President Trump-backed $ABTC just suffered its first revenue drop as a public company. This “not just a miner, not just a financial manager” company is currently targeting 50 EH/s to strengthen its BTC-focused growth strategy.

The following guest post is from bitcoinminingstock.io, A public market intelligence platform that provides data on companies exposed to Bitcoin mining and crypto treasury strategies. First published by Cindy Feng on November 20, 2025.

While much of the Bitcoin mining sector is pivoting towards AI and HPC infrastructure, American Bitcoin (Nasdaq: ABTC) is taking a very different approach. It is scaling up to be a top-level Bitcoin miner and is looking to grow a sizable BTC fund, but claims it is not there yet. just Miner or passive BTC vehicle. But the central question is whether the economics can justify their ambitions at a time when many of their peers are pivoting away from Bitcoin mining.

Let’s take a closer look at the company’s first quarterly results as a Nasdaq-listed company.

Current Bitcoin mining status

The company was born on March 31, 2025 and listed on the Nasdaq on September 3. In that short time frame, it moved quickly.

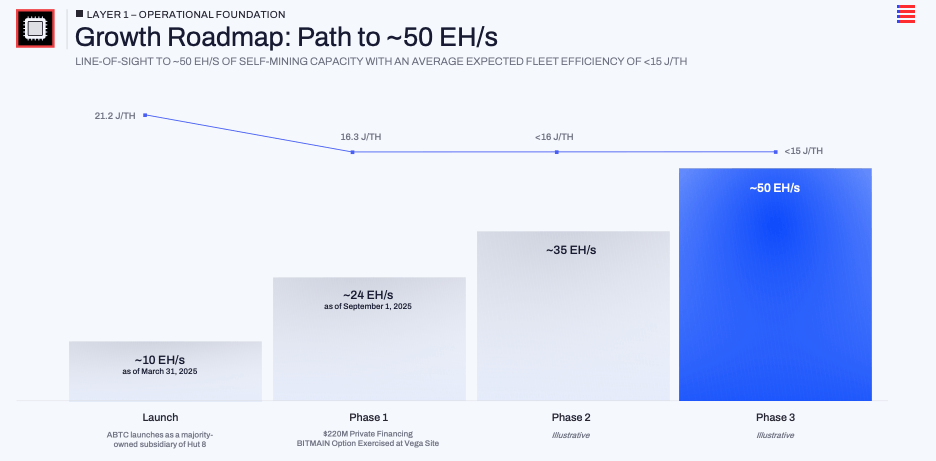

By the end of the third quarter, we reported installed capacity with an average fleet efficiency of ~25 EH/s. 16.3J/TH. The primary driver was the exercise of the new miner’s purchase option of approximately 14.8 EH/s at the Vega site in Texas. Meeting with management provides a roadmap for next goals ~50 EH/sec.

that screenshot Investor presentation (12 pages).

