The Fed’s recent quarter-point rate cuts may seem routine, but the timing could not be more important. Markets are bracing for a change in tone and perhaps direction following Powell’s upcoming departure. Rumored Trump nominees like Kevin Hassett have publicly called for deep interest rate cuts, which could make borrowing costs much lower than the Fed currently projects.

However, policy shifts do not occur suddenly. The new chairman will take over a divided committee, with several members still leaning hawkish. So 2026 could be a tug-of-war between political pressure for cheap money and institutional vigilance against inflation. This tug of war is important for the price of Ethereum. Because it determines whether liquidity expands or contracts in the broader risk market.

Ethereum price prediction is caught between caution and hope

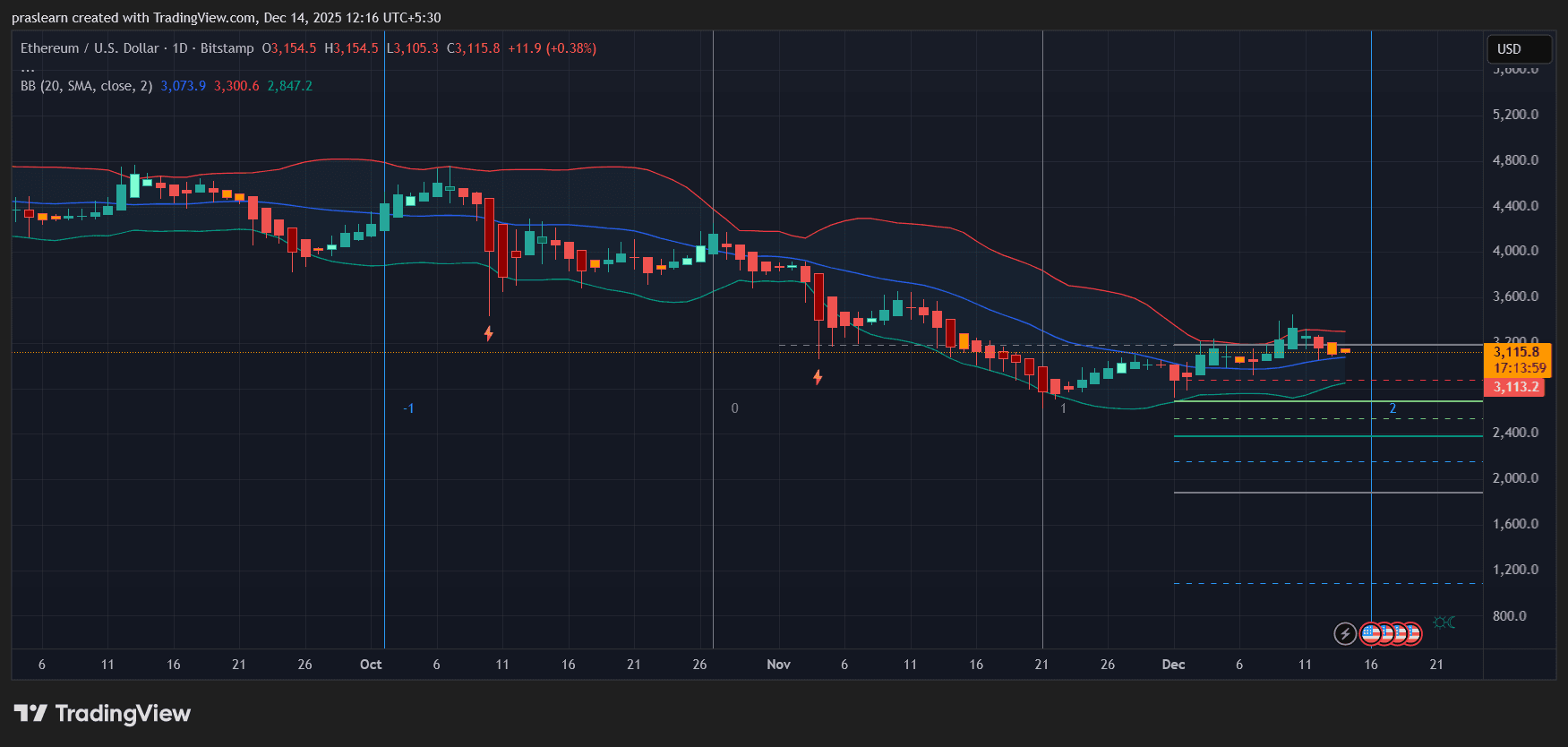

ETH/USD daily chart – TradingView

On the daily chart, ETH/USD trades around $3,115solidified after a weak rebound from November’s lows around $2,850. of Bollinger bands (20,2) Similar to XRP’s structure earlier this month, it shows reduced volatility. Ethereum price repeatedly failed to break out of the middle band $3,300showing hesitation among the bulls.

If ETH price loses the level below $3,000, the next major support lies at the following levels: $2,850, $2,600, $2,400 — Zone marked by past accumulation and Fibonacci retracement. On the other hand, a clean break above $3,300 along with volume could reignite bullish sentiment and start an upward move. $3,600 – $3,800.

This setup reflects a market awaiting macro approval, which will likely come from the Fed rather than the blockchain.

Why the Fed transition is important for Ethereum price

The price of Ethereum rises when money is cheap and liquidity flows freely. From the DeFi boom of 2020 to the NFT mania of 2021, every big rally occurred during the Fed’s aggressive easing cycles. If the new Fed chair supports deep interest rate cuts, it could reinvigorate speculative assets, including cryptocurrencies.

But the decision-making process could be delayed by uncertainty surrounding a change in leadership, delays in economic data due to the government shutdown, and the possibility of a legal battle over the Fed’s independence. In other words, Hesitation among institutional traderscurrently monopolizing ETH volume. Until there is clarity, Ethereum price may continue to oscillate between optimism and caution.

Ethereum price prediction: 2026 could start with chaos and end with momentum

Ethereum price movements in early 2026 are expected to reflect a wait-and-see mood. Markets will be watching any speeches, nomination leaks, or interest rate forecasts for any hints of how dovish or hawkish the new chairman will be. If President Trump-backed Fed leadership moves quickly to cut rates, Ethereum could see a liquidity-driven rally by mid-2026, with the possibility of a retest. $4,000 And beyond that.

Otherwise, if the Fed remains divided, Ethereum price could fall into the first half of the year or stay within a narrow range. In any case, once the policy direction becomes clear, volatility will likely rise sharply. Traders should be ready then.

The $ETH chart shows stability, not strength. The macro context shows uncertainty rather than certainty. Together, these represent a cautious start to 2026. A change in Fed leadership could either spark the next rally in ETH prices or serve as an anchor to cap the rally.