The Crypto ETF market came to life on Thursday as both Bitcoin (BTC) and Ether (ETH) spot funds delivered impressive performances, marking the second-largest daily influx since its inception.

The 12 US Spot Bitcoin Exchange Trade Funds, which debuted in January 2024, had an influx of $1.17 billion as the underlying assets peaked at $113,800 when the market closed on July 10th.

The Spot Ethereum ETF also had a record day, witnessing the second highest inflow date ever. This was marked by ETH running to $3,000 after weeks of positive momentum against the biggest cryptocurrency after Bitcoin.

Spot Bitcoin ETF has a net inflow of $1.17 billion, the second largest since its debut

BlackRock’s Ishares Bitcoin Trust (IBIT) has surpassed its daily inflow chart at $448 million, followed by the Fidelity Wise Origin Bitcoin ETF (FBTC) at $324 million and the Ark 21Shares Bitcoin ETF (ARKB) at $268.7 million, according to data from Farside Investors. This is the sixth day in a row for the fund that offers investors to be exposed to spot market performance of flagship cryptocurrencies.

Bitwise’s contributions from BITB included $77.2 million, Grayscale’s Bitcoin Mini Trust (BTC) of $81.9 million, and Vaneck’s Hodl of $15.2 million. Yesterday, only Grayscale Bitcoin Trust ETF (GBTC) experienced the leak, which was $40.1 million. The total trading volume for the day was $51.3 billion, increasing its net worth under the ETF to a record $1393.9 billion.

The $1.17 billion inflow exceeds only the $1.37 billion recorded in the Spot Bitcoin ETF on November 7, when Donald Trump was declared the winner of the 2024 US presidential election.

Spot Ethereum ETFS accumulates a daily influx of $380 million, led by BlackRock’s ETHA

Meanwhile, the US Spot Ether ETFS deal also witnessed a positive trend on Thursday, winning $383.1 million without spills. This also marked the fund’s second highest net inflow since its launch in July 2024.

Naturally, BlackRock’s Ishares Ethereum ETF (ETHA) controlled the inflow, recording a net inflow of $300 million. This was the highest daily influx on the fund’s record. Fidelity’s Feth appeared in a distant two seconds at $37.3 million, with GaryScale’s Ethereum Mini Trust (ETH) for $20 million and Grayscale Ethereum Trust (ETHE) for $18.9 million.

Trading volume crushed previous records at $5.1 billion, and net worth under the control of Spot Ethereum ETF increased to $11.844 billion.

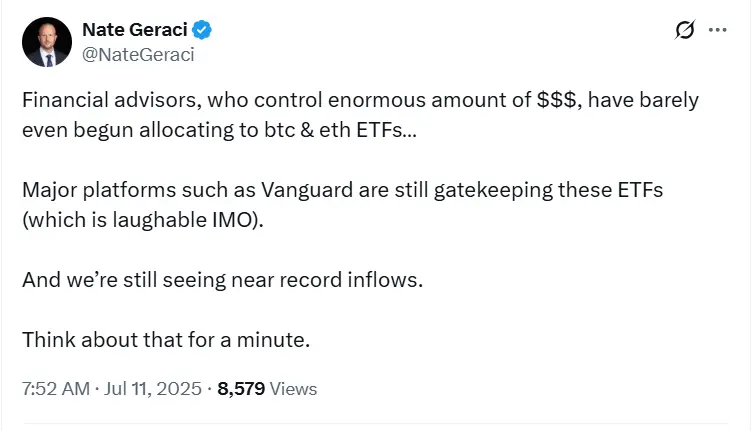

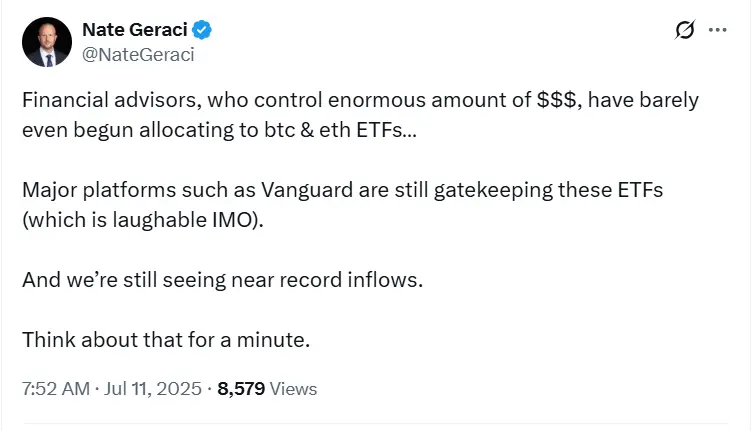

Nate Geraci, president of Novadius Wealth Management, shot a traditional financial advisor at the X-Post. Bitcoin Ether ETFs continue to see influxes that are close to recordings. He called for the decision from asset management giant Vanguard to gatekeep the instruments from clients as “laughterable.”

Demand for Bitcoin and Etheric ETFs outweigh the daily supply of crypto

Both Bitcoin and Ether Spot ETFs are absorbing the net issuance of the underlying crypto.

Data raised by Ultra Sound Money shows that the net issue of Ether in 24 hours was 2,045 ETH, worth around $62 million. That figure is well above the net inflow into Spot Ethereum ETF on Thursday, at $383.1 million, equivalent to 126,636 coins. Currently, the circulation has 189 million ETH.

Similarly, 450 BTC worth $53.40 million was mined yesterday, but the inflow into the Bitcoin ETF was worth 11,550 BTC, far exceeding the supply. A recent report by Galaxy Research shows that the US Bitcoin ETF and Michael Saylor company strategy collectively accumulates $28.22 billion in BTC.

Potential Fed rate reductions and US crypto policy expected to drive demand for Bitcoin and ether through ETFs

Presto Research analyst Min Jung said that while the potential risks of US tariffs continue to loom on the market, positive catalysts like the expectations of interest rate cuts by the Federal Reserve and the increased facility’s appetite for digital assets will continue to drive growth in the crypto space. He believes that demand for Bitcoin and ether spot ETFs may remain “robust” in the medium term, especially as assets’ roles evolve in diversified portfolios.

Investors are also closely watching recent developments in regulations, including the upcoming Genius Stabble Coin Act and the removal of major IRS Cryptobroker tax regulations. LVRG Research Director Nicklack said the development surrounding these events has fueled institutional demand for major cryptocurrencies as costly barriers and legal complications have been removed from the traditional financial system.

At the time of writing, Bitcoin (BTC) is trading at $118,372, an increase of 6.56% over the past 24 hours. Meanwhile, Ether (ETH) has changed hands at $3,007, up 8.29% since yesterday.