Bitcoin has recently been trading at a critical point after setting a new all-time high, but the momentum appears to be changing. Despite temporarily pushing over $120,000, BTC was unable to maintain a level above that record, and breakouts above ATS remain unconfirmed. This lack of follow-through has fueled bearish speculation, with some analysts warning that the market may face an increased negative risk in the short term.

Related readings

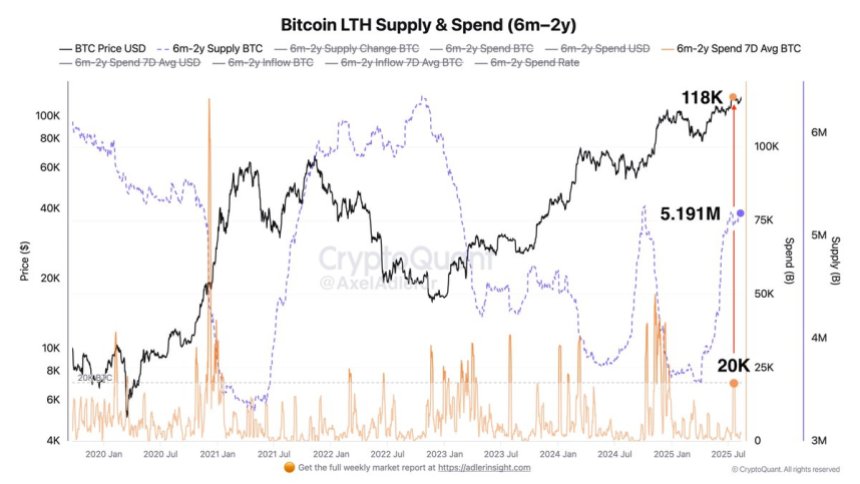

At the same time, on-chain data draws more constructive images for long-term stability. According to the latest insights, the Long-Term Holder (LTH) cohort (who held Bitcoin between six months and two years) significantly increased supply. Since April, when BTC was trading at $83,000, their holdings have grown from 3.551 million to 5.191 million.

This accumulation suggests strong belief among veteran investors despite short-term volatility challenging the market. Traders are focusing on whether Bitcoin can regain $120,000 and establish a solid breakout, but the continued accumulation by long-term holders will strengthen the broader bullishness structure. A conflict between short-term weakness and long-term strength could define the next major move for Bitcoin.

Signal strength of long-term Bitcoin holders

According to top analyst Axel Adler, the best-ever latest test of Bitcoin shows a very different behaviour compared to past cycles. During this move, long-term holders (LTHs) who held the coin between six months and two years have made a profit. data It reveals that the average expenditure over the seven days has risen to 20,000 BTC. However, this level is far below the typical distribution spikes of previous cycles, with spending often spikes from 40,000 to 70,000 BTC.

This milder sales activity suggests that convictions between long-term holders remain strong. Rather than actively profiting, many people choose to continue accumulating or simply hold on their own. Adler emphasizes that accumulation is still above distribution and reflects confidence in the market’s future direction. Such behaviors from experienced participants usually indicate a healthier, more sustainable bull phase. This sales pressure is absorbed without disrupting the broader upward trend.

Despite this courageous background, Bitcoin faces critical technical testing. To see the strength of the latest movement, BTC needs to push the $125,000 level decisively. A breakout that exceeds this resistance could test the resilience shown by long-term holders and pave the way for further price discovery.

If the Bulls are successful, a combination of institutional demand, long-term accumulation and lower sales pressures could drive the next major gathering. Conversely, if they fail to regain $125,000 in the short term, the Bears could give them space to test low levels before the next leg goes up.

Related readings

Testing support after ATH rejection

Bitcoin’s four-hour chart shows the price of $124,000 is set back just below the recent all-time high after a sharp rejection of nearly $123,200. Following this failed breakout attempt, BTC has returned to $117,300, currently surpassing the significant confluence of the 100 and 200 moving averages.

From $116,900 to $117,600, this zone serves as immediate support. The decisive breakdown here could be exposed to $115,000. However, the moving average continues upward, reflecting the underlying bullish structure despite short-term debilitating.

Related readings

The repeated rejection of between $123,000 and $124,000 highlights the importance of this resistance. The Bulls need to regain this zone with confidence in checking momentum and expanding the uptrend to a higher level. Until then, the market is in the consolidation phase, with traders carefully looking at whether they have $117,000 in regional support.

Dall-E special images, TradingView chart