As Bitcoin (BTC) has lost $115,000 in support amid a wider market correction, trade experts suggest that the assets have officially entered correction mode.

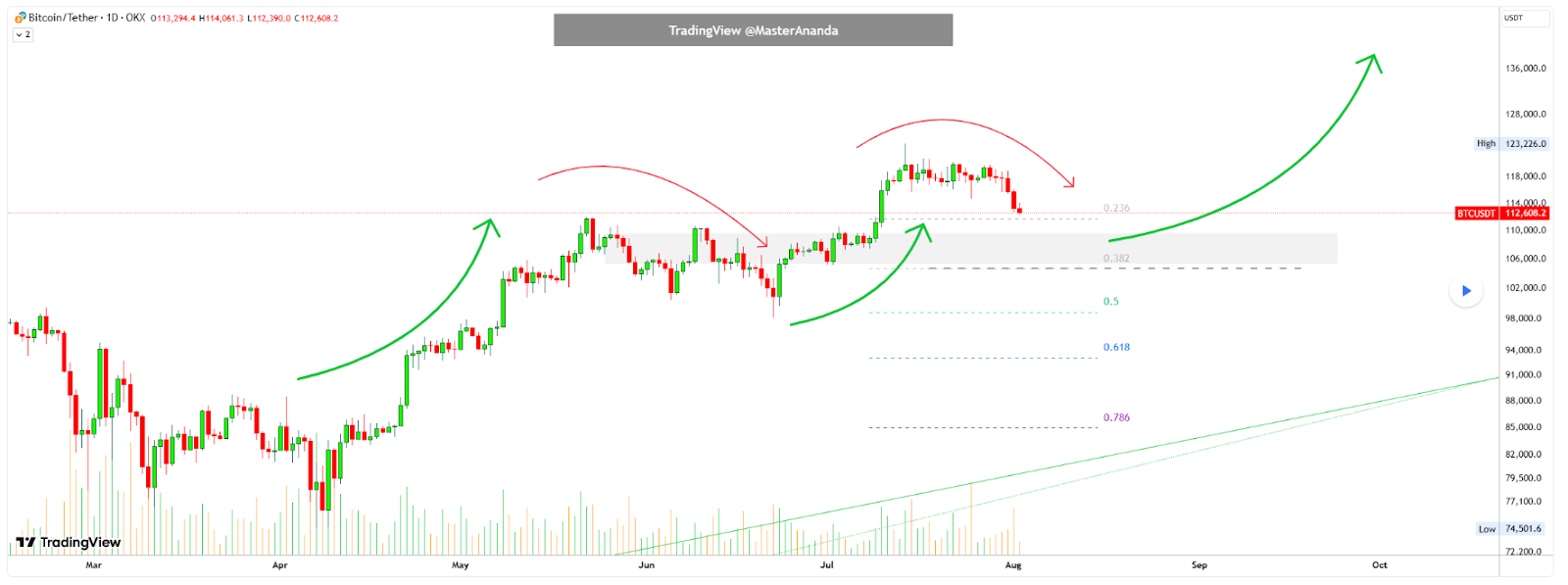

According to Master AnandaBitcoin’s correction phase is evident in a near 10% drop from its record high in mid-July, and prices are currently testing the top major support of the previous.

August 2nd TradingView analysis, Ananda Despite its current bearishness, Bitcoin is characterized by staying within a healthy bullish cycle and re-releasing its upward momentum.

Thus, the current revision appears to be part of a broader pattern of price fluctuations that set the best historically new stage. If past trends are like that, this consolidation could pave the way for new gatherings to fresh, top-highs.

Important Bitcoin Price Levels to Watch

Analysts highlighted strong support from $110,000 to $100,000, with $100,000 serving as a critical technical and psychological level.

The additional pullback zone is marked with Fibonacci retracement levels, with 0.382 levels at around $106,000 and 0.5 levels at nearly $102,000.

As long as Bitcoin is above $100,000, the long-term bullish trend remains. A weekly or monthly closing below that level will encourage a reassessment. Past cycles suggest a horizontal integration period before updated uptrends.

It’s worth noting that Bitcoin hit the sidelines with the stock market as investors rattles off employment data from July, which disappointed them in July and the uncertainty that stemmed from clearing US trade tariffs.

Meanwhile, another cryptocurrency analyst Ali Martinez said on August 2nd, Bitcoin found strong support at $107,160, with over 111,000 BTC accumulated based on GlassNode data.

This level marks the largest purchase zone above the current price and reinforces it as a critical floor. Martinez also pointed out that the resistance was built for $117,400 and 88,000 BTC was purchased.

For Bitcoin to avoid further losses, as things stand, they must hold above the $110,000 support zone below this level.

Special images via ShutterStock.