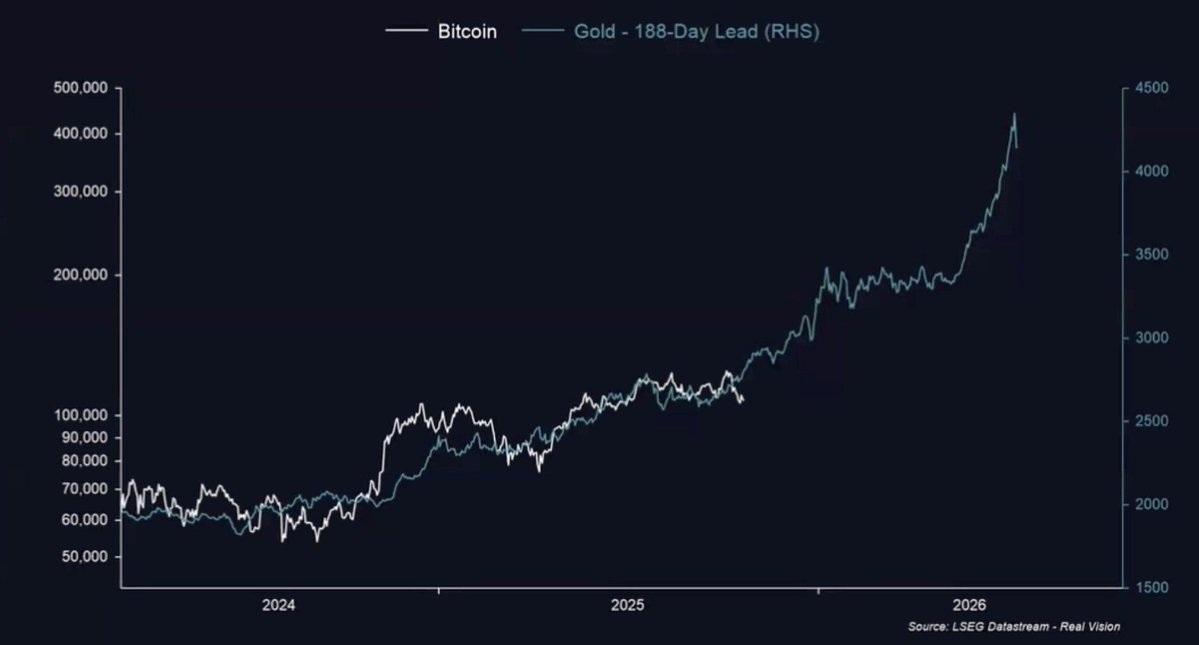

According to a recently shared chart, Bitcoin lags gold price movements by about 188 days.

According to analysts, this situation is considered a bullish signal for the cryptocurrency market.

This chart compares Bitcoin and gold rates for the period 2024-2026 based on LSEG Datastream and Real Vision data. Despite the time difference, Bitcoin’s line is above gold’s correction curve.

Amid continued economic uncertainty, gold is up 45% since the beginning of 2025, while Bitcoin is up about 20% over the same period. However, analysts argue that the 188-day gap indicates an impending acceleration in Bitcoin’s price trend.

This trend is also believed to be related to the increase in institutional investment in Bitcoin ETFs. Analysts like RealVision founder Raul Pal frequently cite these historical correlations.

On the other hand, the correlation between Bitcoin and gold is only 0.09, indicating that Bitcoin still has a similar volatility structure as technology stocks.

An image comparing the BTC price chart and the gold chart.

Considering the image shared by Real Vision, it is claimed that BTC price could exceed $400,000 in 2026.

*This is not investment advice.