Analysts are increasingly hoping for the start of the alto season as Ethereum is a huge success and altcoins surge across the market. Over the past few days, bullish momentum has pushed many digital assets high, and the price structure shows clear signs of strength. For many traders, this is the moment they’ve been waiting for. This is a long-standing shift in which altcoins surpass Bitcoin and offer original returns.

Related readings

A breakout that surpassed Ethereum’s recent major resistance levels added fuel to the story, with large and mid-cap altcoins following in the footsteps. The new optimism in the market has sparked speculation that an AltSeason cycle may already be underway, with capital rotating from Bitcoin to the wider Altcoin market.

However, not all experts are convinced. Bitcoin’s continued advantage and most Altcoin The reason for caution is that it’s far below their all-time high. The historic Alto season has usually seen an aggressive outperformance across the board, but the market has not yet fully confirmed it.

Altseason is still waiting for a true breakout

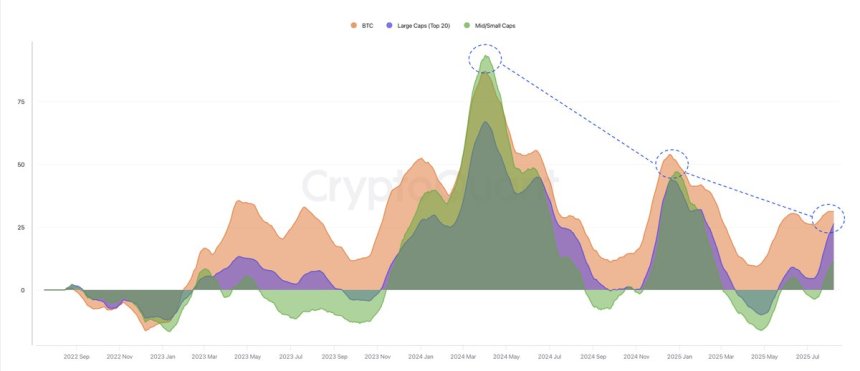

According to top analyst DarkFost, the much-anticipated AltSeason hasn’t really begun. By examining the comparison chart For Bitcoin, large caps (top 20), and medium/small caps, DarkFost points out that the current cycle shows the weakest Altcoin performance ever. The Altcoins have made a notable move in recent weeks, but their profits are still pale compared to Bitcoin’s dominant run.

The last example similar to the real alto season occurred in the early 2024. This was 2024, when mid- and small projects were particularly drawn at out-of-pace over short but intense periods of Bitcoin. That surge marked a clear capital rotation from BTC to the broader market, providing an oversized return for Altcoin owners. However, current market conditions suggest that a widespread outperformance of types has not yet been realized.

Ethereum has broken past multi-year highs, with some Altcoins posting impressive profits, but the gatherings look selective rather than extensive. The big caps are steadily recovering, but the mid and small coins that are characteristic of the explosive alto season are still behind. This disparity suggests that institutional and retail capital continues to concentrate on more established assets.

For the confirmed AltS season, analysts monitor sustained breakouts with mid- and small performances compared to BTC. Until that shift occurs, the current market may be better described as a powerful altcoin rally at the dominant stage of Bitcoin, rather than the start of the full-scale alto season.

Related readings

The Altcoin Market is approaching critical resistance

Total crypto market capitalization, excluding Bitcoin (Total2), shows a strong bullish momentum currently sitting at $1.57 trillion after a weekly surge of 13.21%. The rally is retesting the market from its 2025 high at a level of $1.6 trillion.

The chart reveals that the market has been on a sustained uptrend since early 2024, with price action consistently maintaining a bullish structure above the 50-week moving average (blue line). Both the 100-week (green) and 200-week (red) moving averages are at a high level, enhancing long-term support and signaling healthy market conditions.

Related readings

In the event of a breakout, Total2 could target previous record high zones of nearly $1.75-1.8 trillion, marking a potential acceleration of capital turnover from Bitcoin to Altcoins. Conversely, if this resistance is not cleared, it could lead to a short-term pullback to $1.4 trillion support, consistent with a 50-week MA. The next few weeks will be important to determine if the alto season will really light up.

Dall-E special images, TradingView chart