This month, Bitcoin’s inactive price performance sparked a wave of bearish sentiment among institutional investors. This increases the likelihood that digital assets will be closed in red in September.

On-chain data also reveals a decline in miner accumulation, further heaviering the already dense cryptocurrency.

ETF Exodus and Miner Selling could push Bitcoin down

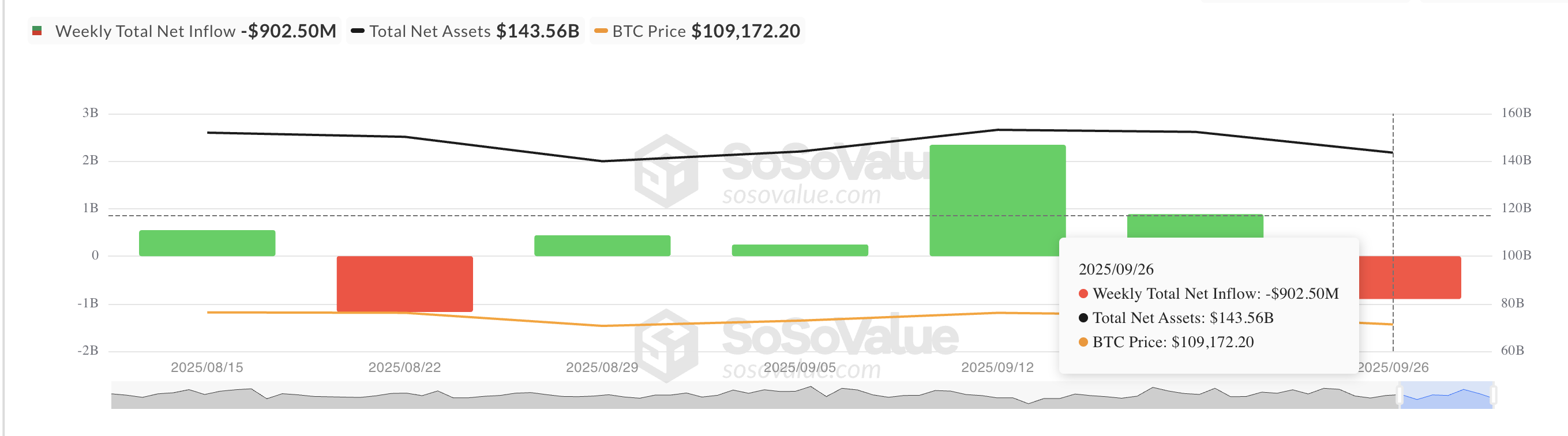

The stable liquidity outlet from Spot BTC Exchange-Traded Funds (ETFS) reflects declining institutional benefits. According to Sosovalue, between September 22 and 26, the capital outlet from these funds was $903 million, indicating a receding capital from the market.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Total Bitcoin Spot ETFs inflows. Source: SosoValue

The correlation between ETF flow and BTC prices has been strong historically. In July, coins surged beyond $120,000, with monthly ETF inflows exceeding $5 billion. The current outflow shows a severe contrast, suggesting that institutional interest and participation from middle-aged people may be in decline. This trend risks major cryptocurrencies falling further if institutional investors continue to remove capital.

