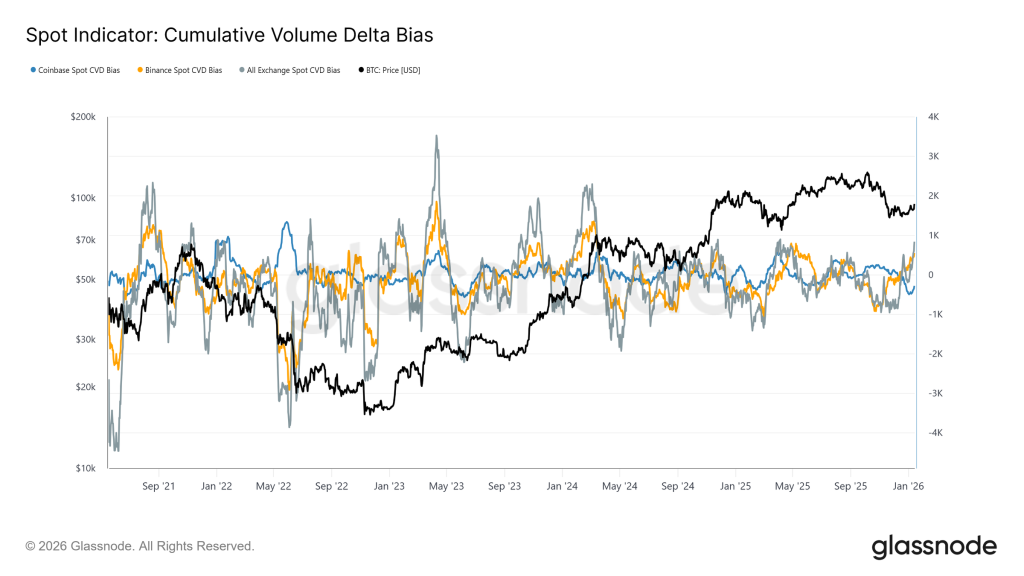

Bitcoin’s rally in early 2026 was pushed back into a familiar problem area: a dense zone of overhead supply that has repeatedly held back gains since November, according to Glassnode. In its latest Week On-chain report, the analytics firm framed the move above $96,000 as superficially constructive, but still largely dependent on derivatives positioning and liquidity conditions rather than sustained spot accumulation.

