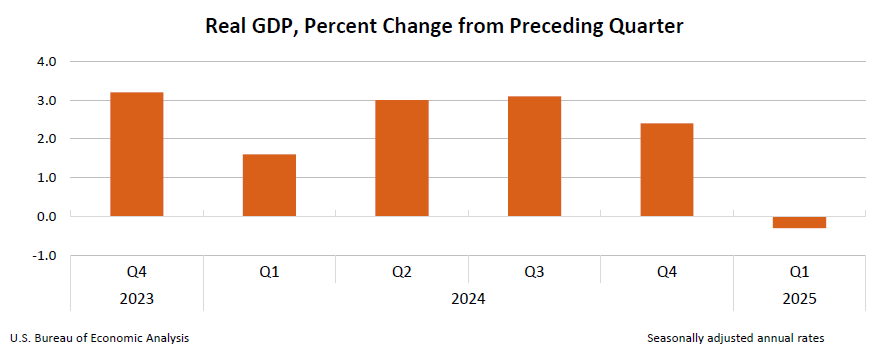

The US economy shrank 0.3% in the first quarter of 2025 after companies rushed to import goods in the wake of President Donald Trump’s world trade war.

Bitcoin’s edge goes low after the US economy shows weakness

According to a report released by the US Department of Commerce on Wednesday, the world’s largest economy signed 0.3% in the first quarter of the year, with economists turning their fingers to President Donald Trump.

Companies continued shopping to make Trump’s controversial tariffs the forefront, leading to a surge in imports, which resulted in a hit with GDP. GDP is a measure of the value of all goods and services produced in the economy, and imports are deducted from the final figures.

(The US economy has reduced by 0.3% due to higher than usual imports in response to Trump’s tariff war/US Department of Commerce)