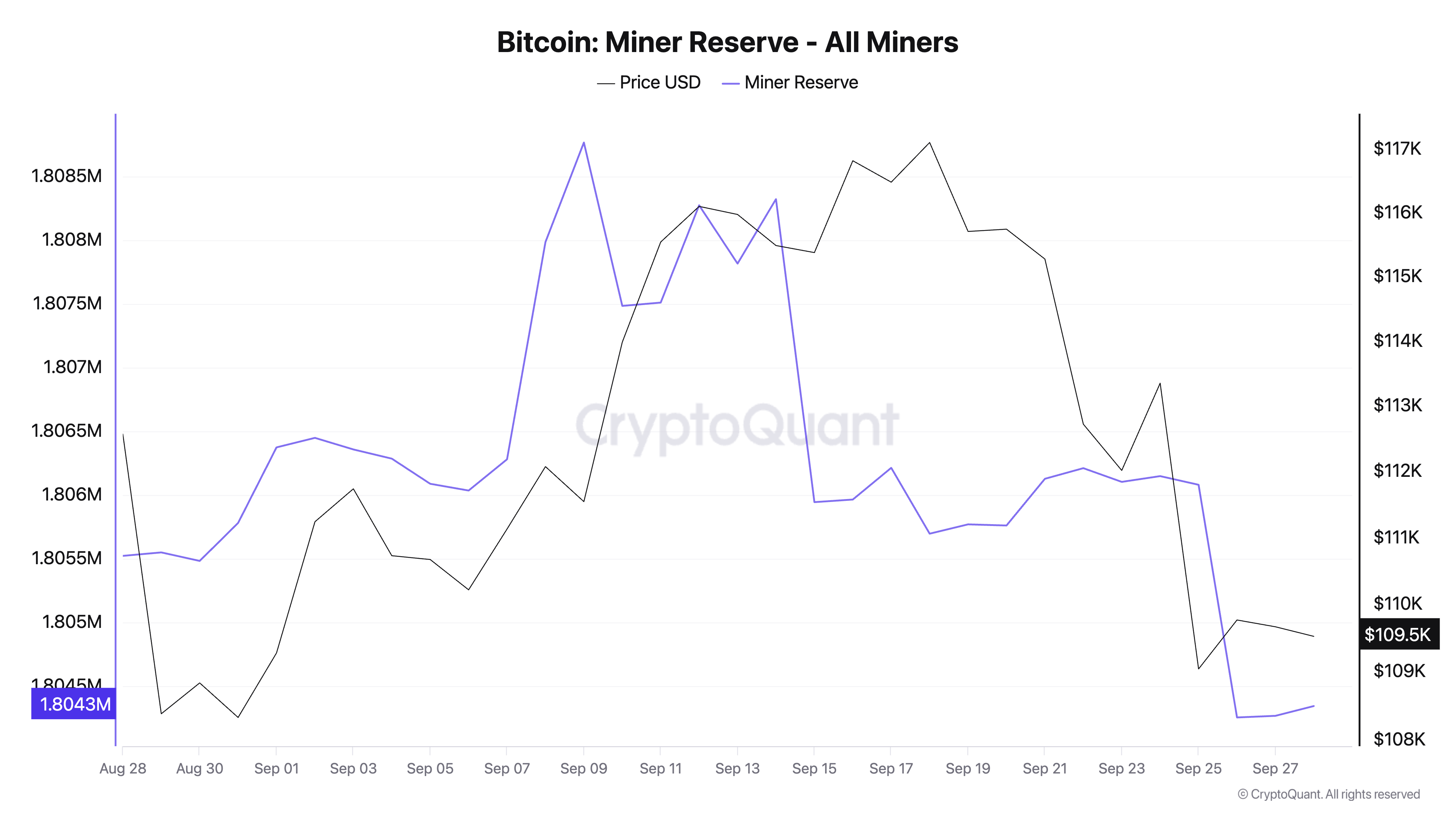

Furthermore, on-chain data shows a decline in miner reserves, showing miners selling BTC rather than accumulating, increasing the bearish outlook for the coin. According to Cryptoquant data, the reserve holds 1.8 million BTC and has lost 0.24% of its value since September 9th.

Bitcoin Minor Reserve. Source: Cryptoquant

Miner Reserves tracks the total amount of BTC held by miners in their wallets before they can be sold on the market. When these reserves fall, it indicates that miners are liquidating their holdings to realize profits or cover operational costs.

This behavior often increases the supply of coins in the market and increases downward pressure on BTC prices.

Heavy sales can cause fresh lows

If Spot BTC ETF continues to record log flaws and miners on the BTC network continue to sell, Coin’s price could extend the dip and drop to $107,557.

BTC price forecast. Source: TradingView

However, if Demand Rockets and Market Sentiment improve, the price of BTC could go above $110,034 and rise to $111,961.

Within ETF leaks and minor pullbacks, post-bitcoin prices stalled.