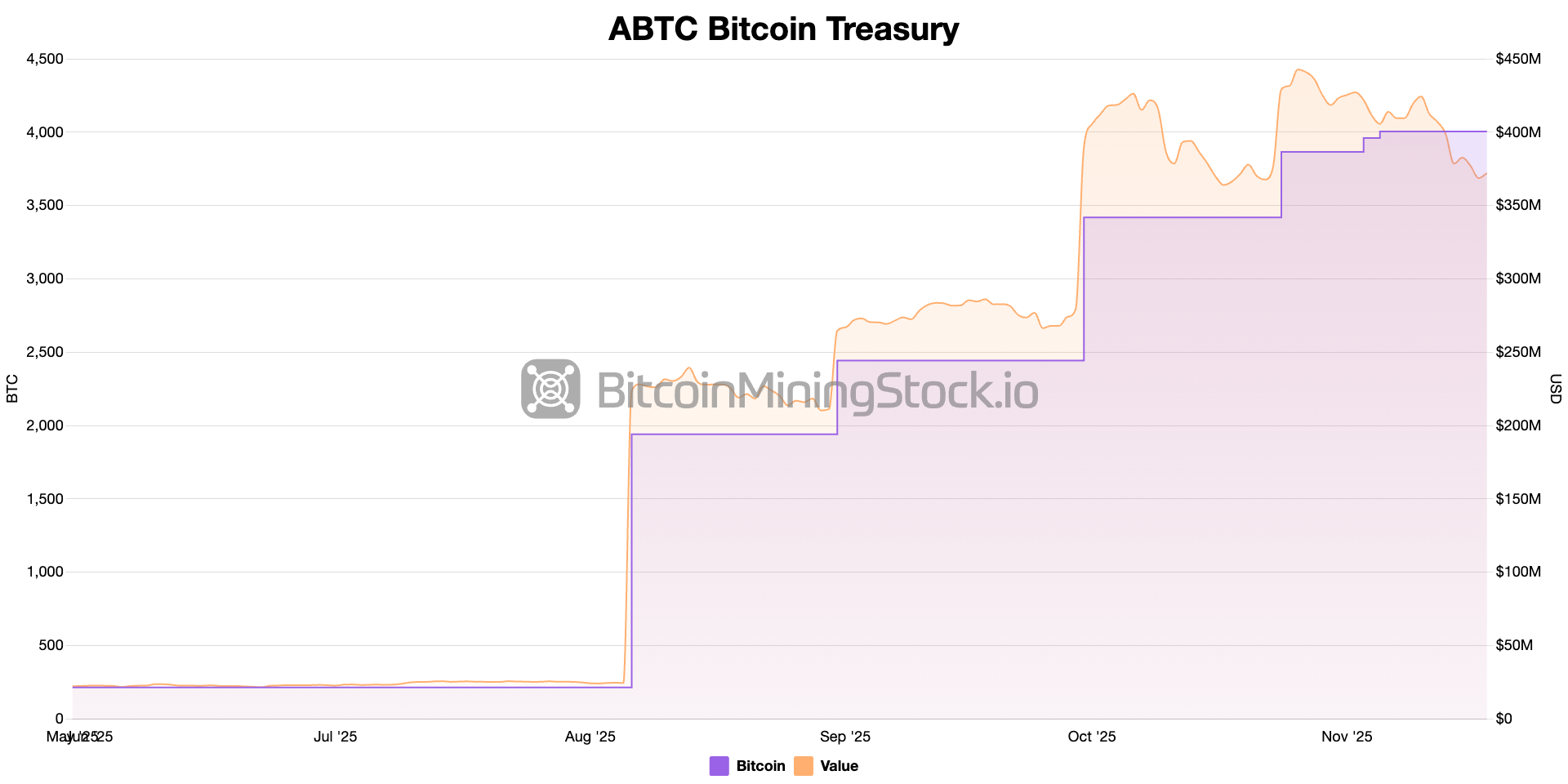

In the same short period of time, Bitcoin reserves went from zero on April 1st to 3,418BTC As of September 30th (as of this writing, the number has reached 4000BTC+). Management translated this to 371 Satoshis per share, highlighting an approximately 50% increase in BTC per share since listing. They openly want the market to take notice Bitcoin per share As the primary value lens, not just revenue or headline hashrate.

In summary, American Bitcoin is a deliberate and focused bet. Bitcoin mining and scaling your BTC holdingsnever leave them.

