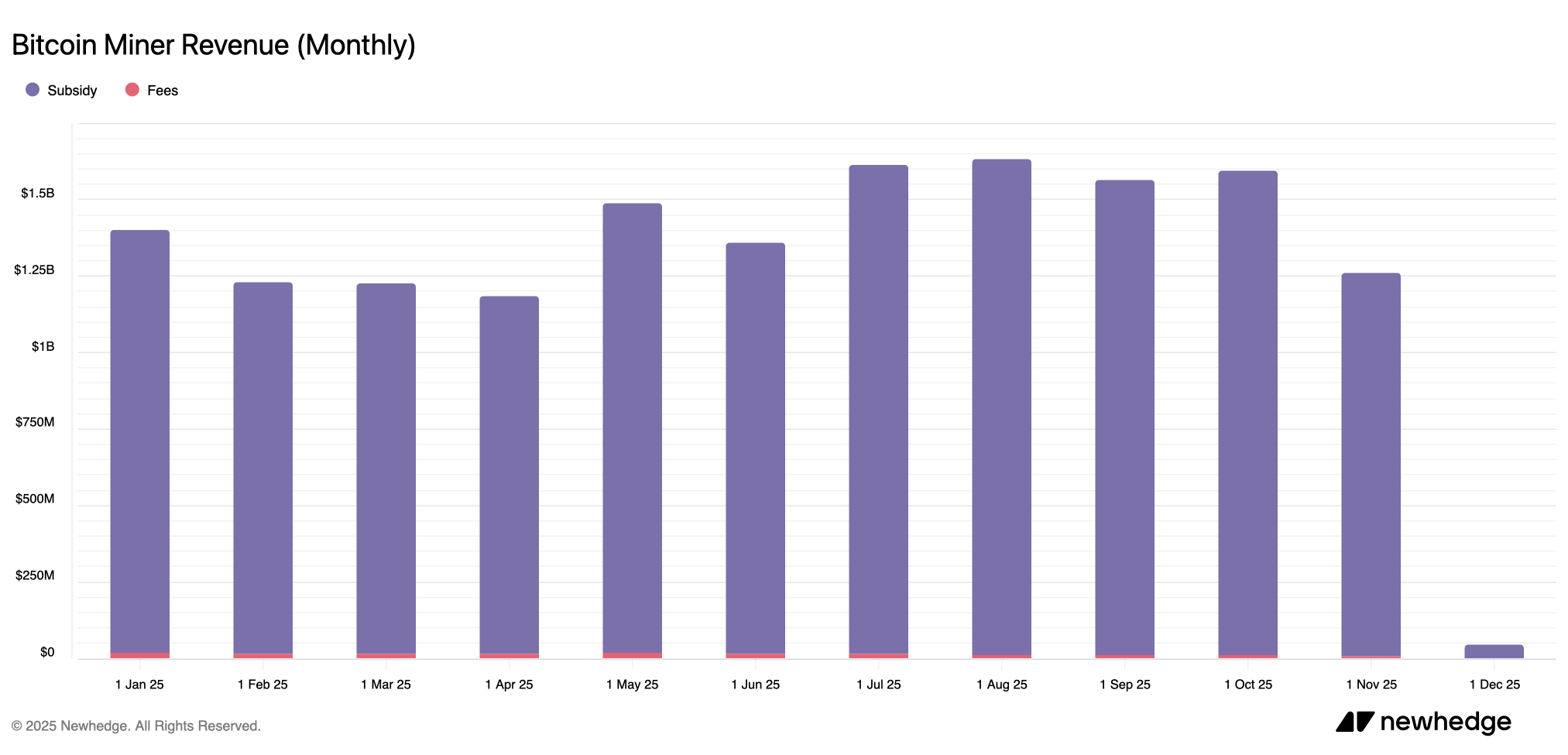

Bitcoin miners continued to plod through November, which was the fourth least profitable month of 2025, according to data. From start to finish, the mining pool processed approximately 453 blocks and collected a total of $1.262 billion in revenue. This revenue includes both grants and fees collected along the way.

Miners grapple with plummeting Bitcoin spot market

Unfortunately for miners, November’s revenue was about 20.9% lower than October, as profits fell from $1.595 billion to $1.262 billion, according to figures recorded by newhedge.io. In fact, November’s revenue was the lowest since April and ranked as the fourth-lowest month of 2025.

The toughest period of the year remains April with $1.18 billion, followed by March with $1.22 billion, February with $1.23 billion, and November’s total. Of the $1.262 billion raised in 30 days, only about $9 million came from on-chain fees. This means that the fees will average out to about 0.71% of the total block reward.

The top three mining pools, Foundry, Antpool, and F2Pool, collected approximately $368.3 million, $239.9 million, and $139.5 million, respectively. Over 30 days, Foundry recorded about 29.14% of the total hashrate, while Antpool’s compute share was about 18.98% and F2Pool’s contribution was about 11.04%. ViaBTC followed closely behind, contributing 10.38% of the overall hashrate.

read more: Ether ETF leads weekly rally as Bitcoin and Solana stay in the green

What’s bad is that BTC price once again dropped significantly on November 30th, and the decline continued until December 1st. Estimated hash prices, or hash power in petahash per second (PH/s), via hashrateindex.com are already at serious lows, with Bitcoin valued at $85,879 as of 9 a.m. ET on Monday, so one petahash is now worth just $36.39. The decline in Bitcoin’s USD value played a large role in the drop in revenue in November compared to October, and is a big part of the pressure miners are currently feeling.

Despite the tough conditions, miners continue to move forward and have to adapt to narrower profit margins and lower hash prices while waiting for a more friendly market to return. With revenues compressed, fees subdued, and Bitcoin trading softening into early December, the sector is relying only on the best in terms of efficiency, scale, and patience. It’s the only tool left when the network refuses to give anyone a break.

Frequently asked questions ❓

- How much revenue did Bitcoin miners earn in November? It earned about $1.262 billion, making it the fourth least profitable month of 2025.

- Why did miner revenue decrease compared to October? Falling Bitcoin prices and weak hash prices drove November’s decline.

- Which pool generated the most mining revenue? Foundry, Antpool, and F2Pool led the month with the highest total payments.

- How have fees affected miners’ revenue? On-chain fees accounted for only about 0.71% of total compensation in November.