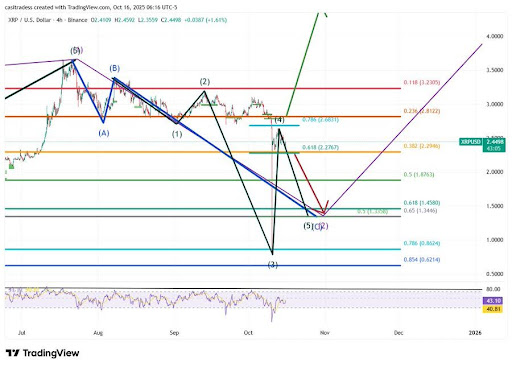

After a strong rally, XRP is showing signs of hesitation and is struggling to break out of key resistance levels. Recent price action has fallen neatly within an Elliott Wave pattern, suggesting that the market may be entering one final correction before the next big move unfolds.

Market pauses after storm

CasiTrades in the recent market updateAlthough prices managed to recover nicely after last Friday’s sharp sweep, momentum It seems to be losing momentum now. The analyst said such a pause is natural after a strong move. In Elliott Wave Theory (EWT), this type of deceleration corresponds to the fourth wave. The fourth wave is the stage where the market consolidates before preparing for the final shock wave.

The analyst emphasized that the market is unlikely to change direction immediately after a large third-wave decline. Instead, they often complete an exhausting wave 5 move to end the impulse cycle before a new uptrend begins. However, CasiTrades noted that the market has not yet shown the necessary strength to reverse the eventual decline.

The price trend is currently stalled near the fourth wave resistance level. What if the market was really sharp V-shaped? recoveryit should have already cleared the $2.82 resistance mark with strong momentum, but it hasn’t done so yet. Given this situation, analysts think it may take another wave before the market is fully exhausted. selling pressure and reset your emotions.

Market data confusion: There is no “universal” XRP chart

CasiTrades further emphasized: market Data between exchanges is highly inconsistent, making accurate analysis difficult. The analyst noted that each trading platform had different lows during the recent selloff, with some pairs falling below $1, while others managed to hold much higher levels. Because of this difference, CasiTrades advised traders to focus on the exchange they personally trade on to ensure accuracy, as there is no “universal” XRP chart.

According to analyston Binance USD, XRP price fell to $0.77, marking a sharp 72% decline from the local high and falling below the 0.786 Fibonacci retracement level. CasiTrades believes that a repeat of such extreme lows is unlikely, but the next potential retracement level around $1.46 (0.618 Fib) and the golden pocket around $1.35 remain important areas of interest. These zones coincide with multiple technical elements such as a 5th wave extension, a macro Fibonacci retracement, and a 2nd wave target.

The analyst explained that if XRP retests these deeper levels, it could trigger a strong reversal and set the stage for the long-anticipated shocking wave targeting the $6.50 to $10.00 range.

Despite the turmoil caused by the recent market crash, CasiTrades sees potential signs of hope. She pointed out that the crash may have changed the value of XRP. structure From a shallow wave 4 correction to a broader macro wave 2 retracement that may precede the strongest shock wave in the cycle.