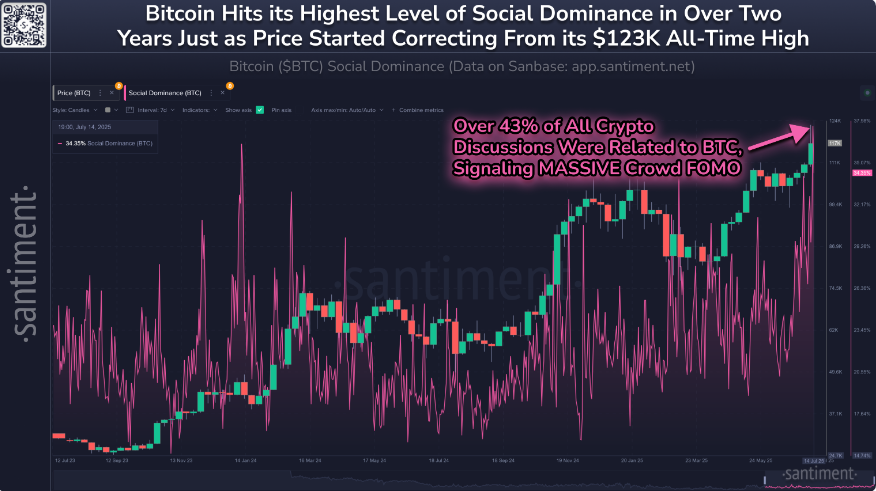

This week, Bitcoin Chat took over social media, and coins rose to fresh highs. According to Santiment, Bitcoin’s market value exceeded $123,000 for the first time in its 17-year history. At the same time, 43% of all crypto-related posts were related to “BTC.” The surge in mention came when prices peaked. Things then pulled back. According to data, Bitcoin slid to around $117,125 on Monday.

Social Media Frenzy Signals Pullback

Based on reports from Santiment, online talk spikes often match local tops of prices. Santimento analyst Brian Kinlivan pointed out that retailers may be too late.

He said similar spikes were followed by dips on June 11th and July 7th. If almost half of all Crypto posts focus on one coin, retail FOMO can raise prices for a short time. But emotions get calm and traders get priced.

Analysts measure their pros and cons

Cryptoquant’s Axel Adler JR says the market hasn’t been overheated yet. His “peak signal” gauge is not triggered, suggesting there is more room to run. Meanwhile, Michael Harvey of Galaxy Digital is hoping for a short pause before making more profits.

Harvey said integration on current levels was his basic case. However, he also kept the possibility of another move high by the end of July.

A past warning has appeared

Quinlivan’s previous attention has proven accurate. After the social spike on June 11th, Bitcoin slipped. The same thing happened after the surge in optimism on July 7th. These episodes reveal that online buzz and price tops often hold hands. Traders who saw these patterns may have entered the dip waiting for a cooldown.

What traders should see next

Based on the report, the next key entry point may come after sentiment has cooled back. Looking at social domination along with on-chain signals could potentially give us a clearer image. When the peak signal from the Cryptoquant finally lights up, it can mean true fatigue. Until then, Bitcoin vehicles could change further up and down.

This market movement captures the double-rimmed quality of hype. Meanwhile, large gatherings attract new money and enthusiasm. On the other hand, they can show the top that brings the pullback.

Unsplash featured images, TradingView charts