- Huma Price fell sharply as investors were blocking supply growth significantly.

- The project will release more than $9 million tokens today, August 26th.

- Market-wide liquidation amplifies volatility.

The bear ruled the digital assets landscape on Tuesday. Cryptocurrency market capitalization has reduced its market capitalization from nearly 4% to $3.79 trillion in the last 24 hours.

Bitcoin hovered under $110,000, while Ethereum hovered at $4,430.

Altcoins suffers the most, with Link, Sol and Doge losing up to 10% in the past day.

advertisement

Meanwhile, Huma Finance appeared to be suffering the most after losing more than 14% within the last 24 hours.

Huma Price appears to be poised for even more declines as the PAYFI project prepares to release 377.92 coins worth around $9.03 million in the next few hours.

Huma braces for large token unlocking

Token de-denation is common in crypto spaces, but often causes volatility when adding new supplies to circular assets.

Huma’s 377 release is modest compared to 1.733 billion distributions, but is enough to shake up the market.

Market players are hoping for bearish momentum from unlocking events that catalyze price drops.

The “selling rumors” story may be behind Huma’s current substantial charge.

Investors and traders want to avoid more losses, especially as the wider market remains in the red.

Common sentiment suggests that Huma Finance absorbs little increase in supply.

The event will require demand to surge in ecosystem activities, participation in governance, and to raise Huma prices during the $9.03 million token release.

Therefore, Altcoin can have a hard time ensuring reliable footing in the short term.

How about HUMA traders?

Certainly, Huma Finance’s short-term bias looks unstable. Nevertheless, a variety of factors could shape the performance of assets in the future.

HUMA traders should be aware of immediate performance.

Price stability or enhanced sales pressure can define short-term trajectories.

Additionally, the trajectory of Huma Finance relies on broader emotions.

As Bitcoin and Ethereum switch to uptrends, the small caps record a notable bounceback.

Common emotions suggest extended dips or integration before considerable recovery.

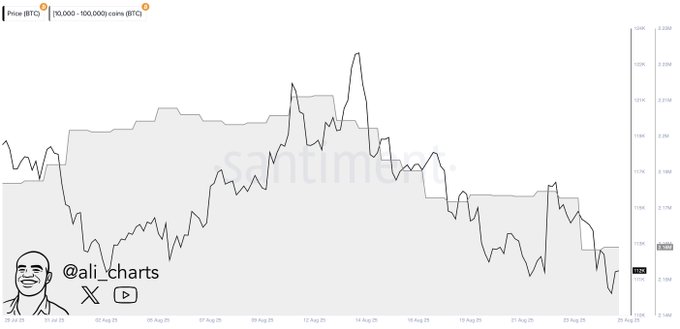

Large investors offloaded about $6 billion worth of BTC the previous week.

50,000 Bitcoin $ BTCworth $6 billion, whales have sold over the past two weeks!

9:20 PM, August 25, 2025

Such developments indicate the lack of convictions for solid meetings in future sessions.

Nevertheless, this could potentially book a whale profit after Bitcoin’s best-ever most recent run.

Bitcoin needs to regain $112,000 to support the rebound to $120,000.

Meanwhile, Huma Finance has established itself as a cryptographic project with real-world utilities.

It aims to democratize the global payments industry with immediate liquidity access.

The payments sector has recently been green traction, especially after stable US regulations.

Enthusiasts will see how Huma Finance demonstrates its competitiveness in the PayFi space in the coming months and years.

Huma Price Outlook

Native Coin lost about 14% on its daily charts after soaking from its intraday highs to $0.02663 to $0.02288.

HUMA trades at $0.02414 after a short jump from a 24-hour low.

On-chain data and technical indicators suggest a further decline in digital coins.

Huma Finance could plummet to a new weekly low amid the rising supply going forward.

moreover, Huma has been in decline since its debut, and is now down 80% from its peak release.

However, sudden changes in the broader market could lead to a significant recovery in HUMA prices.