The cryptocurrency market is currently weathering a wave of macroeconomic uncertainty. Monday, January 19, 2026 $Ethereum price slipped towards $3,200 The support level reflects broad ‘risk-off’ sentiment across global markets. While Bitcoin has struggled to stay above $92,000 due to the renewed trade tensions between the US and the EU, Ethereum’s on-chain metrics tell a much more bullish story.

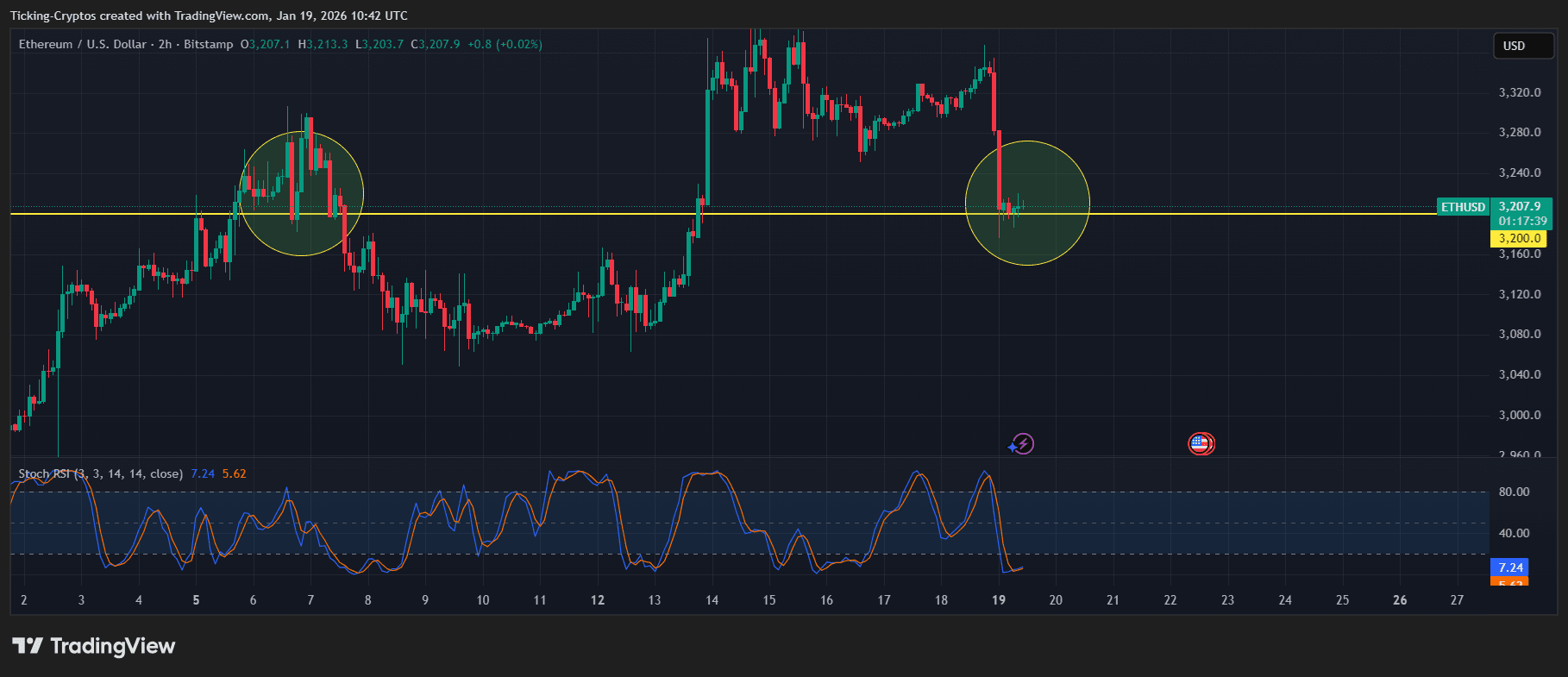

Ethereum Price Analysis: $3,200 Support Remains

According to recent market data, Ethereum ($Ethereum) has retreated to the lower limit of the price upward channel. Despite the decline of about 3% in 24 hours, technical analysts observe that the uptrend remains structurally intact as long as the price remains above the reference value. $3,100 – $3,200 zone.

Ethereum/USD 2H – TradingView

The immediate resistance is $3,350 mark. If the daily candlestick closes above this level, a change in momentum towards above $3,500 could occur. However, if the $3,000 psychological floor fails to hold, we could see a deeper correction towards the $2,700 liquidity pocket. Investors often use exchange comparison To find a platform with the best liquidity to trade these volatile swings.

whales accumulate Ethereum From Binance

Retail sentiment remains cautious, but institutional investor whales see this decline as a great buying opportunity. On-chain monitoring revealed several large companies withdrawing thousands of dollars. Ethereum from Binance.

In particular, an entity labeled “Insider Whale” was recently added 20,000 Ethereum This brings its total position to more than $730 million. This level of aggressive accumulation typically suggests that large investors are poised for a medium-term recovery, likely driven by continued Clarity Act momentum and consistent spot ETF inflows.

Macro headwinds: US-EU trade tensions

The main driver of today’s overall market cooling is the escalating tariff threat between Washington and Brussels. According to reports Reutersthese tensions are putting pressure on both traditional stocks and digital assets. Ethereum is often sensitive to changes in global liquidity and is feeling the pinch, but its decentralized ecosystem continues to evolve.

Vitalik Buterin recently highlighted the need for “better DAOs” that leverage AI and ZK technologies to improve governance efficiency and go beyond simple token holder voting. For those who want to hold assets for a long time while securing them. hardware wallet It remains a top priority during periods of high macro volatility.

Ethereum Price Prediction: What’s Next? Ethereum?

The technical “coiling” phase that Ethereum is currently undergoing typically precedes a major move. With foreign exchange reserves at their lowest levels in years and demand for whales remaining strong, the imbalance between supply and demand could quickly reverse once trade tensions ease.

Check us out to stay updated on the latest developments. Cryptocurrency News Section For real-time updates.