Ethereum price has been trading almost flat this week, rising just 1.3% over the past seven days and hovering around $4,430. Even the month-on-month ETH price performance is not positive, with a slight increase of 2.7%.

Despite the slowdown in performance, the buildup is quietly occurring, suggesting that something big may be going on beneath the surface.

Whales and short-term holders are quietly accumulating.

The most notable change comes from the Ethereum whale. According to on-chain data, large holders added around 870,000 ETH in the past 24 hours, increasing their total holdings from 99.34 million ETH to 100.21 million ETH.

At its current price of about $4,440, this additional whale is worth nearly $4 billion. This is one of the largest daily influxes of whales in recent weeks.

Want more token insights like this? Sign up for editor Harsh Notariya’s daily crypto newsletter here.

Ethereum whale in action: Santiment

Such a move typically suggests that deep-pocketed investors are bracing for an upward breakout rather than exiting after a rally.

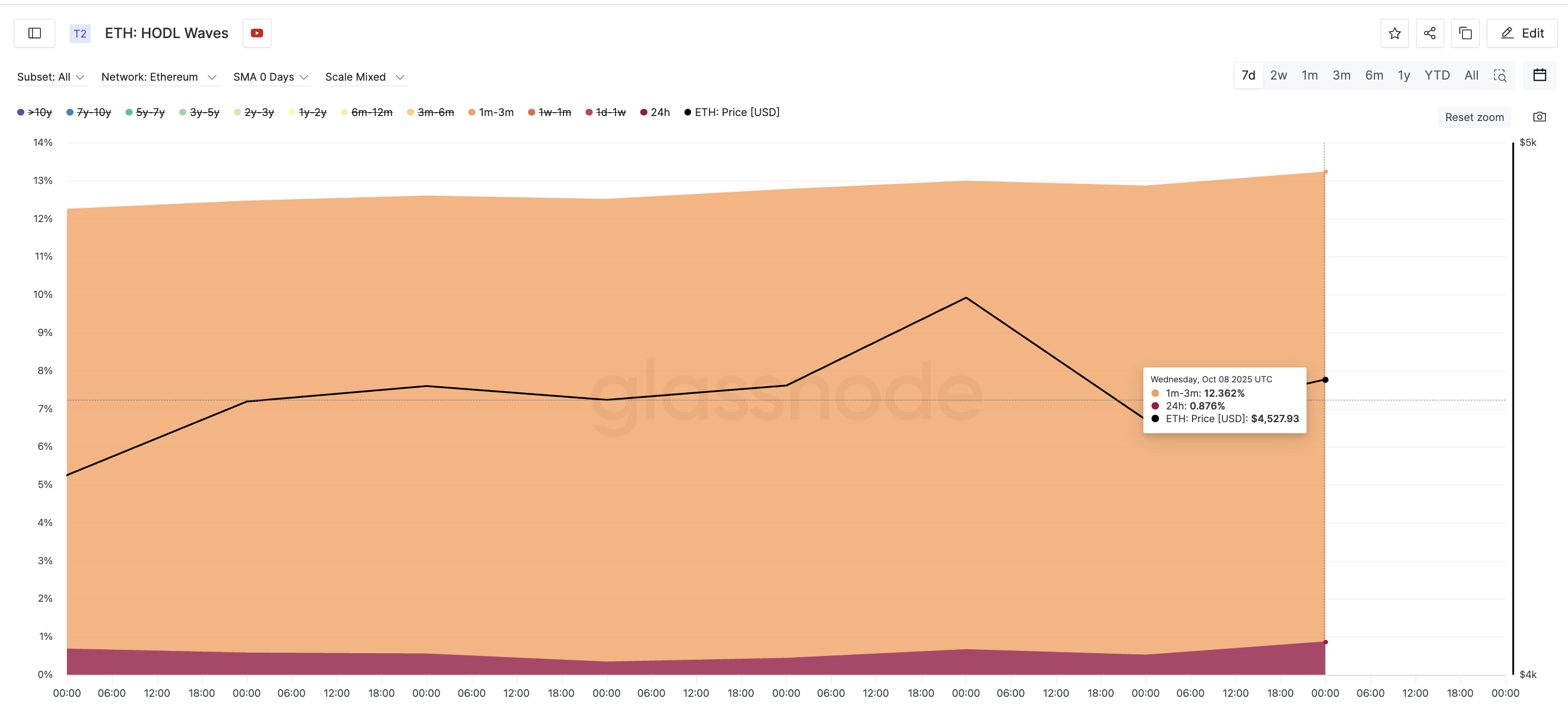

At the same time, activity among a small but active cohort is increasing. According to Glassnode’s HODL Waves, which tracks how long different age groups have held coins, both short-term bands have widened significantly.

The 24-hour group increased from 0.34% to 0.87% since October 4, and the 1-3 month group increased from 11.57% to 12.36% compared to the previous week.

Ethereum accumulation continues: Glassnode

An increase in short-term holdings, especially during weeks of weak prices, generally indicates that more traders are re-entering the market, adding liquidity and momentum to the early accumulation phase.

The combination of whale inflows and a short-term rally suggests that Ethereum’s current calm may be masking preparations for a stronger directional move.

Ethereum price chart structure supports the accumulation story

Ethereum’s chart settings reflect this on-chain optimism. The asset trades between two major Fibonacci levels ($4,400 and $4,620), forming an ascending triangle, a structure where the price makes new lows against flat resistance.

This pattern often indicates accumulation before a breakout.

Furthermore, a hidden bullish divergence appeared on the daily chart from August 25th to October 9th. This occurs when the price forms a higher low while the Relative Strength Index (RSI), a tool that measures market momentum and overbought or oversold conditions, forms a lower low.

Ethereum Price Analysis: TradingView

Hidden bullish divergences typically appear during corrections within an uptrend and indicate that the broader rally is likely to continue.

This signal typically indicates a weakening of selling pressure and the possibility of a continuation of the ongoing trend in which Ethereum price is trending upwards.

If Ethereum decisively closes above $4,620, the rally could continue towards $4,870 and $5,130, as the breakout was confirmed. Conversely, a break below $4,400 (the closing price of the daily candlestick, not just a breakout) increases the likelihood of a pullback toward $4,240 or even $4,070, invalidating the short-term bullish case.

For now, both whales and short-term traders appear to be betting on one key event. It is whether Ethereum can eventually break through and sustain $4,620 and start the next major leg higher.

The post Ethereum Whale Pins Almost $4 Billion in Breakout Hopes, but $4,620 is Key appeared first on BeInCrypto.