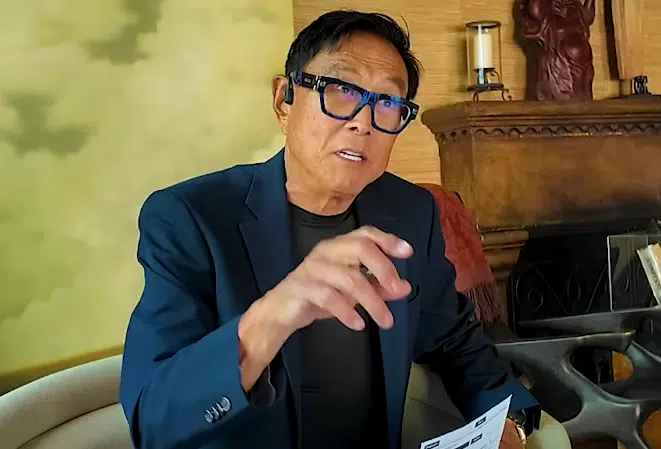

Robert Kiyosaki, author of “Rich Dad, Poor Dad,” announced on his X account that “the 60/40 nonsense of financial planners is dead.”

The 60/40 investment formula is Invest 60% of your portfolio in stocks to pursue growth and 40% in bonds to ensure stability and reduce risk.

This is a typical recommendation from financial advisors, but Kiyosaki says that “that sordid relationship disappeared in 1971, the year Richard Nixon took the dollar off the gold standard.”

This turns the dollar into a fiat currency, and its value is no longer backed by gold reserves. allowed the United States to print unlimited moneydescribed by CriptoNoticias. This has changed the stability of traditional markets.

“Who would be stupid enough to buy bonds (debt) from a bankrupt country? The truth is finally coming out. Morgan Stanley is now promoting 60/20/20, a more stable path to future financial security and freedom,” Kiyosaki said in the post.

That is, 60% is stocks and the remaining percentage is bonds and gold. “The fact is gold has outperformed stocks and bonds for years and no one said anything,” he added.

In this context, Kiyosaki emphasizes the strength they are showing. Gold, silver, Bitcoin (BTC), and Ethereum’s native cryptocurrency, Ether (ETH).

This reflects Kiyosaki’s view that assets such as precious metals and BTC can protect against inflation and continued devaluation of fiat currencies. That’s because they have characteristics (such as scarcity) that serve as stores of value in times of economic turmoil or geopolitical tensions.