The asset-light model is a magic recipe

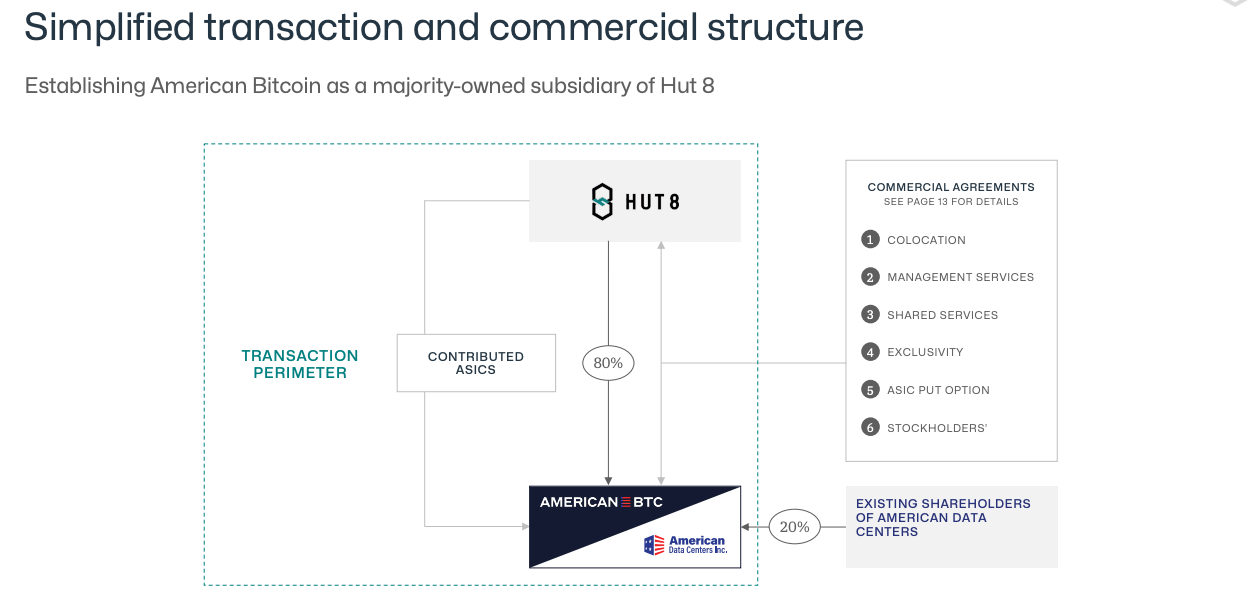

Uniquely, American Bitcoin’s Bitcoin mining operations are tied to a partnership with Hut 8. We don’t own any major infrastructure. hut 8 Develop and operate the site, negotiate with power companies, and provide the physical environment for miners. american bitcoin They buy and fund ASIC fleets, pay hosting and service fees, and focus their capital on miners and Bitcoin rather than substations and buildings. In the third quarter, management said: SG&A expenses are approximately 13% This is a reasonably lean cost base and is consistent with the argument that not owning the infrastructure reduces fixed overhead costs.

Relationship between Hut 8 and Bitcoin in the US (Screenshot from Hut 8 presentation, page 11).

