Bitcoin’s little cousin, XRPtook a fresh bullish bet after surpassing the $3 mark in July. According to trading charts and public comments, the token first pulled back $3 (the highest point in seven years) in January 2025, and regained that level in mid-July.

The comeback has analysts reading the movement as a change in market structure, with prices close to $3.12 as momentum checks continue.

Trendline breakouts and support flips

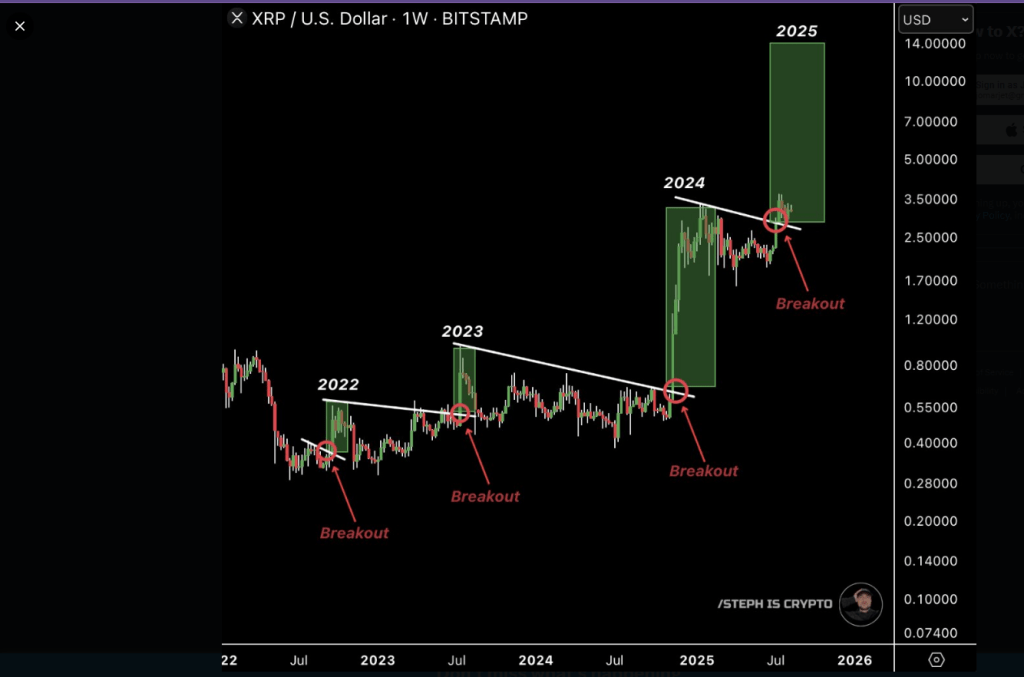

Analyst Steph says long-term breakouts Descending trendline It’s now important to the weekly XRP charts.

Steph points out that it supports a $3-dollar flip from resistance as a classic technical cue. He used historic weekly charts to argue that past breakouts from similar trendlines often led to strong rallyings, highlighting patterns that date back to 2022 when price action became more visible.

This is the most difficult #xrp Previous bloom markets.

Congratulations if you are still here.

Become rich! pic.twitter.com/clltus7mqj

– Steph is crypto (@steph_iscrypto) August 12, 2025

Patterns seen several times since 2022

The report tracks the same setup across multiple cycles. After the collapse of Terra in May 2022, XRP fell, forming a broken, descending trend line in September 2022, sending prices close to $0.55.

Then a new trend line was formed and then broke sec vs. ripple The July 2023 ruling preceded the move to $0.94.

After the breakout after the US election in November 2024, the latest massive run brought XRP to around $3.4 in January 2025. These episodes form the backbone of the “recurring pattern” case.

Different calls from the target of the analyst

Steph predicts it could rise to $14 from around $3.12 at the current rate. His message states that some early sales traders made profits, while others could see a big return if the paper unfolded.

Based on the report, some commentators have expressed similar targets, saying that when XRP traded nearly $2, the token was ready for a massive breakout and directed the Fibonacci level to $14.

What to see next

The volume of push above recent highs tells the story. Keep in mind if $3 stays as support and if weekly breakouts are retained as prices rise.

Also, take a look at the time that merged for more than five months, as the long flat base could precede a sudden movement if the buyer was enforced. It is also important that derivatives flow and where large owners place sales orders.

Unsplash featured images, TradingView charts