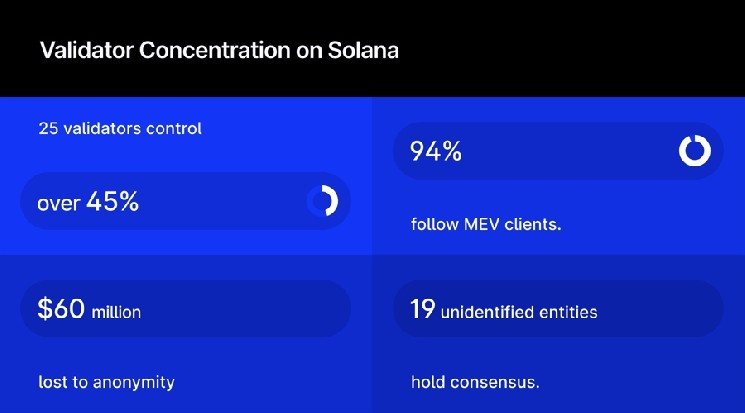

Protocol teams are obsessed with the number and geographic distribution of validators while ignoring accountability through identity. The top 25 Solana validators control 45.5% of all stakes, but users who are delegating billions of dollars cannot identify them or assess their alignment with network value.

An anonymous verifier extracted $60 million with impunity through an MEV attack. Networks like Aleph Zero also demonstrate how serious conflicts can escalate when users are unable to differentiate between leadership factions.

The blockchain industry has confused technical decentralization with meaningful decentralization, creating a system that appears decentralized while operating with a centralized, unverifiable power structure.

Digital assets meet tradfi at fmls25 in london

Anonymous verification enables “accountability arbitrage” where validators reap the economic benefits of network participation while avoiding the reputational costs of decision-making. That 94% of Solana validators adopted MEV-optimized clients without community consultation illustrates how obscurity can enable tailored behavior that undermines the value of the prescribed network.

(#Highlighted link#)

This creates a network that combines the worst characteristics of both centralized and decentralized systems: the opacity of traditional institutions and the coordination challenges of decentralized governance.

What does it mean to use Lunar as a validator?

At Lunar, we have been in this space since 2019 and have worked with many major ecosystems at various stages of growth.

As validators, we contribute to:

Top development team and hardware

Event sponsored… pic.twitter.com/WKmXumGrcP

— Tim Haldorsson (@timhaldorsson) September 23, 2025

The illusion of interest-based democracy

Current validator selection mechanisms optimize capital allocation rather than governance capacity, creating a system where economic power is directly translated into political control without corresponding accountability. Solana’s Nakamoto coefficient with 19 validators exemplifies this. Despite thousands of validators participating, 19 unidentified entities can control the consensus.

Users delegate billions of assets to unidentified verifiers, effectively recreating the premise of traditional financial trust while removing regulatory protections. This represents centralization disguised as decentralization, concentrating power between actors that explicitly avoids building community trust through transparency and public verification.

Building a network using Validator Authority

Smart networks differentiate themselves through validator curation strategies that align individual reputation with overall network health. This requires treating validators as ecosystem partners whose brand and capabilities complement your strategic goals. Figment’s organizational success shows how branded validators can become ecosystem multipliers. Their relationships, expertise, and reputation create network effects that go beyond consensus security.

Rethinking Solana’s validator client paradigm 💻

In the latest @ValidatedPod, @Austin_Federa is joined by @1ultd and CEO @Syndica_io. They detail Sig, a new Solana validator client built on Zig. This is intended to optimize reads and make validator nodes run more efficiently… pic.twitter.com/1Pz2mtGfhP

— Solana (@solana) March 26, 2024

When a validator has a public brand, its success is tied to the success of the ecosystem in a way that anonymous operations cannot replicate. They become natural content creators and thought leaders who grow their ecosystem mindshare through their audience.

It provides decentralized expertise that improves the quality of governance decisions while building community trust in the evolution of the network. Most importantly, validators with public reputations create market-based accountability mechanisms where poor performance carries reputational costs that go beyond individual operations.

What are the problems in the growth of the cryptocurrency ecosystem? ↓

Since 2017, our marketing campaigns have had a measurable impact on this sector.

Our contributions to various crypto ecosystems including Polkadot, ICP, Rose, etc. have received positive feedback from projects… pic.twitter.com/qVVKcKMZTX

— Lunar Strategy (@LunarStrategy) January 31, 2024

Market evolution towards transparency

Faceless verification represents a transitional period in blockchain evolution, a primitive attempt to solve coordination problems without understanding human incentives. Market dynamics are increasingly focused on transparency, with institutional investor demand flowing towards verifiable infrastructure providers.

Networks that recognize this evolution early will build a sustainable competitive advantage through verifier authority. Those who treat opacity as a feature will be competing for a shrinking market of users who accept opacity in exchange for marginal benefits. The future belongs to networks that combine technological excellence with human responsibility. With the network, you’ll know who’s protecting your assets and why you’re worthy of their trust.