Lido, once a very large share of the Ethereum staking market, has caused concern that the protocol is approaching a level that is considered a dangerous concentration, increasing competition from rivals and developing infrastructure tailored to institutional finance paves new paths for the industry.

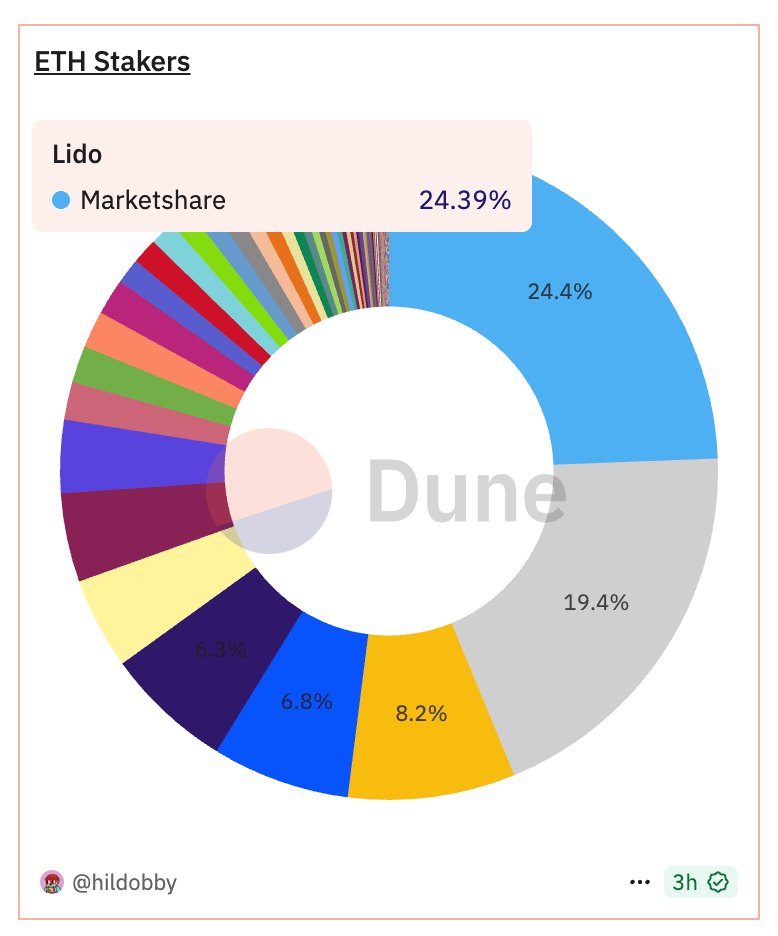

It remains a dominant force, but Lido’s market share is currently at 24.4%, down from its high, which held at 32.3% in the second half of 2023. This is within a prominent distance of the 33% level that many researchers and Ethereum Core developers said would allow a single liquid staking provider to have a disproportionate impact on blockchain consensus mechanisms.

Shift refers to a mature staking ecosystem. If Lido once seemed unwavering, it is now facing a combination of agency-grade operators, community-run decentralized protocols, and exchange host staking products.

For Ethereum, this diversification may be a sign of improved blockchain health. If these trends continue, Ethereum staking in 2025 may not be defined by concerns about the advantages of a single provider and competition between special service models.

“Lido share has dropped significantly due to concerns about distribution and the safety of the protocol,” said Darren Langley, general manager of Lido-Competitor Rocket Pool. “There was a great community effort to ensure that Lido was not reaching 1/3 of its total stock.”

Ethereum Staking Market August 14th (Dune)

One of the most distinct beneficiaries of rebalancing is Figment, a staking infrastructure provider with a strong institutional customer base. Although Figment has long been ranked among Ethereum’s biggest validator operators, the past year has resulted in a significant acceleration of ETH deposits from funds, custodians and large asset managers.