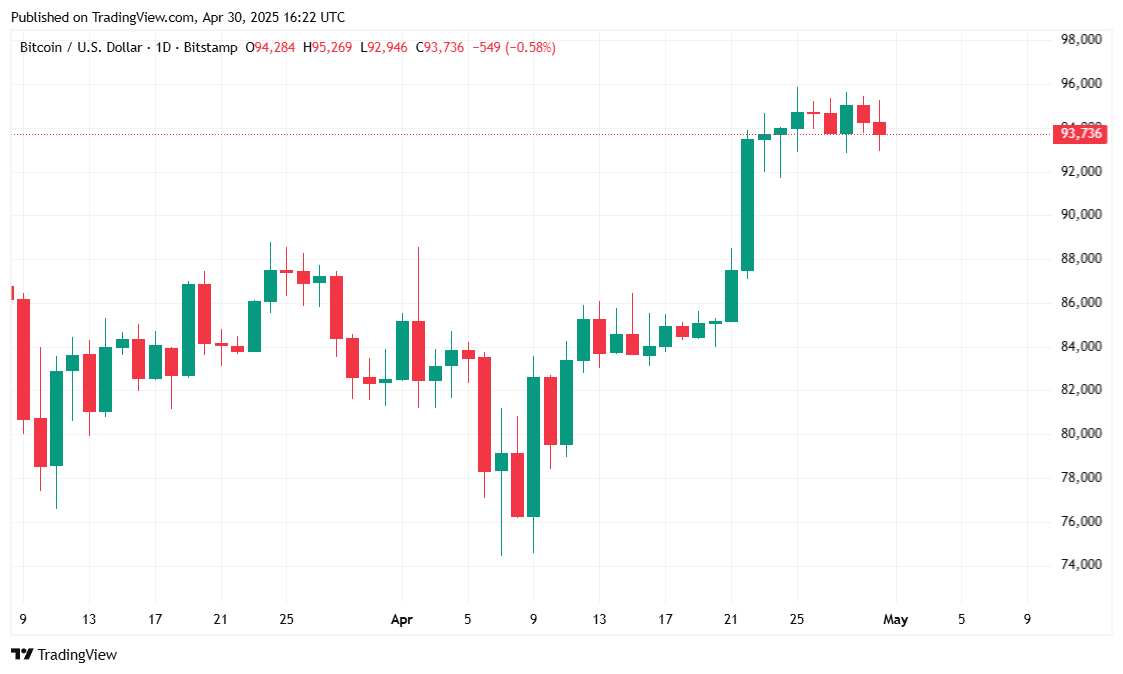

The traditional markets were the S&P 500, Nasdaq and Dow Jones Industrial Average, which soaked 0.91%, 1.27% and 0.61% at the time of reporting, respectively. Bitcoin (BTC) was traded mostly sideways, hovering around $94,000 in the first half of the day.

Trump remained rebellious after the report was released, denounced his predecessor for contraction.

“We need to remove the Biden overhang,” the president said. “This takes a while and has nothing to do with tariffs. It’s just that he left us with bad numbers, but when the boom starts, it’s unlikely to be anything else. Be patient.”

Market Metric Overview

Bitcoin is trading at $93,721.16 at the time of reporting, according to CoinmarketCap data. Cryptocurrency has experienced a modest 1.48% DIP in the last 24 hours, but has maintained a profit of 0.75% each week. Throughout the day, BTC fluctuated within a relatively harsh range between $92,979.64 and $95,485.41.

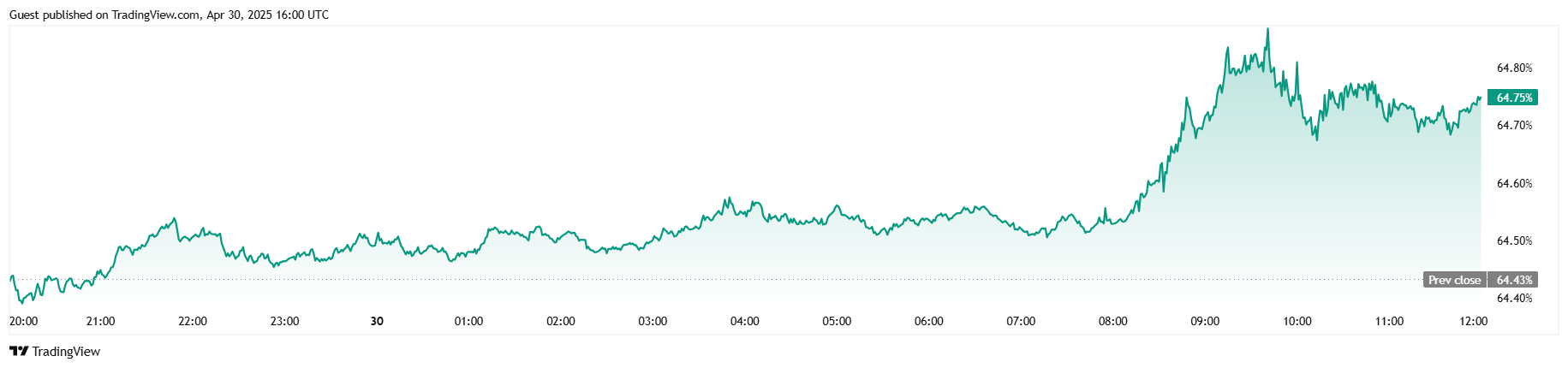

Despite a slight drop in prices, Bitcoin trading activity jumped, with 24-hour trading volume increasing 26.22% to $30.67 billion. Market capitalization fell 1.03% to $1.86 trillion, but data from Trading View shows that Bitcoin’s control over the broader crypto market rose 0.50 percentage points to 64.75%.

(BTC dominance/trade view)

In the derivatives market, Coinglass data shows open interest on BTC total futures reaching $62.4 billion, a mere 0.02% increase over the last 24 hours. The liquidation activity was minimal, totaling $276,630, split almost evenly into advantages and short positions ($141,860 and $134,770, respectively). A balanced liquidation suggests indecisiveness among traders, bolstering current horizontal price action as markets await a clearer signal for the next major movement of cryptocurrency.