Foundry USA unexpectedly mined eight Bitcoin blocks in a row. Controlling about a third of the network’s hashrate makes the pool run less likely, but it’s still possible.

summary

- Foundry USA has straightened out eight Bitcoin blocks ranging from 910,500 to 910,507 in an orchid that grabbed Crypto Feed.

- With about 36% of the network’s hashrate and about 30% share of active pool activity, the probability of this streak was about 1 in 12,000 people, but it’s still within the realm of coincidence.

- The run shows how several large pools can capture multiple blocks in a short time in a row, highlighting concerns about continuous centralization in Bitcoin mining.

The rare streak of eight consecutive Bitcoin (BTC) blocks ranging from 910,500 to 910,507 heights has temporarily attracted attention in feed and block explorer. The repetitive appearance of a single miner made it difficult to ignore the pattern. The continuous blocks were impressive. One mining pool, Foundry USA, appeared in eight entries in a row.

Size matters

As of late 2024, Foundry USA controls around 36.5% of the total hash rate of the Bitcoin network, translated into approximately 280 echhash (EH/S) per second. This domination surpasses its competitors such as Antpur and Luxor Pool in China, with Foundry USA as the world’s largest mining pool.

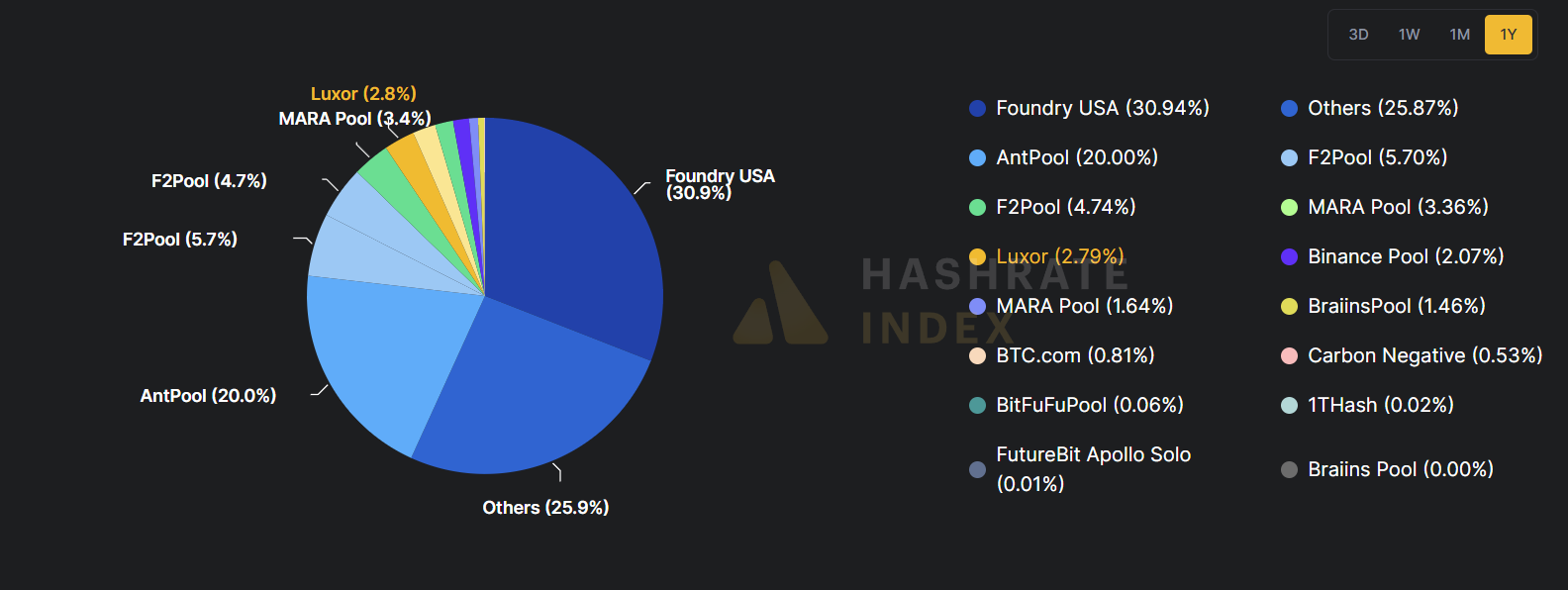

Mining pool by share | Source: Hashrate Index

At the time of reporting, Foundry USA is reported to be one of the largest public mining pools that appear in most trackers with a share of approximately 31% of reported pool activities per Hashrate Index data. The reported slices meant that Foundry USA found about three in about three blocks per 10 blocks on average over that period. The relative scale of the pool is the context of fundamental facts that frame the streak as not inexplicable but not prominent.

- A quick calculation using a pool share of ~30% shows odds of about 0.008% for the same pool mining eight consecutive blocks, or about 1 in 12,000 people.

In other words, winning streaks were rare, but not unheard of. It looked like a lucky roll of a big pool dice, not a network acquisition.

The background of low prices

Run shows that in report and in the block expresser snapshots, it shows very low trading fees and many mild blocks in recent moments. Rates are often reported in single-digit single-digit single-digits of Satoshis per virtual byte, with many recent blocks carrying relatively few transactions.

You might like it too: Novograts’ Galaxy Digital may find a better return with AI than crypto

In that environment, miners’ incomes lean heavily towards fixed subsidies rather than fees, and miners who happen to earn several consecutive blocks will repeatedly collect the same standard subsidies, adding additional fee income for each block.

Each of the eight blocks featured familiar structural elements recorded in all the blocks mined.

- Header;

- Coinbase reward.

- And it doesn’t include any transactions.

The notable details of the public records were merely repeated attributions to a single pool across consecutive heights. The repetitions seen by explorers and Mempool logs have produced clear, circular data points.

Historical similarities

There was a precedent for sharp public responses as a single pool approached most of the hash power.

Early episodes of Bitcoin’s history attracted similar attention when a prominent pool ruled most of its reported capabilities. These moments encouraged public scrutiny and sometimes prompt responses from operators and the wider community. The chain continued to record the blocks in the same way through these episodes, leaving public records as key evidence.

The same pool listed in the 8 blocks looked impressive as it gave an impression of concentration. Even if mathematics showed that it was within the normal range of a large pool, the pattern was worried about centralization.

Foundry USA mined exactly eight blocks in a row. This is very unsettling! Even many bitcoiners I know are beginning to panic.

I have been warning people for years: Bitcoin is dangerously centralized. A small group of miners and insiders dominates both the network and its prices…pic.twitter.com/ooyo17x9rn

– Jacob King (@jacobkinge) August 18, 2025

This episode settles into a larger flow of anomalies and attention cycles that pass through space regularly. As Parker Merritt of Coinmetrics Solutions Engineer previously wrote, the centralization of Bitcoin mining pools remains “the highest concern in the Bitcoin community” at face value, even at face value, as the overwhelming majority of mining rewards “are increasing risk factors such as censorship and network destruction.”

read more: Bitcoin mining faces surge in electricity demand and record fees