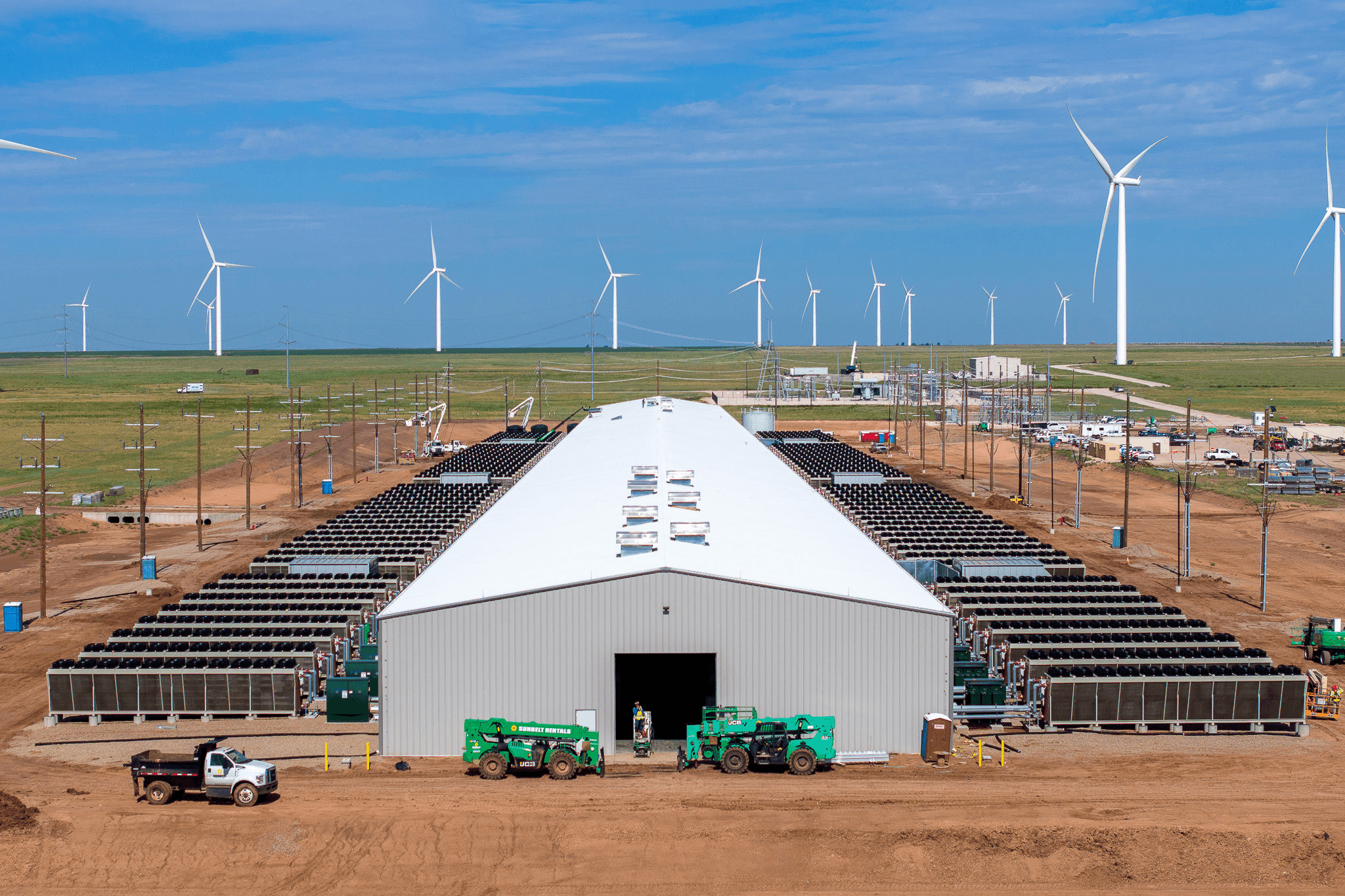

Vega in Amarillo is a prime example. In the third quarter earnings call, Asher Genuto said that American Bitcoin currently accounts for more than 95% of the local co-op’s load, and that it operates as follows. Behind-the-meter customers for fully abateable wind farms. If there is a need to reduce the load on the grid during peak events, mines can be powered off immediately. Management’s argument is that AI and HPC data centers cannot do that without disrupting customers. Giving Bitcoin Mining a Niche Market: Cheap and can absorb intermittent power and keep it out of the way when the power grid is under load. In some ways, the Vega site is a template for how American Bitcoin believes it can keep production costs below spot, even as competition increases.

Vega site (Photo courtesy of Hut 8).

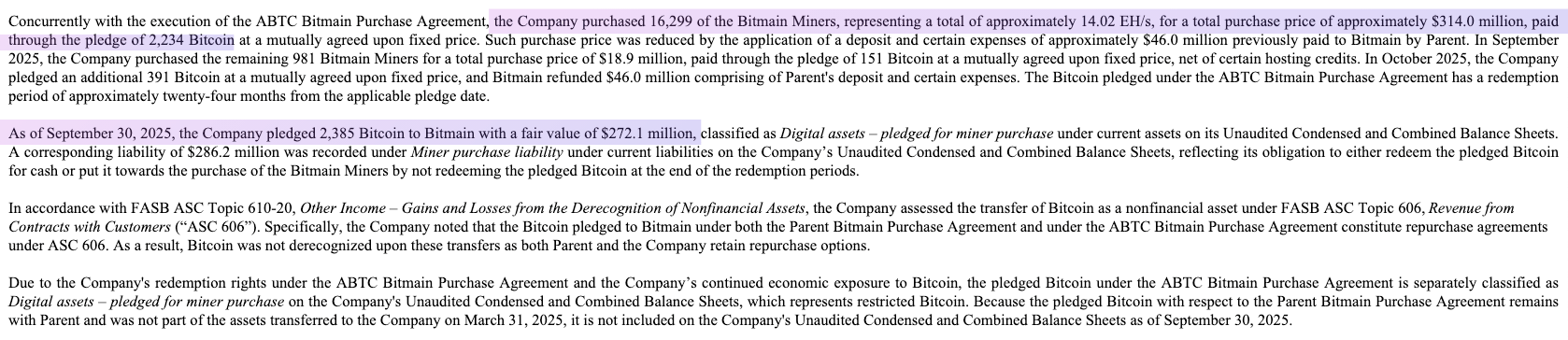

Add to that a financing twist. Instead of paying miners entirely in cash, American Bitcoin structured the Bitmain transaction by pledging large blocks of Bitcoin as collateral for the purchase of new ASICs.

The combination of outsourced infrastructure, flexible power, and BTC-backed equipment financing is the real mechanism behind the 50 EH/s goal.

What does Q3 tell us about the economics of this model?

Our first quarter as a public company provides a small but useful test of our core thesis.

