The decisive break in Bitcoin beyond the psychologically significant $95,000 mark has injected fresh optimism into the market, at least among miners.

This important milestone has on-chain data that has caused minor emotional changes and shows a significant increase in BTC minor reserves over the past few days.

Miners bet on BTC upside down as reserves jump from the annual low

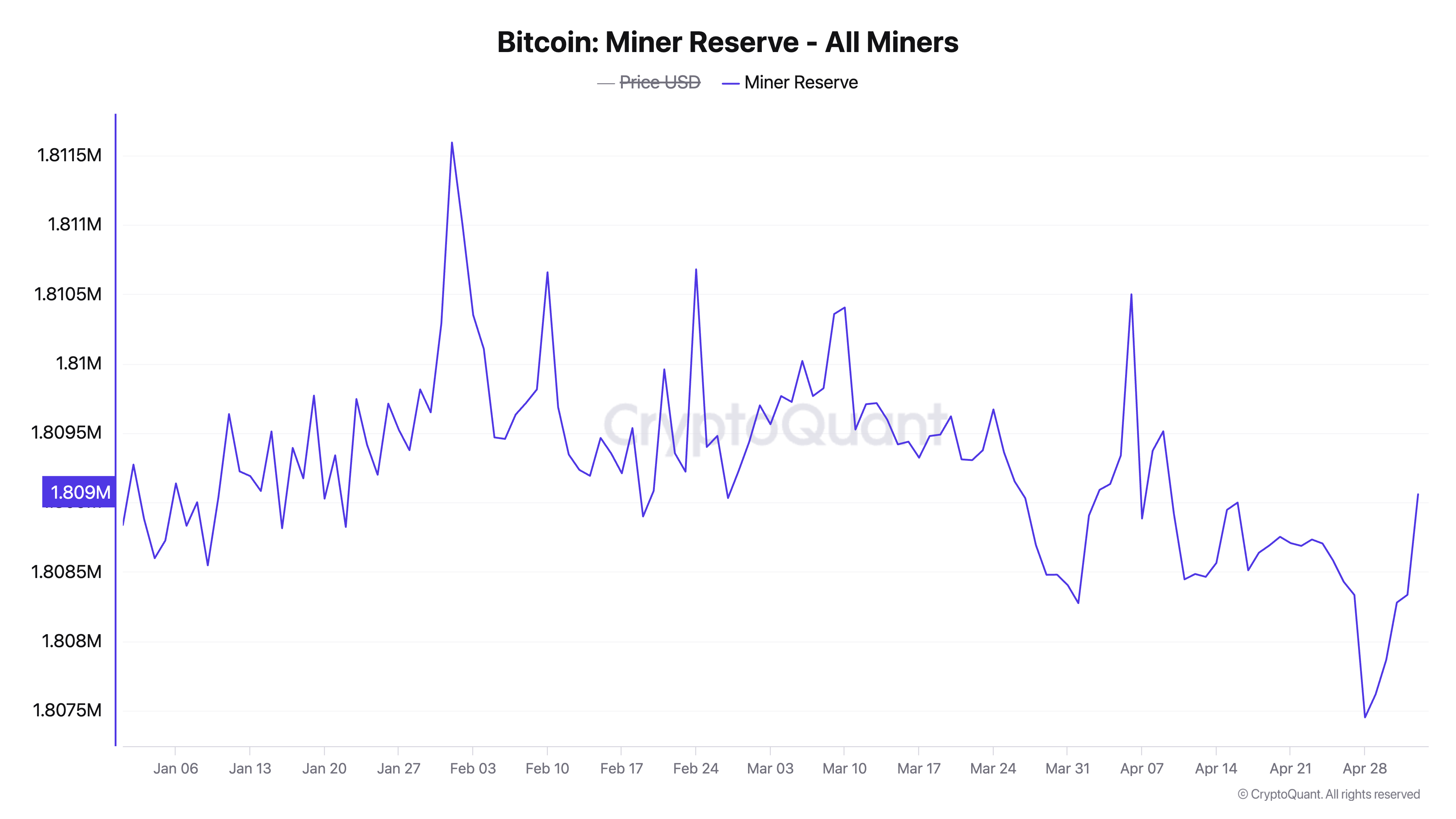

Bitcoin’s minor reserves began rising on April 29, shortly after BTC was closed above the $95,000 threshold, according to Cryptoquant.

