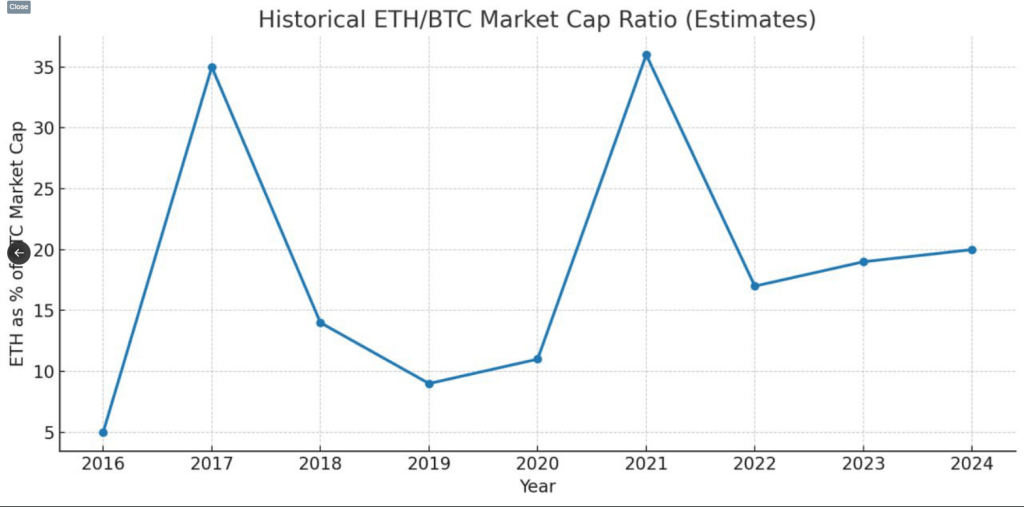

This week, mathematics-based scenarios are gaining attention in the market. Experts say the market value of ether has historically moved to around 30-35% of Bitcoin’s market capitalization during the major Bull Run.

Related readings

If Bitcoin rises from its current price of $119,250 to $150,000, that ratio places the ether near $8,656 at the top of the model.

At the time of writing, ether It increased by 8% on a 24-hour price transfer and reached $4,630 at New Weekly High. Bitcoin Data from Coingecko Shows, slowly finished in major regions at $120,000, and slowly finished.

According to an analysis by trader Yashasedu, the low ratio range between 22% and nearly 30% will result in ether from $5,370 to $7,400 if Bitcoin reaches $150,000.

Market Cap Mathematics and Upside Case

According to the trader’s logic, the calculations are simple. Select the BTC price, multiply the market capitalization by the BTC supply, apply the selected ETH/BTC market cap ratio, divide by the ETH supply to get the ETH price.

In the major bull run, $ eth Usually it hits 30-35% of Bitcoin’s MCAP.

2017: ~35%

2021: ~36%I still see the same setup

> TVL on @ethereum Over $90 billion since 2022

>Institutions buy billions of dollars worth $ eth

> Billion dollar ETF inflows

>Inventory migration… pic.twitter.com/xuacoafw9p– Long Live (@yashasedu) August 10, 2025

Yashasedu note that in 2021, ether climbed to around 36% of Bitcoin Market capitalizationso the 30-35% range is currently cited.

Reports reveal institutional flows and growth. ETF Demand Ether is part of the reason why some traders expect the pattern to repeat.

Flow, Ministry of Finance, and TVL

Based on the report, Spot Ether ETFS recently recorded a daily inflow of $1 billion. It’s the biggest day ever.

Several well-known market voices have put out a higher Bitcoin target that is supplied to these scenarios. Tom Lee, Arthur Hayes and Joe Barnett predict that Bitcoin will reach $250,000 by the end of 2025.

Michaël Vande Poppe, founder of MN Trading Capital, said it is likely that new ATHs will be seen for ETH and new ATHs for integration. These calls are opinions, and traders use them to construct scenarios rather than certainty.

Related readings

Short-term signals and technical forecasting

On the other hand, technical indicators show current emotions as bullish, while fear and desire are in 73 (greed). According to one price forecast, Ethereum is It is expected to rise Approximately 10% will reach $5,125 by September 12, 2025.

Ether recorded a price fluctuation of 20 out of 30 days, 67% plus days, and around 8.33% over the last 30 days. These numbers feed both bullish stories and cases for attention.

Meta featured images, TradingView chart