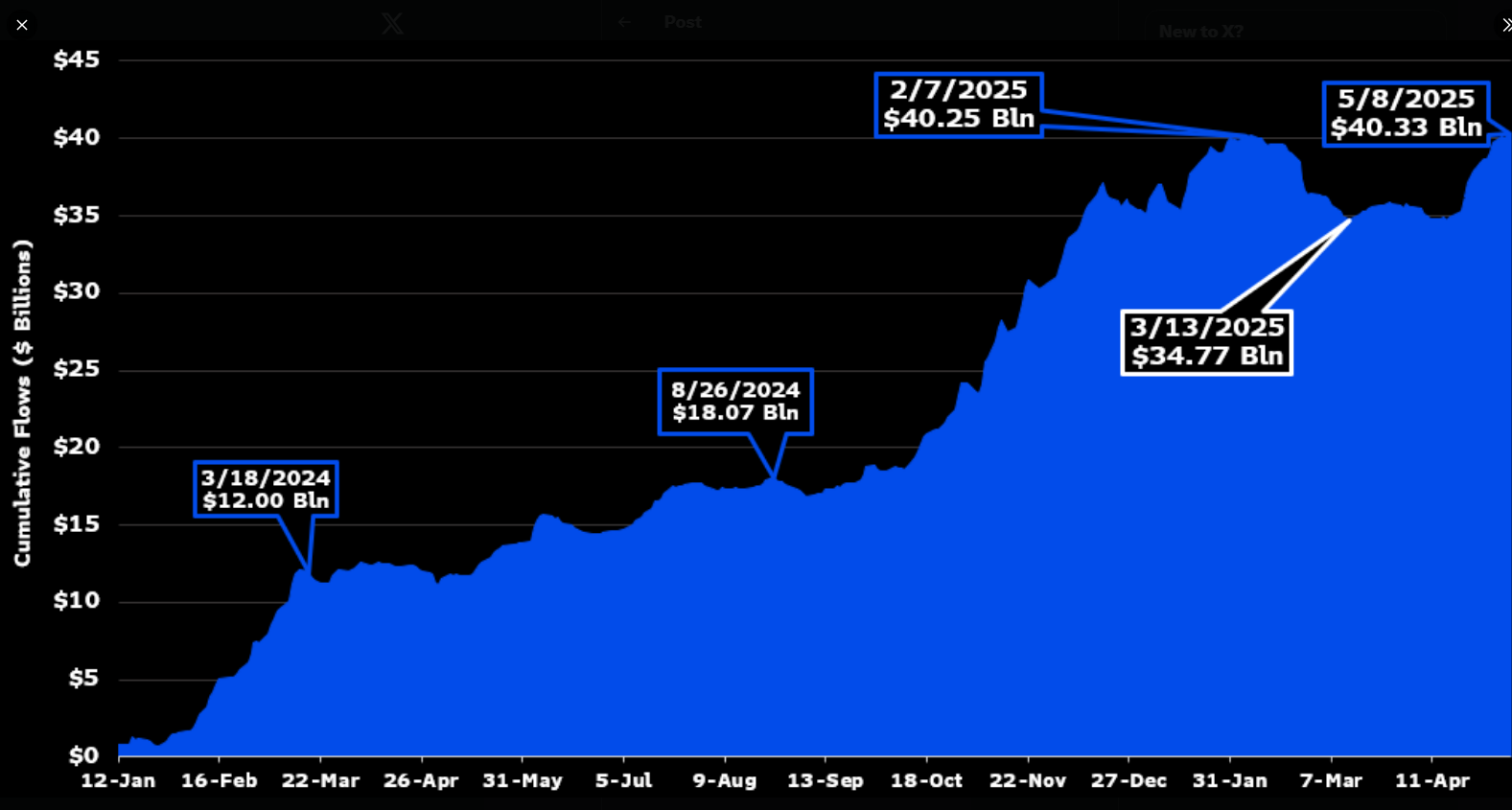

Based on figures shared by Bloomberg analyst James Seyfert, Spot Bitcoin ETF has already attracted more than $40 billion in lifetime inflows. On May 8, 2025, investors pumped new money, bringing it to $40 billion in total. That number indicates that individuals continue to use regulated funds to purchase Bitcoin. It also reflects increased confidence not only from large companies but also from everyday savers.

Spot ETF inflows will be a new hit

It jumped to $40.333 billion following the recent influx on May 8th. Funds alone were added up over previous records for the day. Investors have been putting money into the product since it was launched in early 2024. Their company’s hands continue to raise the flow of ETFs even as prices fluctuate.

After yesterday’s inflow, Spot Bitcoin ETFs are currently in a new, high-water market with lifetime flow. According to Bloomberg data H/T @ericbalchunas pic.twitter.com/0gkpnlmprs, currently $40.33 billion

– James Seyfert (@jseyff) May 9, 2025

Growth since launch

When the US found a Bitcoin ETF released around March 2024, its total lifespan was around $12 billion. By August 2024, that figure had risen to around $18 billion.

Fast forward to March 2025, with the highest ever flow at nearly $35 billion. They broke the $40 billion barrier in two more months. That steady increase indicates that interest continues to fade in Bitcoin exposure in the form of plain vanilla funds or unadorned investment vehicles.

Institutional investors push demand

It’s accumulating by big money investors. Rather than chasing coins individually, asset managers and hedge funds use ETFs to invest in Bitcoin. Analysts say they will add safety tiers and hedges to their large portfolios.

Additionally, these ETFs must be strictly regulated, which introduces more scrutiny from regulators. Some predict that this change might make Bitcoin look like a regular asset.

Fans are speaking

Social media reactions were hot following the milestone. “Bitcoin controls,” one user posted. It’s a line of slang that shows Bitcoin is dominating other assets. Others praised their ability to achieve shopping through regulated channels. Some fear that slowing the price of Bitcoin could slow the ETF flow, but they did not express any concern.

The rise above $40 billion clearly indicates that such ETFs have acquired a portion of the market. But they are just one way that Bitcoin is held. Miners, open exchange traders, and non-exchange transactions all transfer larger amounts.

In the future, observers will see the flow of ETFs as emotional meter. If more money is flowing, it may be a sign of new confidence. When the tide goes away, it may indicate that the buyer is finding a replacement.

Unsplash featured images, TradingView charts