Report from Encryption We propose that large holders are actively moving while smaller players are bailing out.

Related readings

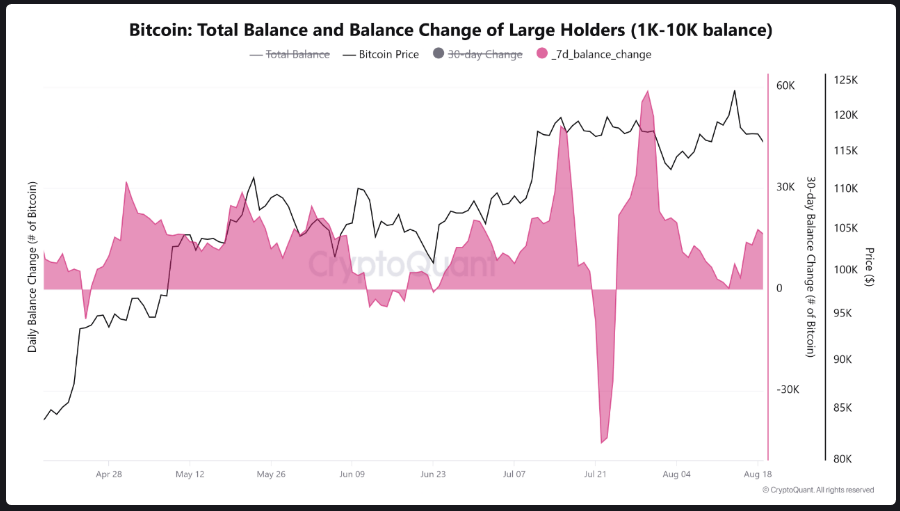

Last week, wallets linked to major Bitcoin participants grabbed over 16,000 BTC during the price decline.

At the same time, retail investors are pitching to weaknesses, increasing the gap between whales and small traders.

Analysts see this as a clue that the market could be a local bottom.

Seasonal pressure and the Fed’s expectations

The timing of these movements is more complex. September rarely becomes a good-for-the-market. Data from the last 35 years show S&P 500 This month we averaged 1%, and Bitcoin often reflects the drag of the season.

Now throwing the Federal Reserve Meeting On September 15-16, traders allocated 80% chances to a 0.25% rate reduction, and there is a cocktail of uncertainty.

For some, cuts signal potential relief for risky assets. For others, historical patterns obscure short-term optimism. In any case, volatility seems inevitable.

BlackRock Transfer causes fear of sales

Within the background of this macro, a single transaction issued an alarm. BlackRock has shifted by nearly $120 billion, above 10,584 BTC in a day.

Such movements are rarely overlooked. Transfers to exchanges often meant they were ready for sale, and the market responded quickly.

Bitcoin The level previously served as the launchpad for the Rally, which pushed prices to an all-time high of $124,000 this August, has now just over $112,000.

Traders are now looking at that number like the Hawks and questioning whether it can again serve as a safety net.

However, technical signals should not tell a unified story. The relative strength index is at 32.90, scraping off the sold zone.

However, the MACD is still weak, with the line remaining below the signal mark, suggesting negative momentum. This indicator split will keep traders guessing whether the next big move will go up or down.

Related readings

Crypto market at intersections

If $112,000 is held, the rebound will be on the table. Breaking it can accelerate the downside, especially if the institution starts to unload more bitcoins.

Adding whale accumulation, seasonal debilitation and looming Fed decisions, the short-term outlook doesn’t look like a straight line, but a curve with a twisty surprise.

For now, the fight is clear. It’s between confidence and fear, and the outcome may depend on what happens before this month closes.

Unsplash featured images, TradingView charts