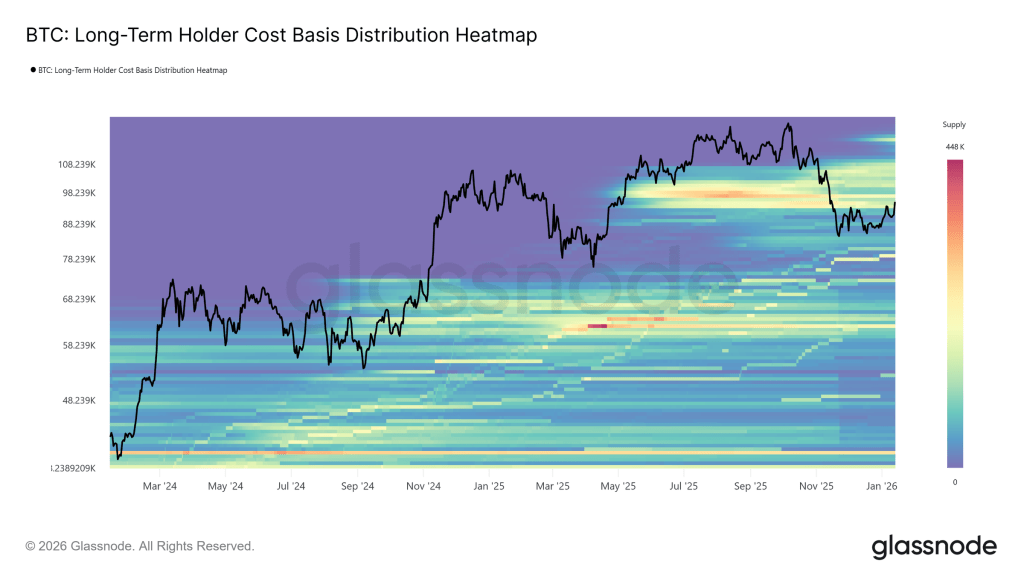

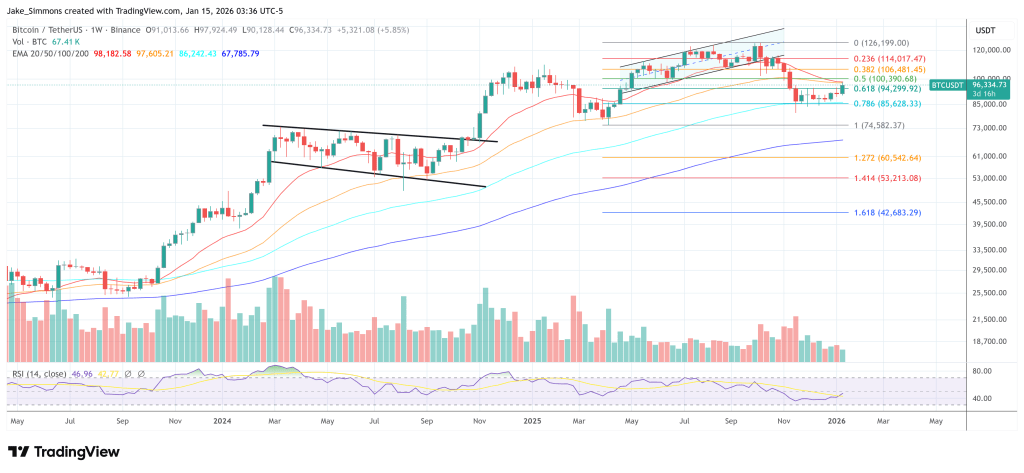

The heart of Glassnode quarrel That said, Bitcoin built from April to July 2025, rising straight into a historically significant range of long-term holder (LTH) cost base associated with a sustained distribution around cycle highs. The report explains that a “dense cluster” has occurred between approximately $93,000 and $110,000, and that the rebound since November has repeatedly stalled near the lower limit.

“This region has consistently acted as a transition barrier, separating correction phases from sustained bullish regimes,” Glassnod wrote. “The market is now facing a familiar test of resilience as prices once again put pressure on this indirect supply. Diversification of long-term holders remains a prerequisite Towards a broader trend reversal. ”The company’s view is frank. The market has returned to the same selling ceiling, and clearing it requires not only price research, but actual absorption.

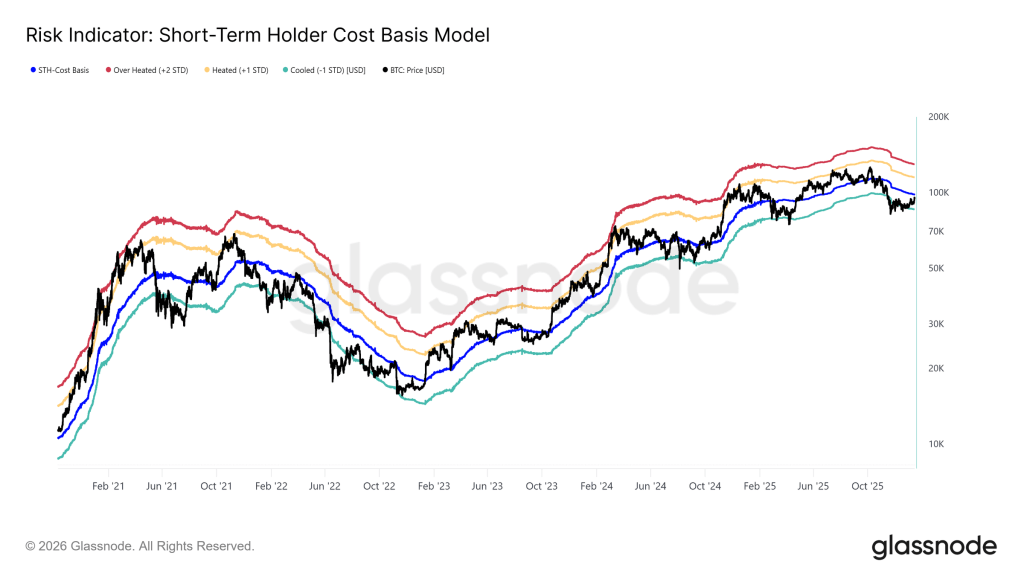

The next level the report highlights is Short Term Holder (STH) On a cost basis, it is $98.3,000 and is treated as a measure of reliability for new buyers. If it continues to trade above this, it would indicate that recent demand has been strong enough to absorb indirect supply while maintaining profits for late entrants.

Glassnode points out that on-chain, long-term holders are still net sellers, and the total supply of LTH is still on the decline. The key change is speed. The report said the rate of decline has “slowed significantly” compared to the aggressive distribution seen in Q3 and Q4 2025, suggesting profit-taking continues, but to a lesser extent.

Related books

“What happens going forward will depend primarily on the demand side, particularly the ability to absorb supply from investors built up in the second quarter of 2025,” the report said. “Failure to sustain levels above the true market average of approximately $81,000 over time will significantly increase the risk of a deeper capitulation phase reminiscent of the period from April 2022 to April 2023.” This is one of the clearest downside conditions in the note. If the market loses its long-term average, the probability distribution shifts towards a more severe unwinding.

