Ethereum entered the volatile phase after hitting a multi-year high of nearly $4,790 and retreated sharply to a $4,200 level. The amendment represents an 11% decline in just a few days, shaking the excess position and fostering debate among analysts about ETH’s next move.

Some market watchers have warned that Ethereum could face a deeper pullback if the $4,200 level is not retained as support. Violations here could send ETH low, with traders looking at the $3,900-$4,000 zone as their next major demand area. This cautious perspective underscores the potential for momentum to fade after strong parabolic rally from mid-July.

However, another story has emerged. Many analysts claim that during this drawdown, Ethereum has already washed away excess leverage and sets the stage for updated strength. and request With institutional flows, strong ETH ETF influx, and a continuous accumulation of whales, bullish voices believe ETH is preparing for another leg.

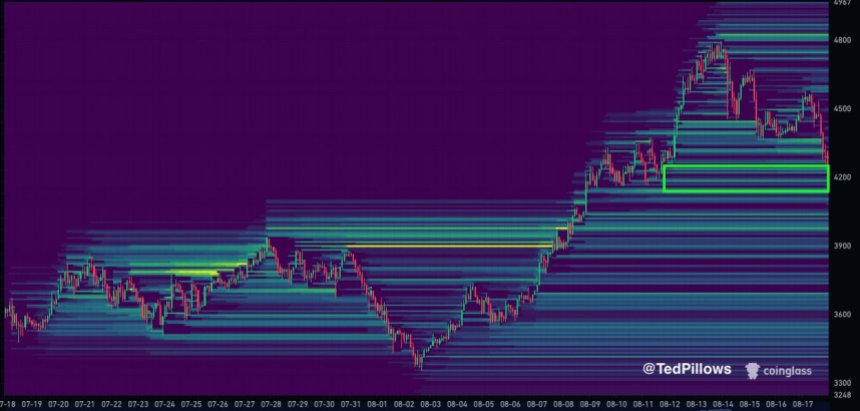

Ethereum grabs liquidity at key price levels

Top analyst Ted Pillows recently shared Ethereum’s liquidity Heatmaphighlighting the $4,350 zone as a critical level of massive liquidity taken. According to Pillow, the move will determine whether Ethereum can stabilize and build a stronger base for the next rally. He raises an essential question: Is $4,350 enough for ETH to hold?

In the short term, the $4,350 zone serves as a key pivot. If ETH maintains this level, it acts as a launchpad for another push to $4,800, and ultimately exceeds $5,000. However, if they can’t hold it, they could retest deeper support, with prices close to $4,000.

The supply of exchanges is declining, indicating strong accumulation and lower sales pressure. Institutional adoption is on the rise, ETFs are attracting record inflows, and large companies are adding ETH to their financial strategies. The clarity of US regulations has improved, alleviating concerns about large investors and legalizing ETH as a core asset.

With these drivers in place, pillows and many other drivers believe that once current volatility settles, Ethereum is on a clear path to setting a new all-time high of over $5,000. The market could be turbulent in the coming weeks, but the wider trajectory remains high.

Weekly Chart Analysis: Sub-Resistance Integration

Ethereum’s weekly chart shows a decisive pullback after touching on $4,790, with prices currently increasing to around $4,270. The move represents an 11% decline from its recent peak, but comes after an explosive rally above the long-term moving average. It emphasizes the changing market momentum.

The 50-week moving average is $2,811, and the 100-week and 200-week averages are clustered at nearly $2,788 and $2,443, respectively. The distances of ETH above these levels reflect strong bullish momentum as assets are well supported by a higher trend structure. Historically, when Ethereum is well above these averages, the corrections tend to be part of a healthy integration before resuming upward movement.

Long-term investors may interpret retracements as resets of over-expansion conditions, allowing ETH to be prepared higher for potentially different legs. If Ethereum is stable here, a retest of $4,790 and a final breakout to an all-time high of over $5,000 remain a reasonable scenario for the coming months.

Dall-E special images, TradingView chart