Bitcoin prices have been on a roller coaster for the past seven days, rising below $100,000 from the early blues of the week when the crash was marked. The flagship cryptocurrency has been in service for a lifespan of up to $108,000 over the past few days.

This recent revival has not been particularly reflected in the blockchain. Latest on-chain data suggests that traders don’t want to bet on the price of Bitcoin. A typical market analysis platform evaluates this scenario and proposes potential impacts on price.

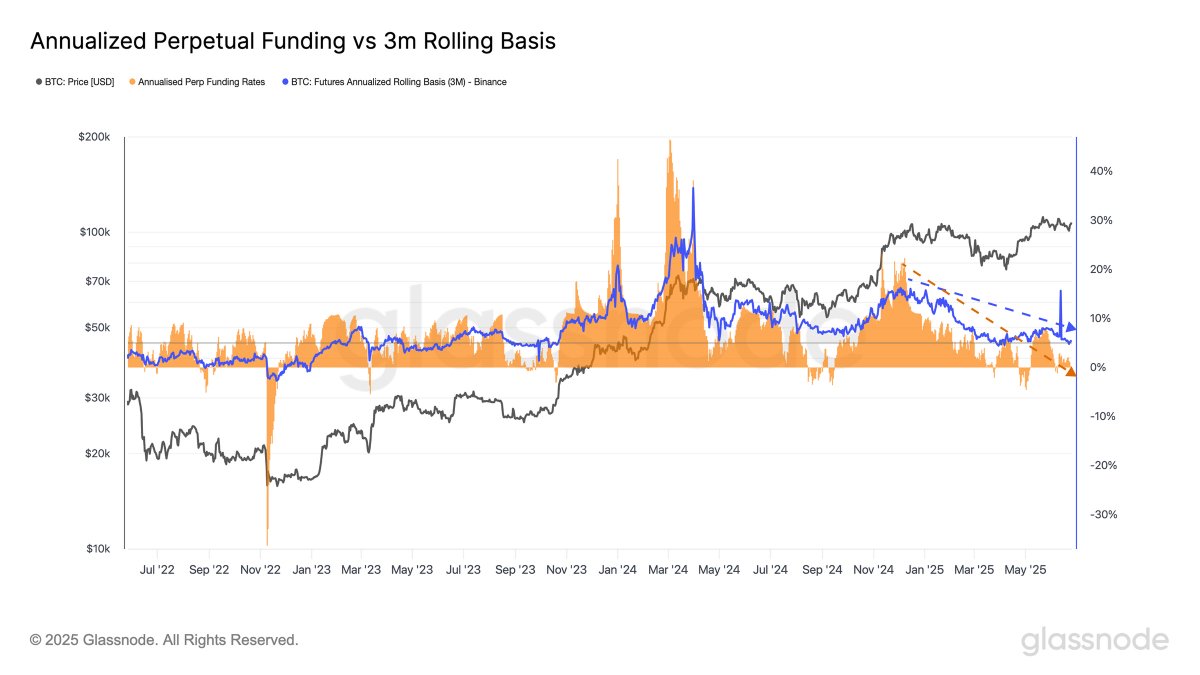

The decline in funding rate reflects an increase in short-side positioning: GlassNode

In a June 27 post on the X Platform, on-chain analytics firm GlassNode revealed that Bitcoin funding rates, which have been declining over the past few months, appear to be stuck in a downward trend. The relevant indicators here are the “binance (3m) futures” metrics on “permanent (perp) funding rate for the year” and “annual rolling basis for 3 months (3m) futures.”

Annual PERP funding rate is an important metric that tracks recurring payments between long and short traders in the derivatives market. This metric provides timely insight into sentiment and leverage in the cryptocurrency derivatives market.

If the funding rate is high or positive, it means that the long trader is paying a short position to the trader. This direction of regular payments usually suggests strong bullish sentiment in the market. On the other hand, a negative value in the metric means that the short trader is paying the long trader.

Meanwhile, the annual rolling basis of three-month (3m) futures estimates the annual yields of purchasing cryptocurrency in spot markets and selling Crypto’s futures contracts simultaneously, which expire in three months. Futures usually trade at a higher price than spot assets. This is the difference that traders can use to make profits.

Source: @glassnode on X

As shown in the chart above, the annual PERP funding rate and annual rolling base of 3 months (3M) futures has been down since last November. “Despite high future activity, appetite for prolonged exposure is declining, reflecting increased attention and perhaps more neutral or shorter positioning,” Glassnode said.

Essentially, the decline in funding rates and a rolling three-month basis indicate that short traders are continuing to crowd the derivatives market. There was a cautious approach to the market from traders, but the institutional flow to US-based Bitcoin exchange trade funds and macroeconomic climate improvements were a very silver lining.

Therefore, even as funding rates continue to decline, the market may witness a short squeeze, even if the macroeconomic environment and institutional capital inflows remain stable. This potential scenario is also supported by the fact that the market tends to move in the opposite direction of the crowd.

Bitcoin price at a glance

At the time of this writing, the price of BTC is around $107,180, and there has been no significant movement in the last 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

ISTOCK featured images, TradingView chart