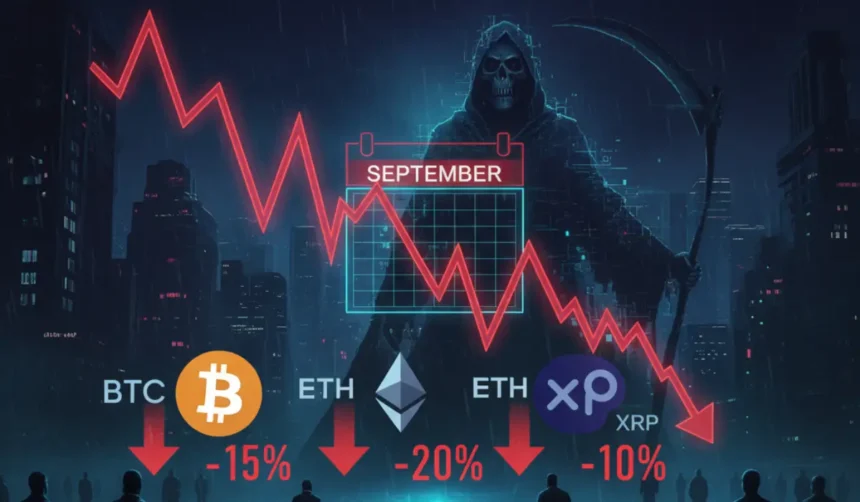

The September curse refers to periods of unfortunate sudden declines and a more advantageous margin that is usually tracked that month. This article covers everything about this phenomenon, its associated financial theories, and the effects seen in the crypto marketplace. This article also provides insights into the effectiveness of October, particularly. This is a direct aftereffect of September’s effects.

September Curse: defined and explained

The weak seasonal performance that was regularly reflected in the crypto market during September is known as the September effect. No effective causes have been found for this particular effect observed during this period. However, the market trends and growth rates found in the month are Efficient Market Hypothesis (EMH). There are several financial theories that explain this phenomenon. However, most of them are not entirely reliable and cannot prove the actual cause behind the effect. It is also important to note that over the past few years the effect of September has been reduced in intensity and gives optimistic notes about the year to follow.

According to historical records available so far, the phenomenon of the September effect is evident in the stock market from 1928 to 2023. During this period, the average market efficiency saw a surprising decline in September. However, the effect of September was not always true and was caused by following calendar trends each year. Contrary to our belief, for years between 1928 and 2023, September has been one of the best performing months of the year. Over the years during the period, there were better performance months outside of September. However, the term “September Curse” was established in financial markets as the average seen in many September fell significantly during the specified period.

One of the most important features of the September curse is that most financial advisors and experts cannot predict its effectiveness for the benefit of investors. Even if it had an impact on market efficiency in a negative direction, it wasn’t crushed in most years. However, it stands out, especially for crypto enthusiasts who are constantly exposed to market updates and trends. Apart from all this, the intensity of trends since 2014 remains a note of hope and positivity that will forever fade from the market.

Possible causes behind the September curse: Speculation explained

Investor behavior is one of the most commonly believed causes of the September curse. As September is the month opened in the last quarter of the year, the majority of the investor population will be in a hurry to revise both the stock and the financial portfolios. Cryptocurrency Market. They will deal with tax losses that have occurred over the past few months and develop strategies to obtain the most advantageous margin possible in the last quarter of the year.

Strategies put into practice by many mutual fund giants in the financial market can also be held as reasons for the curse effects seen in September. Stock liquidation by investors’ families is observed as another reason for the curse, meeting the requirements for schooling. Investors hoping for the September curse can also ease potential losses as much as possible, thereby taking precautions to separate from large investments this month and take liquidation. Liquidation from large industrial investors can further increase the strength of the effect and challenge the market’s efficiency to a greater degree.

Is the September curse invalid? Some propagation thoughts

Many expert financial enthusiasts and stock market experts say there is no phenomenon like the September effect. According to them, there is almost no chance that this downward trend will last for almost a century. Industry experts and the enormous ecosystem would have already taken effective measures if its effectiveness had been negatively hampered over such a long period of time.

I also agree that the September curse is certainly a thing of the past, and has not appeared particularly since the 1990s. Some respects August is the worst monthits effects will be made more noticeable in September. Meanwhile, healing is actually a major market scene, not a weak performance. Therefore, experts advised investors to view the September curse as merely a historic event, and were manipulated and propagated as an active phenomenon to benefit certain institutional benefits.

The union between the September curse and the October effect

Whenever there is a debate about the September curse, The effects of October are equally important and are being discussed. However, unlike the September curse, there are some historical events related to the effects of October. However, these historical events are limited only to a few years of the period mentioned. This may have affected parts of that particular year, not beyond October and more, but later on. Some of the historical events that can be seen as reasons for the effectiveness of October include the DJIA declines, including the Panic in 1907, Black Tuesdays and Thursdays in 1929, Black Mondays in 1987, September 11, 2001, and the subprime crisis in 2000.

Final Thoughts on the September Curse

The September curse is an unusual effect observed every year since 1928. However, the average decline for a given month has been a decline in trends over the past few years. Separately, many economic experts believe that such a trend does not exist and is nothing more than a thing of the past. A coalition between September and October has also been discovered, suggesting a pattern relocation over a number of consecutive months. Ultimately, however, we do not emphasize this supposed phenomenon, as no valid causes have yet been found to back up these assumptions.