For context, the reserve had fallen to an early year decline of 1.8 million btc just one day ago, turning the course back and showing signs of accumulation.

Bitcoin Minor Reserve. Source: Cryptoquant

Bitcoin’s Minor Reserve tracks the number of coins held in miners’ wallets. This represents a coin reserve that the miners have not yet sold. Once that falls, miners move coins from their wallets, and are checking bearish feelings towards BTC, usually to sell.

Conversely, when this metric rises as it is now, it suggests that miners are holding more mined coins.

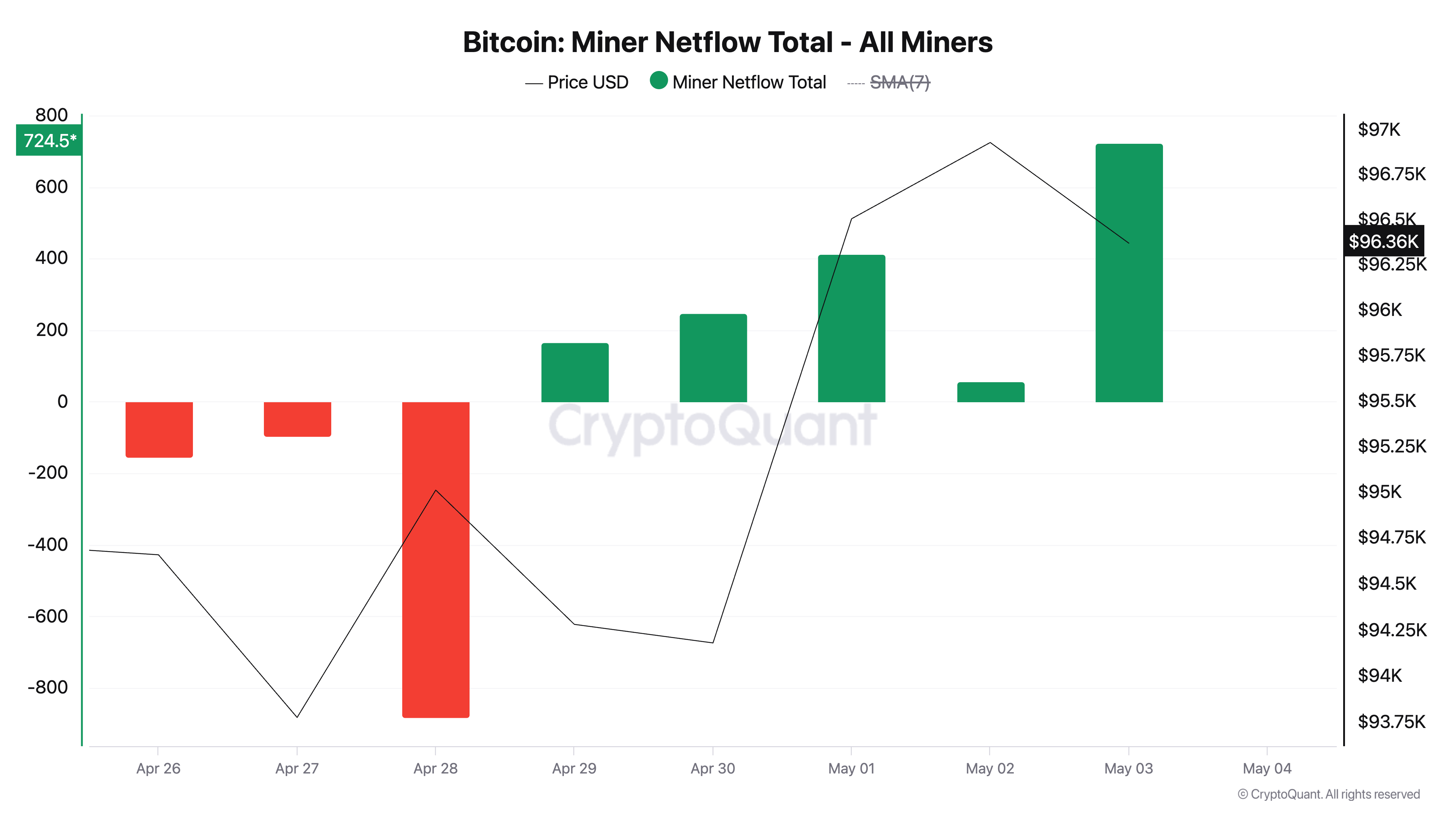

Additionally, bullish changes in minor sentiment are further supported by positive minor Netflow recorded since April 29th.

