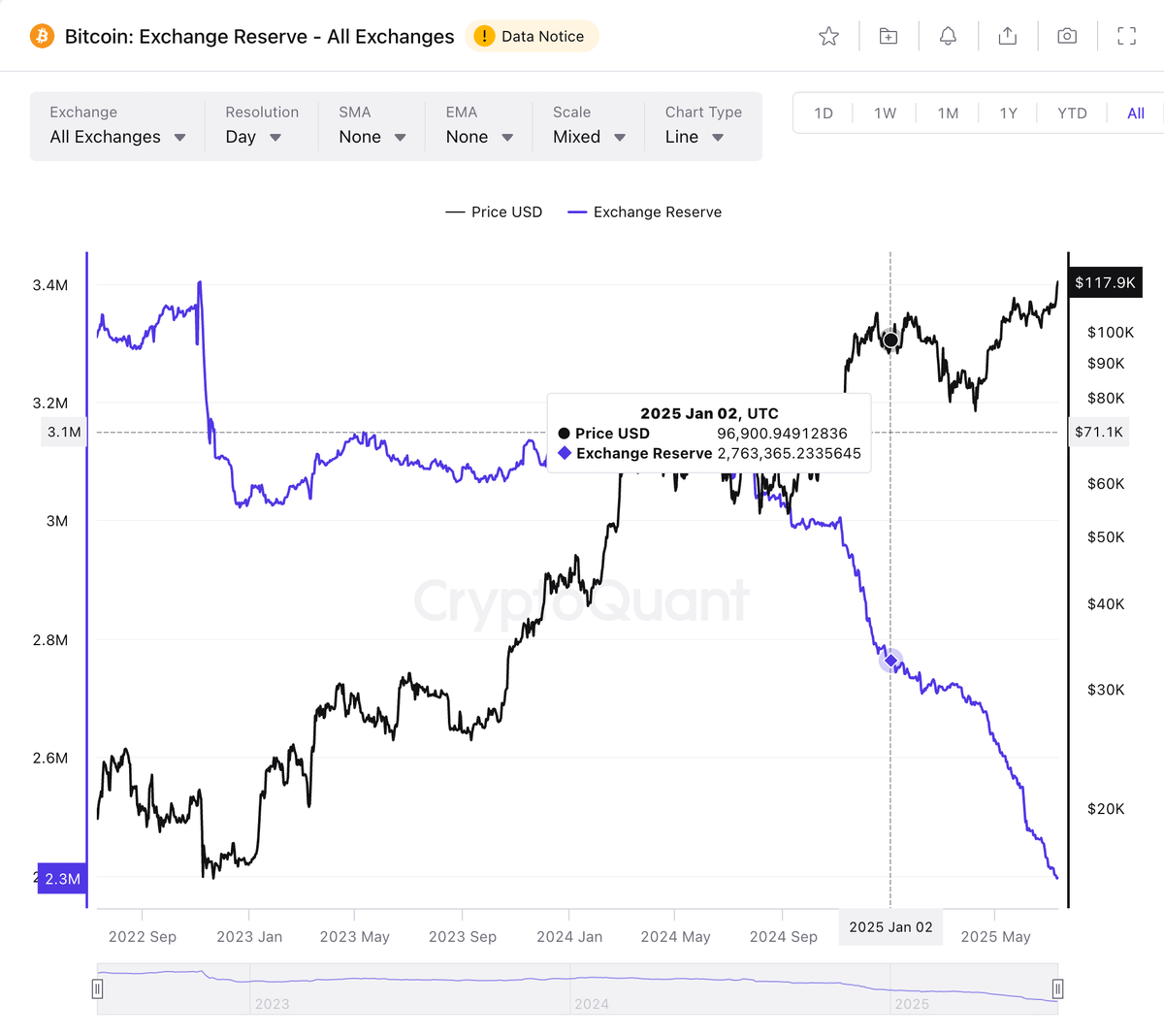

According to new data from Cryptoquant, investors are steadily pulling Bitcoin Holdings from centralized exchanges, with over 360,000 BTC bookings since January 2025.

This trend shows a major shift towards independence and long-term retention of investors as they gained momentum after Bitcoin price exceeded $96,900 earlier this year.

Will retail participation in exchanges decrease?

The decline in Bitcoin on the Central Exchange (CEXS) reflects a significant change in investor behavior in the first half of 2025. Based on analysis by on-chain researcher @AI_9684XTPA, the reserve reduction is above 360,000 BTC. At current values, this is worth around $42.8 billion.

Related: Corporate Bitcoin Holdings will skyrocket to $85 billion. Are you promoting growth?

This decline came alongside the price rise of Bitcoin, which reached $96,900 on January 2, 2025.

In particular, investors mean moving assets off the exchange, but often means storage for use on long-term or distributed finance (DEFI) platforms. As of this reporting time, Bitcoin is currently trading at a new all-time high of 118,255, an increase of 6.4% over the past day.

Chart data confirms ongoing trends

Cryptoquant visual data confirms that exchange reserves have been steadily decreasing since the second half of 2024. This figure is currently reaching multi-year lows, starting from around 34 million btc in 2023. This long-term downward trend suggests that more users prioritize self-supporting over centralized storage solutions.

The chart also shows that Bitcoin prices continue to rise while reserves are falling. This divergence supports the theory that a decline in exchange supply may contribute to bullish price momentum.

OKX backs trends with net inflow

Despite the broader withdrawal trend, OKX, one of the top five exchanges by BTC volume, has reported a net inflow of Bitcoin in the last 24 hours. This sets it apart from other major exchanges where BTC spills continue to be seen.

The influx may be related to the launch of OKX’s BTC Alde+ product. Designed to preserve capital while providing interest returns, this product allows for flexible deposits and withdrawals. This could appeal to users looking for a balance between revenue and accessibility.

Institutions’ Bitcoin holdings skyrocket above 850,000 BTC

In particular, the decline in BTC on the exchange is consistent with a surge in institutional interest in Bitcoin. Asset managers who use spot Bitcoin ETFs and public companies are accumulating BTC at unprecedented rates.

According to data shared by X’s Kyle Chase, by mid-2025 in 2024, the number of public companies holding Bitcoin had risen from 64 to 151. These companies currently collectively own more than 850,000 BTC, worth more than $85 billion. Strategy (formerly MicroStrategy) leads the pack with 580,995 BTC. Marathon Digital, Block Inc., Tesla and GameStop are among other well-known corporate holders.

This trend underscores the role of Bitcoin as a long-term financial asset for companies seeking strategic exposure amid in inflation and Fiat’s uncertainty.

Related: Binance users have dropped out of $223 million tether and Bitcoin Holdings to buy more Etherum

Meanwhile, institutional exposure via spot Bitcoin ETFs on the US list also rose sharply after regulatory approval in January 2024. By mid-2025, the ETF had approximately 1.43 million btc, and approximately 6.84% of its total Bitcoin supply. BlackRock’s iShares Bitcoin Trust (IBIT) controls the ETF space, exceeding 702,055 BTC.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.