As Bitcoin (BTC) attempts to recover from a weekend crash that saw it plummet to $100,000, some crypto analysts believe the BTC market has likely “lost its pulse.” As a result, major cryptocurrencies may be losing their bullish momentum.

Is Bitcoin at risk of losing momentum?

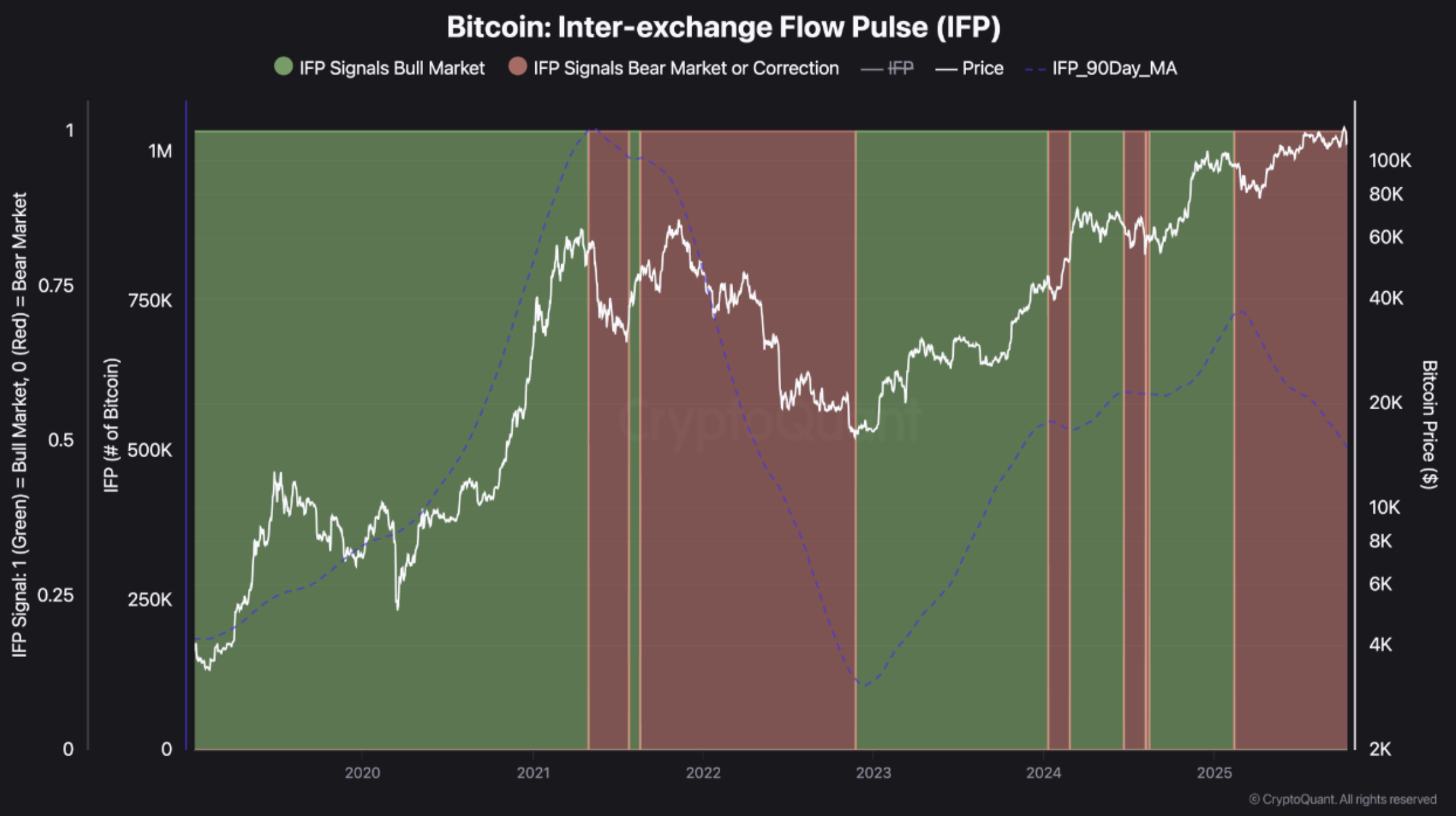

According to a CryptoQuant Quicktake post by contributor TeddyVision, Bitcoin’s inter-exchange flow pulse (IFP) is trending downward, confirming a gradual decline in inter-exchange activity.

Related books

For the uninitiated, IFP measures liquidity as it moves between crypto exchanges. Essentially, this can be thought of as a means to determine how active arbitrage and market making actually is.

To explain, arbitrage refers to the act of buying an asset at a lower price on one platform and selling it at a higher price on another platform, profiting from the price difference. Simply put, arbitrage refers to profiting from inefficiencies.

When such inefficiencies exist in the market and are actually viable, liquidity tends to start moving quickly. At the same time, trading bots begin to move funds back and forth between platforms, market spreads begin to adjust again, and the market begins to feel “alive.”

At this time, IFP increases. Although the rise in IFP has led to greater market volatility, it is generally considered healthy for the market as it confirms that BTC is likely exhibiting bullish momentum.

However, as IFP measurements have declined in recent weeks, traders are finding it harder to arbitrage the price differential, even if it is still showing. TeddyVision says:

Price discrepancies still occur, but arbitrage has become more difficult. Liquidity is low, waiting times are long, and risk-adjusted opportunities are drying up. Traders have fewer setups worth employing and fewer funds circulating between venues.

The analyst emphasized that liquidity is not flowing out of the market, it’s just not circulating as much as before. This drop in liquidity does not cause the market to crash, but it does drain energy from the market.

In conclusion, the market is not collapsing, it is just “too efficient” at the moment for traders to find meaningful arbitrage opportunities to profit from. When inefficiencies exit the market, the underlying asset is likely exposed to risks such as: Lose That momentum.

A healthy correction for BTC?

The market crash on October 9th was the largest single-day liquidation in the history of the cryptocurrency industry, totaling a whopping $19 billion. Although overall optimism has receded, some analysts still expect a quick recovery in sentiment. turn around.

Related books

Fellow Crypto Analyst EtherNasyonaL said Despite the recent market crash, BTC has maintained its upward trajectory and a move to a new all-time high (ATH) could be on the horizon. At the time of writing, BTC is trading at $111,731, down 2.3% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com