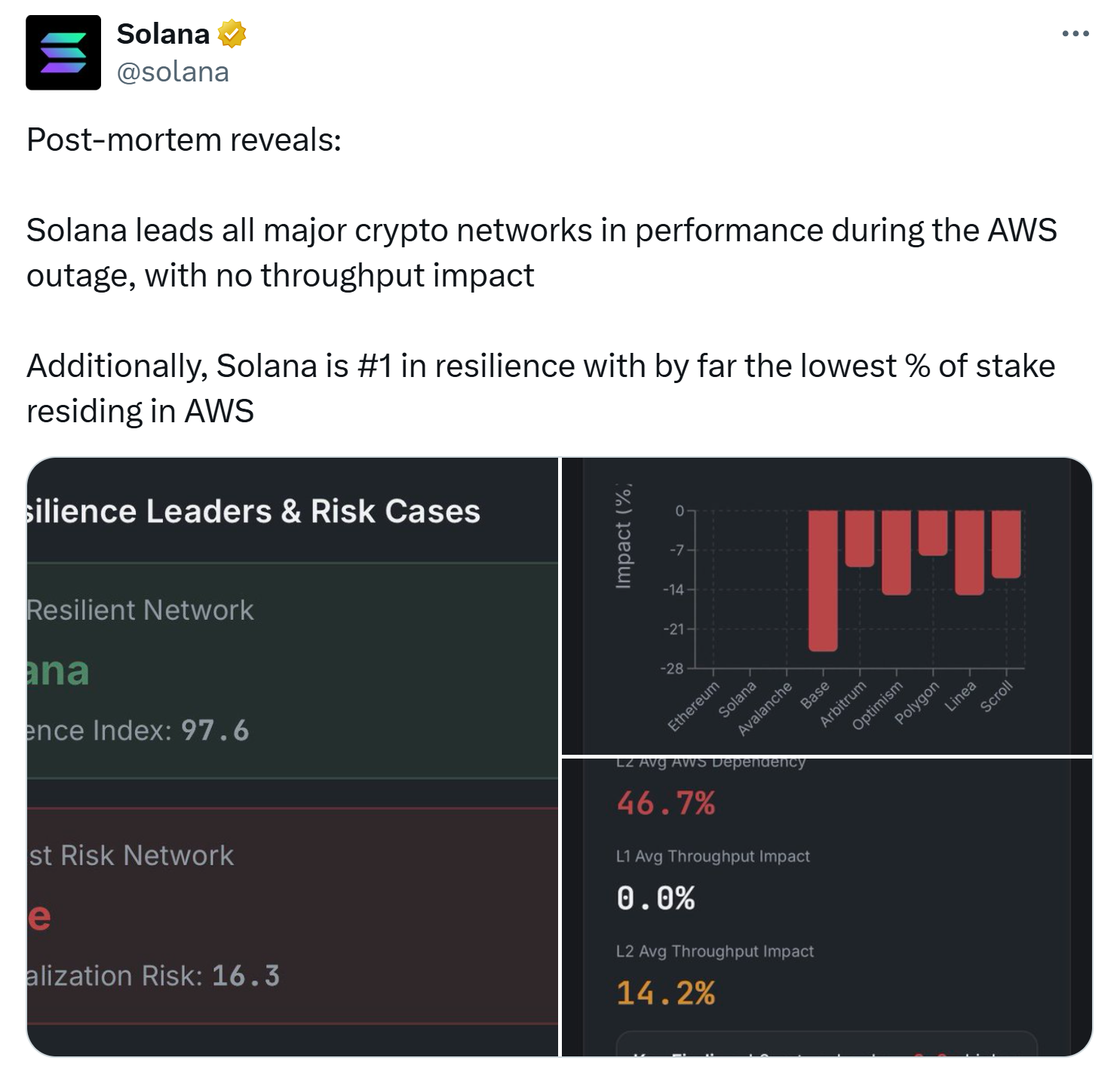

The recent Amazon Web Services (AWS) outage caused major cryptocurrency and fintech platforms such as Coinbase, Robinhood, MetaMask, and Venmo to fail, reigniting the debate over how decentralized Web3 really is.

Although the blockchain continued to produce blocks without interruption, millions of users were unable to access their wallets, exchanges, and decentralized applications (DApps) because their interfaces and application programming interfaces (APIs) were hosted on centralized servers.

“Decentralization has been successful at the ledger layer, but not yet at the infrastructure layer,” BitGet Wallet Chief Marketing Officer Jamie Elcarre told Cointelegraph. “True resilience will depend on diversifying beyond hyperscalers to community-driven, decentralized networks.”

Elkaleh added that full decentralization is “not yet achievable at scale” as most teams rely on hyperscalers like AWS, Google Cloud, and Azure for compliance, speed, and uptime. He said the practical goal is a “reliable, multihomed” infrastructure, which requires distributing workloads across both clouds and distributed networks to avoid single points of failure.

Elkaleh argued that cloud providers offer scalability and security, but at the cost of concentration risk. “If one region or provider goes down, hundreds of apps are affected,” he said. Hybrid systems that mix the cloud with distributed storage and community-run nodes are the next logical step.

X users make fun of so-called decentralized platforms. sauce: Kunal Gandhi

Related: Amazon AWS outage impacts Coinbase mobile app and Robinhood

User locked out of blockchain operation

Anthurine Xiang, co-founder of EthStorage and QuarkChain, said the failure proved that “even with Web3, many services still rely heavily on centralized infrastructure.”

She explained that true decentralization requires redesigning every layer from storage to access so that no single provider can take the system offline. “It’s like your house is fine, but the door is closed,” Xiang explained how users were locked out of blockchain operations.

The power outage began on Monday and lasted about 15 hours. The outage caused Coinbase’s app and Base network to crash, preventing users from logging in or trading, and Robinhood traders reported delays and API failures.

The outage also affected Metamask, with users reporting their wallet balances to be zero. “Their assets were safe, but the service responsible for retrieving balance data was offline,” Xiang explained, noting that it was not a technical failure of the blockchain itself.

Meanwhile, Vanar Blockchain CEO Jawad Ashraf criticized the crypto industry for all “running on the same server.” He claimed that around 70% of Ethereum nodes are hosted by AWS, Google, or Microsoft. “We’re just paying three different landlords instead of one,” he said.

He added that while it is possible to build a fully decentralized system, it would take longer and be more complex than building one on AWS, so “most teams won’t do it right away.”

Solana claims that the outage has no impact on throughput. sauce: Solana

wake up call

Elcarre said the failure should accelerate investment in decentralized cloud, storage and computing networks such as Akash, Filecoin and Arweave. He called on Web3 builders to adopt a hybrid model that combines traditional reliability with distributed redundancy.

“Any major failure is a wake-up call,” he said. “The future of Web3 will not be determined by how decentralized the tokens are, but by how decentralized the infrastructure actually is.”

magazine: Back to Ethereum — How Synthetix, Ronin and Celo saw the light