The ETH/BTC ratio traders use to measure Ethereum’s relative strength to Bitcoin remains in a tight consolidated range since mid-May. This highlights Altcoin’s continued misperformance against market leaders.

This stagnation reflects weakening investor desire for ETH, but it also indicates a wider delay in the start of the full-scale Altcoin season.

As ETH struggles, puts on Altcoin season

Measurements from the daily chart show that the ETH/BTC ratio has been trending within a narrow range since May 13th. Face resistance at 0.026 and find support at 0.023.

ETH/BTC ratio. Source: TradingView

This ratio measures the price performance of ETH against BTC and shows which assets are gaining value faster. Historically, sustained benefits of the ETH/BTC ratio have served as a precursor to a wider Altcoin assembly, as ETH often leads the charge of capital rotation beyond BTC.

However, current side-to-face trends suggest that traders remain risk aversive and choose to continue to focus on BTC, particularly as geopolitical tensions continue.

This trend is worth noting as it raises concerns that the highly anticipated Altcoin season could be further delayed.

According to a June 18 post by Crypto Fella on X, analysts emphasized that the ETH/BTC chart is the “most important chart” for anyone looking to return for the Altcoin season.

Measurements from the provided chart show the pair hovering at the 0.024 level where the previous cycle bottom is formed. Similar structures in 2019 and 2020 saw a stronger ETH rebound compared to BTC after an underestimation of the extended period. But as Crypto Fella points out, “before you see a big reversal, you need to see some degree of strength.”

ETH/BTC ratio. Source: x

Therefore, a critical break above the important resistance at 0.026 is important to mark the onset of a wider Altcoin revival.

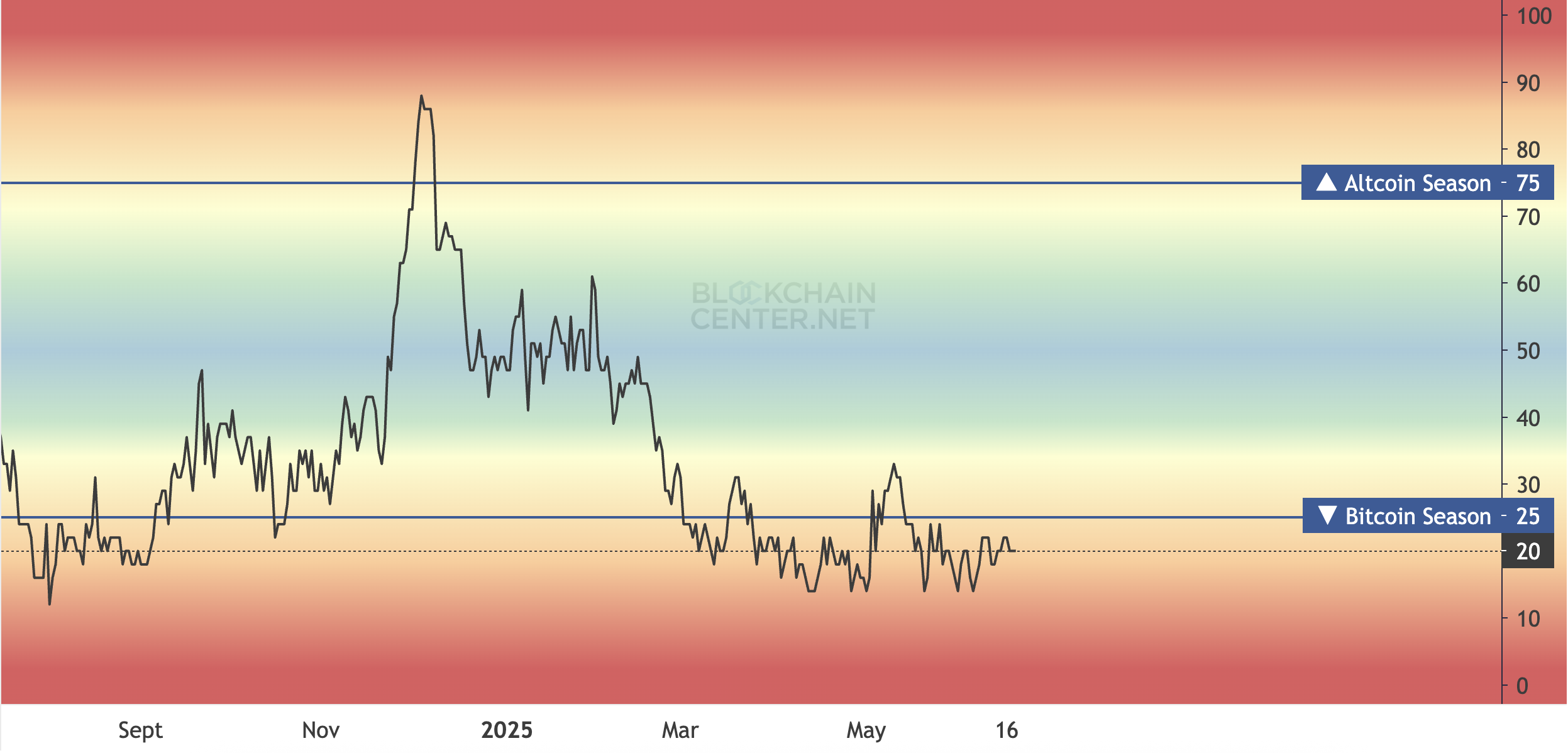

Furthermore, measurements from the AltCoin Season Index show that the market remains firmly in its BTC dominance stage. The Altcoin season begins when at least 75% of the top 50 Altcoins outperform BTC for three months.

Altcoin season index. Source: Blockchain Center

Only 25% have been able to do that in the last 90 days, showing a clear delay in Altcoin’s performance, suggesting that the true Altcoin season could still be a long way off.

ETH is struggling to fall below the 20-day EMA

ETH traded at $2,521 at press time, focusing on a mere 0.15% increase in the past day. On the ETH/USD one-day chart, AltCoin falls below the 20-day index moving average (EMA) and confirms the strength of its bearish amid rising geopolitical tensions in the Middle East.

The 20-day EMA measures the average price of assets over the last 20 days, giving weight to recent prices. A price falls below the 20-day EMA, which shows short-term bearish momentum, suggesting that the seller is in control.

If this continues, the ETH could drop to $2,424.

ETH price analysis. Source: TradingView

However, if demand rises, the ETH price could rebound to $2,745, above the 20-day EMA.