Bitcoin market structure is believed to have undergone major changes since the significant price drop seen on October 10, 2025. Since the market debacle, high-end cryptocurrencies have been on something resembling a recovery trajectory, but some sectors believe a bearish period has already begun.

With BTC below its 2025 opening price, it is becoming increasingly difficult to make a bullish case against the world’s largest cryptocurrency. Additionally, interesting data points regarding the relevant Bitcoin investor demographic have been uncovered, lending further credence to the possibility of the beginning of a bear market.

Are Bitcoin treasury companies offloading coins?

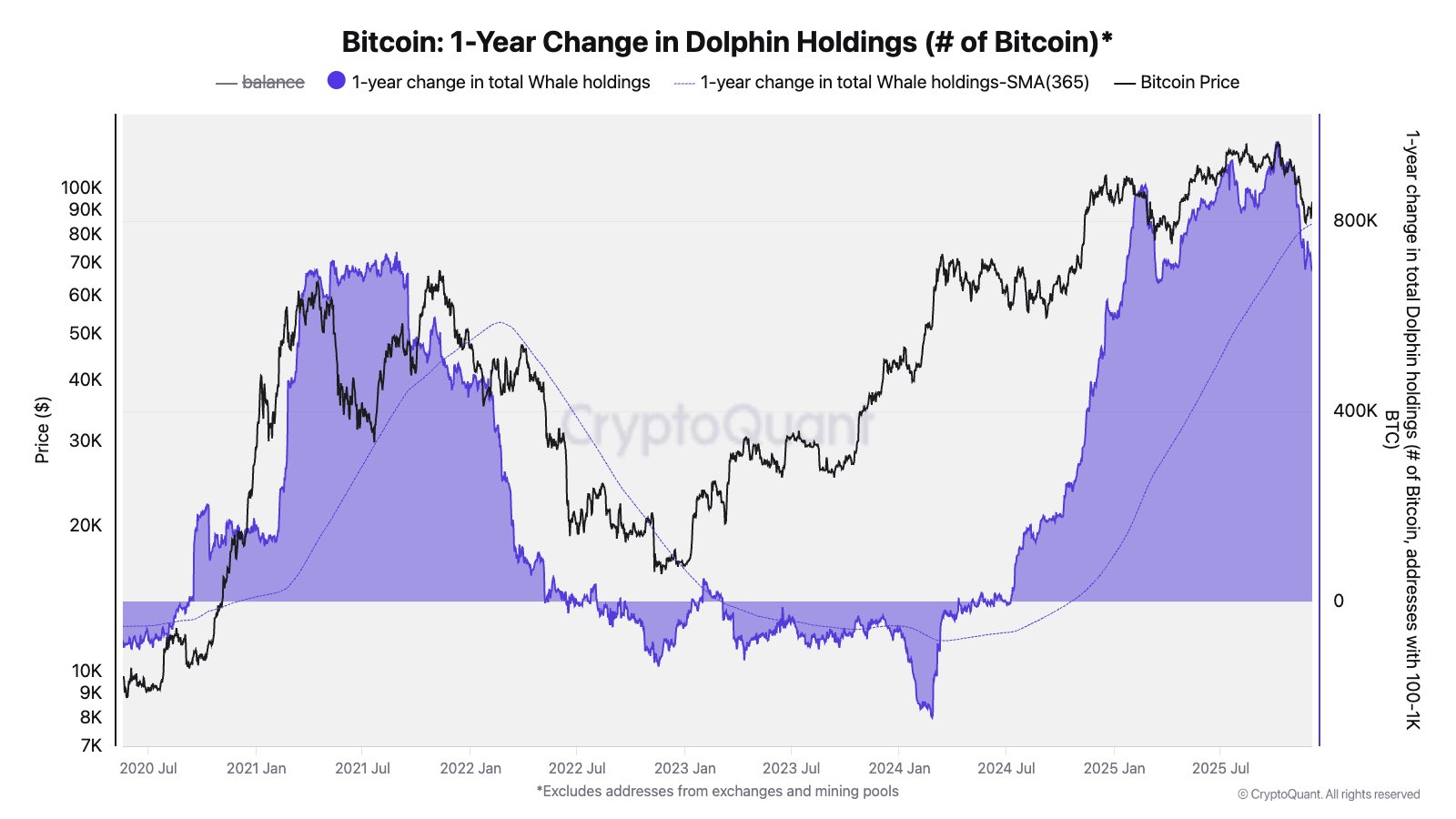

In a new post on X, Julio Moreno, head of research at CryptoQuant, shared on-chain insights that support the hypothesis that a Bitcoin bear market has begun. This conclusion is based on the Balance Growth of a group of investors known as the “Dolphins.”

Dolphins refer to a group of cryptocurrency investors who hold large amounts of coins and are located between small investors (shrimps) and largest investors (whales). Specifically, Moreno described Dolphin as a wallet address that holds large amounts of BTC, ranging from 100 to 1,000 coins.

According to the latest data from CryptoQuant, the growth in Dolphins’ BTC holdings has slowed over the past year and appears to be on the decline. Moreno believes this negative change signals the emergence of a Bitcoin bear market.

Source: @jjc_moreno on X

Moreno revealed that these Dolphin addresses were increasing by about 965,000 BTC year-over-year when BTC price reached its current all-time high of about $125,000. Currently, the BTC price is nearly 30% below its all-time high, and the Bitcoin Dolphins balance is around 694,000 coins.

Moreno wrote to X:

This address cohort also includes ETFs and U.S. Treasuries, which it has also stopped buying.

More interestingly, CryptoQuant’s head of research revealed that this group of investors is made up of ETF issuers and financial companies that have stopped buying Bitcoin. U.S.-based Bitcoin exchange-traded funds have recorded net outflows in five of the past six weeks, according to SoSoValue data.

Meanwhile, BTC and crypto treasury companies have struggled in recent months, with retail investors losing tens of billions of dollars to the hype. Although there are few reports on the sale of crypto assets, this decline in the Dolphins’ holdings tells a completely different story.

Bitcoin price overview

As of this writing, the price of BTC is around $89,151, reflecting a decline of over 3% in the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image created by Dall-E, chart on TradingView