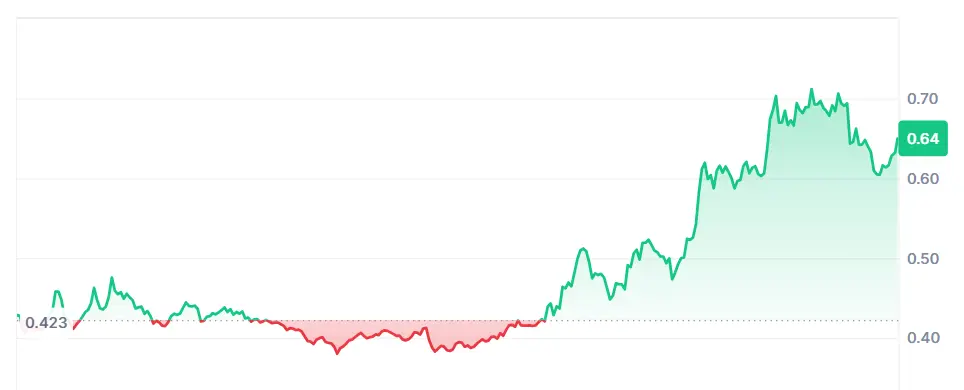

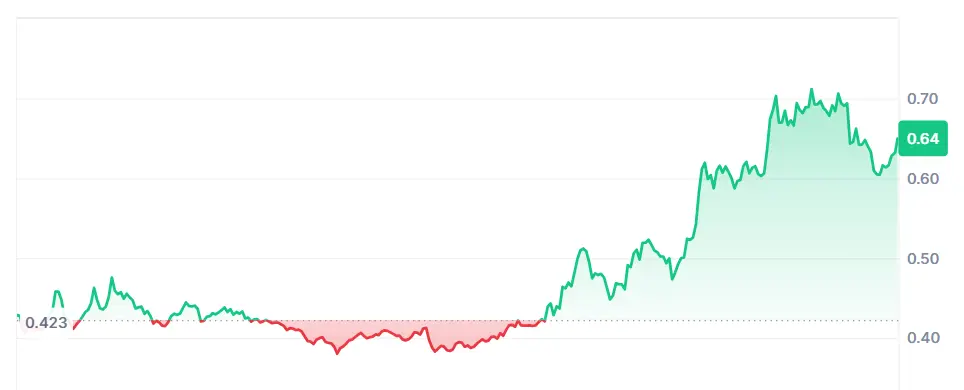

Newton Protocol’s Newt Token prices are currently rising sharply, closing at $0.70 after a rise of 86.7% in the last 24 hours. Newt also saw a 1,070% increase in 24-hour trading volume, currently at $1.688 billion.

Token surges are aligned with the wider Altcoin momentum, with Bitcoin (BTC) being outperformed by major altcoins and widely driven by capital turnover from major cryptocurrencies to those with lower trading volumes and market capitalization.

Developed by Magic Labs, Newton Protocol is an Ethereum and Binance Smart Chain-based automation layer for on-chain finance operations that leverage advanced technologies such as trusted execution environments (TEE) and Zero Knowledge Proof (ZKPS) to prove the accuracy of all off-chain decisions. The platform’s goal is to turn transaction automation into the greatest proof of trust and unlock agent finance across multiple blockchains.

Newt Price is BNB’s biggest hit ever, exceeding $800

Newt’s rally could be attributed to BNB’s surge on July 23rd, after a surge of over $800. Binance founder Changpeng “CZ” Zhao thanked the developers and users for helping them build the ecosystem with XPost. He also teased that the Altcoin season was officially launched, with BNB taking part in market rallies that are strong in ETH, SOL, XRP and more.

CoinMarketCap has an ALT Season Index function. I don’t know how accurate it is, but it does click.

FOMO season soon…https://t.co/pwyzuhuexv

– CZ🔶BNB (@CZ_BINANCE) July 23, 2025

The BNB chain’s market capitalization surged to $111 billion that day, allowing BNB to regain its fifth spot among the top cryptocurrencies. Meanwhile, the open interest (OI) on BNB futures contracts also surged 23% to $1.27 billion, reflecting strong bullish sentiment betting on prices to rise to prices.

In another X post, CZ shared the Altcoin season index and shared: “Foot FOMO season soon”. The index, which determines the odds for arrivals for the Altcoin season, increased its six points by 56 points on Wednesday.

This surge is strongly supported by an increase in daily trading on Binance Smart chains ranging from 4 million to over 14 million, bringing the Decentralized Exchange (DEX) volume to $190 billion per month. The network has seen more than $11 billion in Stablecoin inflows, indicating a growing investor confidence in BNB.

Newton Protocol has skyrocketed 90% since Binance debuted in June

Newt Tokens launched on June 25 amid widespread concerns about insider trading and unequal token distribution. The project has best-in-class disclosure standards and transparent documents, with a total supply of 1 billion, with 215 million newts currently in circulation.

Newt’s key strength is the elimination of insider trading, blocking traders with distributed exchanges (DEX) that dump tokens before official listing announcements. As a protocol that allows secure AI automation to fully control crypto assets, Newton addresses the issues of technical trust through verifiable AI agents, and Newt token embody economic trust through a transparent token distribution mechanism.

Binance announced the Newt list on the platform through the Hodler Airdrop campaign on June 24th, with deals beginning the same day. The exchange was allocated 105.5 million tokens for distribution through airdrop, particularly targeting users who own BNBs in simple acquisition or on-chain programs.

Newt was listed in exchange in multiple trading pairs, including USDT, USDC, BNB and ETH, shortly after AirDrop. Token availability in both the BNB chain and Ethereum was important in stimulating early trading volume and subsequent demand.

Following on to Binance Exchange Debut, Newt witnessed a surge in value by 40%, showing strong investor trust and community involvement. The continued positive momentum is driven by the fact that Newton’s protocol is supported by venture capital heavyweights such as PayPal Ventures and Polygon Ventures.

Read again: Bitcoin Layer 2 Merlin Chain (MERL) fuels major infrastructure upgrades and surges 16% in 24 hours

Newt prices target $0.82 as the peak of trading volume and active addresses

Newt broke seven-day resistance on July 23rd for $0.45, sparking algorithms and retail purchases. The seven-day RSI of tokens stands in an over-position of 85.28, indicating intense speculative interest as shown by trading volumes that surge to $1.6 billion and number of active addresses in the Newton Protocol. MACD shows a bullish crossover, with the Bollinger band expanding on the four-hour chart, suggesting an even higher price hike.

This pattern coincides with the symmetrical triangle breakout that precedes historically strong gatherings. Newt’s short-term price target is $0.82 if it can hold ongoing bullish momentum, according to technical analysis.

At the time of writing, Newton Protocol (Newt) has traded at $0.6439, up 54.82% over the past 24 hours.