Bitcoin Minor Netflow. Source: Cryptoquant

Such actions further reflect confidence in the upwards as miners, often considered long-term holders, choose to accumulate rather than liquidate.

There’s a catch

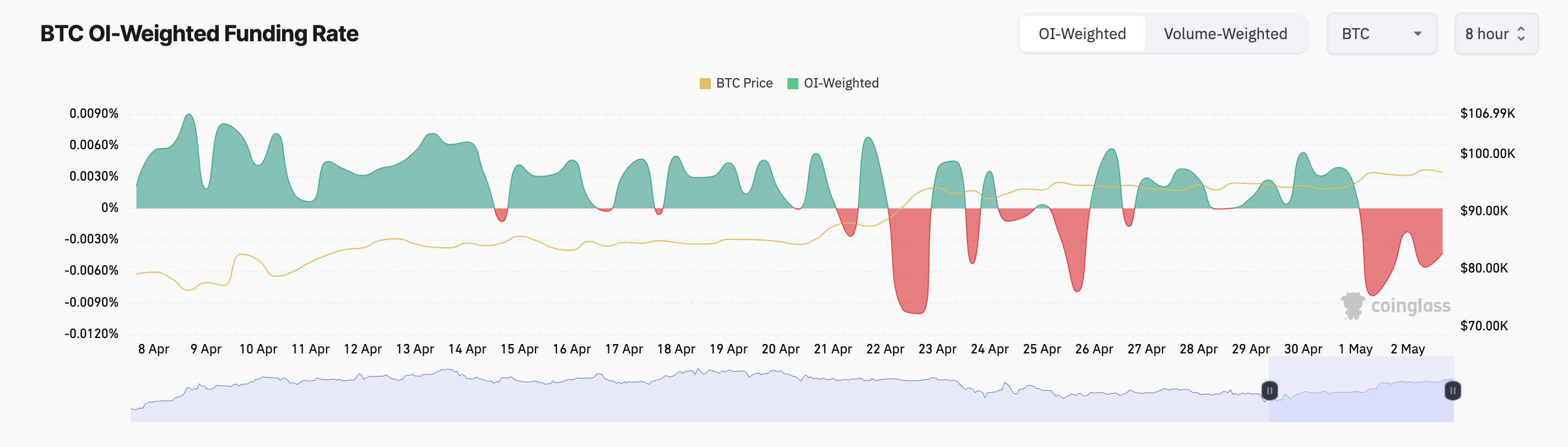

But emotions are not universally bullish. While BTC Minor is backing from sales, derivative data tells a different story.

In the futures market, BTC’s funding rate has remained negative since the beginning of May, a sign that a significant portion of traders are betting on short-term price adjustments. At the time of pressing, the coin’s funding rate is -0.0056%.

BTC funding rate. Source: Coinglass

Funding rates are periodic payments exchanged between long-term and short-term traders in permanent futures contracts to maintain the contract price at the spot price.

If it is positive, it means that traders who hold long positions are paying for people with short positions, indicating that bullish sentiment dominates the market.

On the other hand, such negative funding rates indicate shorter bets than long bets, suggesting bearish pressure on BTC prices.

Breakouts or breakdowns as traders and miners diverge

Minor behavior may refer to renewed confidence, but derivative, stable bearish feelings suggest that traders remain vigilant about potential pullbacks.

If the accumulation of coins is enhanced, BTC can extend profits, outperform resistance by $98,515 and try to regain the price mark of $102,080.

BTC price analysis. Source: TradingView

However, if you win a bearish over a major coin and witness a shortage of demand, its price could fall below $95,000, reaching $92,910.