, ETH appears to be wrapped around for movement. Traders should be aware of volume expansion and breakouts above the $2,600 level to confirm continuity.

Ethereum price forecast table: July 8, 2025

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.