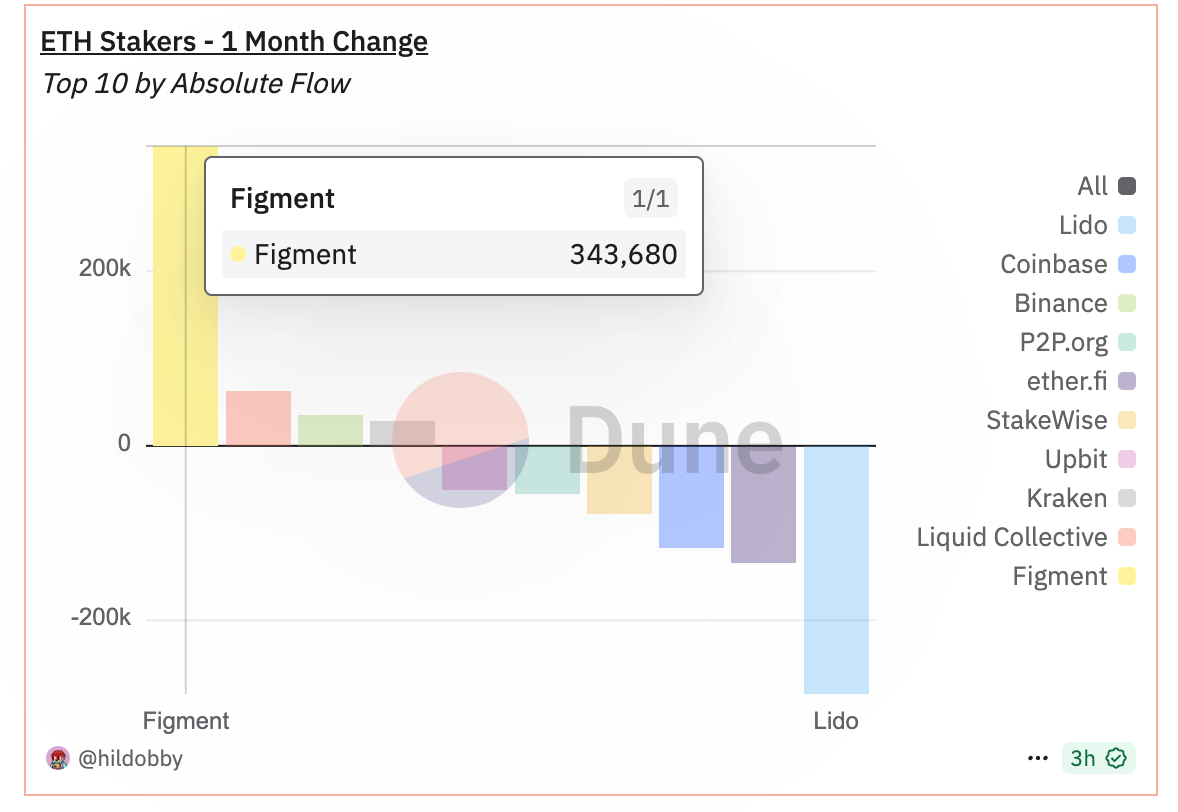

According to data from Dune Analytics, Figment was the biggest winner of new stakers over the last month, adding around 344,000, and now owns 4.5% of all pile ETH. Lido lost its largest number, about 285,000. Ether.fi, Coinbase (Coin) and Binance are also appearing among the largest holders.

ETH Staker 1 Monthly Change 14 (Sand Dunes)

Demand from clients at the agency doubled after the Securities and Exchange Commission (SEC) said in May that staking did not constitute securities activity. Last week, the SEC revealed that people participating in liquid staking don’t need to worry about the securities law either.

“We’re busier than we have with them because the world’s largest institutions employ digital assets,” Figment CEO Lorien Gabel said in an interview. “We have built our business from day one on compliance, regulatory and risk-adjusted performance for customers like the Treasury of Digital Assets and Neobank, which is working.

Read more: Liquid staking sec green light sends eth over $4k, spurs broad staking and layer-2 rally