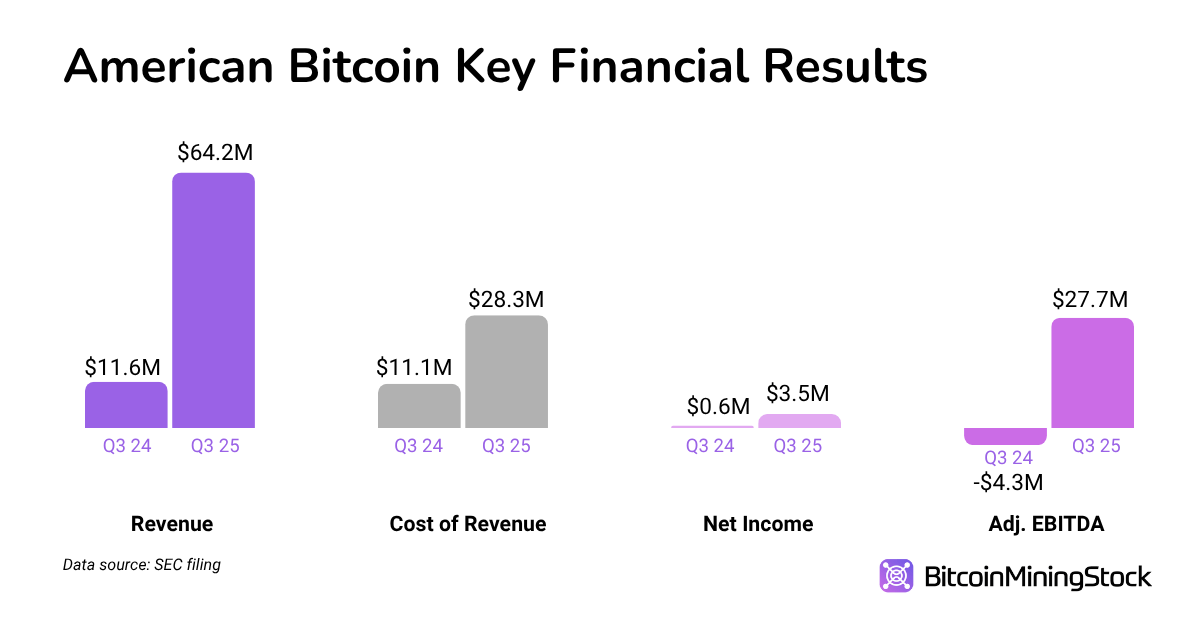

In Q3 2025, American Bitcoin reported revenue of $64.2 million. Cost of revenue was $28.3 million. 56% gross profit margin. This number already includes both the electricity cost and the Hut 8 colocation fee. During the conference call, management pointed out that if you separate out just real-time energy costs and the value of mined Bitcoin, the effective margin would be closer to 69%. Although this is a non-GAAP measure, it is consistent with the company’s claims. It claims that next-generation hardware installed on its flexible wind farm site will allow it to mine Bitcoin for about half the cost of buying Bitcoin on the open market.

Profitability metrics remained strong despite fluctuations in Bitcoin prices. The company recorded a $5.5 million mark-to-market loss on its BTC holdings, but its net profit remained at $3.5 million. Adjusted EBITDA nearly doubled to $27.7 million. This is the first reliable result for a business that didn’t exist 12 months ago.

There is a clear capital strategy at work on the balance sheet. To expand hashrate, American Bitcoin used a BTC collateral structure to finance miner purchases on Vega, rather than relying entirely on cash. As of the end of the quarter, 2,385 BTC of the 3,418 BTC had been pledged as collateral under these arrangements. In other words, the same Bitcoin that underpins the “accumulation” story is also being used to fuel hashrate growth.

Bitcoin promised to ASIC (Learn more (Listed on pages 21 and 22).

These results cannot prove that the model is robust through all cycles. But so far they have shown that: The asset-light structure allows us to increase both hashrate and BTC holdings while providing a healthy margin.

final thoughts

Bitcoin’s first quarter as a publicly traded company in America shows fast execution and reliable early economics. Its asset-light model has delivered solid gross margins and allowed the business to scale quickly without the heavy infrastructure burden typical of traditional miners. But the real test will be whether this “not just the miners, not just the Treasury” approach will hold up, especially if Bitcoin prices fall.

For investors, it’s important to keep an eye on how the story unfolds. 50EH/sec and Balance held per share continues to increase It becomes important. But maybe you’re also looking for answers to a few questions: Since the company has two-thirds of its Bitcoin as collateral, how does it manage risk during a downturn? What happens if the Hut 8 development pipeline stalls? And how long will equity issuance and BTC-backed funding last as market conditions change… The answers to these questions will help you form a clearer theory of your own.