A relevant signal is the net realized gains and losses for long-term holders, which Glassnode says reflects a “remarkably calm distribution regime.” Long-term holders have realized a net profit of approximately 12.8,000 BTC per week, which is a sharp deceleration from the cycle peak of over 100,000 BTC per week. This easing does not mean capitulation risk has disappeared, but it does suggest that the most intense phase of profit-taking has eased.

Bitcoin demand remains uneven

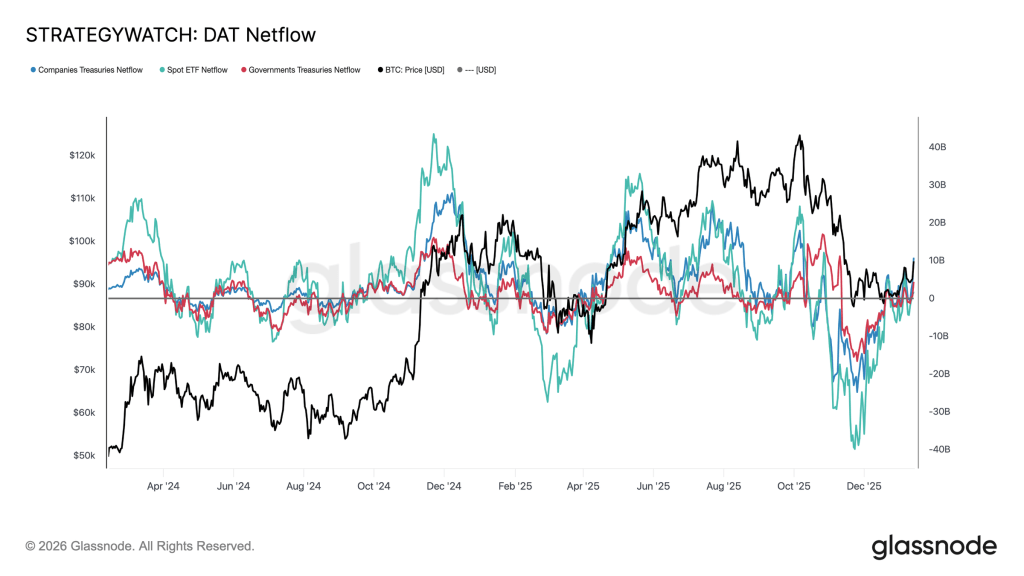

Off-chain metrics tend to be more constructive. Glassnode claims that financial institutions’ balance sheet flows have been “completely reset.” Months of massive outflows across spot ETFscorporations, and sovereign entities, and net flows have stabilized as sell-side pressure appears to have dried up. Spot ETFs are said to be the first cohort to turn positive again and re-establish themselves as major marginal buyers.

In contrast, corporate and government financial flows are portrayed as sporadic and event-driven rather than consistent. As a result, balance sheet demand, while contributing to price stability, may not yet function as a sustainable growth engine, resulting in a market whose short-term direction is more sensitive to derivatives positioning and liquidity conditions.

At the venue level, Glassnode points to improved spot behavior. Binance and the general exchange flow indicators are back in a buy-dominated regime, and Coinbase, which is said to be a consistent source of seller-side attacks during the merger, has “significantly slowed down its selling activity.” The report calls this a constructive structural change, but emphasizes that it still falls short of the sustained, positive accumulation that typically accompanies full trend expansion.

Related books

Most importantly, the report notes that the move into the $96,000 area was “mechanically reinforced” by short-term liquidations in a relatively illiquid environment. Futures volume remains well below the active trading seen for much of 2025, suggesting that relatively little capital was required to force short sales and push resistance higher.

“This indicates that the breakout occurred in a relatively illiquid environment, where modest positioning changes were able to trigger a disproportionately large price reaction,” Glassnord said. “Practically speaking, it didn’t take a lot of new money to force short sellers out of the market and push prices up through resistance.” So going forward, continuity will depend on whether spot demand and sustained volume can replace forced covering once the squeeze urge wears off.

The options market adds a second layer of tension. While Glassnode describes implied volatility as low but “in place,” the skew continues to be asymmetrical to the downside of the price, with a 25-delta skew biased toward puts with medium-term maturities or longer. That is, while participants appear comfortable holding exposure, they remain reluctant to do so without insurance.

Positioning is also important at the microstructural level. The report warns dealers that the Gamma zone around the spot around $94,000 to $104,000 is short. In this setup, hedge flows can amplify the move rather than dampen it, buying on the upswing and selling on the downside, increasing the likelihood of a faster move towards a higher rate strike, such as $100,000, if momentum takes hold.

At the time of writing, BTC was trading at $96,334.

Featured image created with DALL.E, chart on TradingView.com