Jason Atkins, chief commercial officer of crypto market maker Auros, has added to the tension in the crypto market by identifying liquidity, rather than a volatility crisis, as the market’s main challenge. Atkins made this statement ahead of a consensus event in Hong Kong.

Although the analyst later pointed out that institutional benefits Although the crypto market continued to grow throughout 2025, limited market liquidity remains a major barrier, preventing large Wall Street firms from entering without causing price disruption.

In response to this situation, Atkins issued a statement arguing that the market cannot conclude that institutional investors want to participate in the activity without the necessary enabling factors.

The main question, he said, is whether these markets can handle the demand from large institutional investors. “It’s one thing to say, ‘We convinced them to come now,'” Atkins added. “It’s another thing to ask, ‘Is there enough space for everyone?'”

Auros’ Atkins expresses concerns about the liquidity situation in the cryptocurrency market

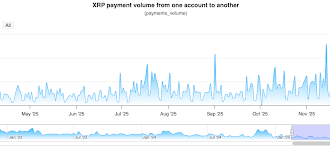

As the debate made headlines, Atkins maintained that liquidity remains high. be important issues In the cryptocurrency market, this is mainly due to a decline in market interest. He further explained that there were significant sales, including: Collision accident on October 10thThe factors behind this trend are traders and leverage outpacing the return to the market.

To better understand this point, industry executives highlighted that liquidity providers have shifted their focus from demand generation to demand fulfillment.

The statement indicated that reduced trading activity will trigger market makers to reduce risk, thereby increasing volatility, which will lead to stricter risk protocols and reduced market liquidity.

On the other hand, Atkins argued that the situation cannot be resolved if markets remain depressed and financial institutions act as stabilizers. This incident shows that markets lack a natural safety net during difficult times.

As a result, a cycle is established in which volatility, caution, and illiquidity mutually reinforce each other and constrain market performance, even when long-term yields are high.

At this point, Atkins emphasized that while volatility itself does not scare big investors, problems arise when volatility is met with market downturns. He also acknowledged that it is difficult to deal with volatility in thin markets, as it is difficult to protect investments and even harder to sell them.

Institutions face significant challenges in the cryptocurrency industry

Atkins’ statement indicates that the current situation in the crypto market is significantly larger for institutions than retail traders. Furthermore, it is noteworthy that large investors have adopted strict rules regarding capital preservation, suggesting a limited ability to accept liquidity risks.

He added: “When you have that level of wealth, or a large institution, it’s not just about getting the best return. It’s about getting the best return while keeping your capital safe.”

Atkins also expressed disapproval of the idea of funds being transferred from cryptocurrencies to AI, arguing that these two fields are at contrasting stages of development.

Reports following his claims emphasized that while artificial intelligence has existed for some time, the recent surge in interest in AI is unprecedented and has not caused funds to leave the crypto ecosystem.

Want to present your project in front of top crypto people? Find out in our next industry report where data meets impact.