Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

The soccer price for the Lion and Player is soft. I hate each of the arcu lorems, Ullachie children, or ullamcorper footballs.

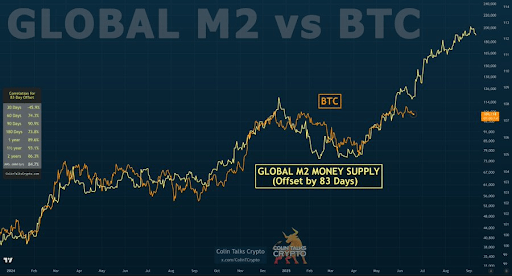

Colin, a Crypto analyst, highlights Bitcoin Price It raises concerns that a deviation from the global M2 money supply and that the Bull Run may have ended. Analysts quickly addressed concerns and noted how such deviations usually occur at some point, but do not override macro trends.

Analysts highlight the deviation in Bitcoin price from the global M2 money supply

in xPostColin revealed that Bitcoin prices are deviating from Global M2 Money Supply. He noted that this deviation is otherwise short-term in broad correlations. Analysts added that this current deviation is similar to the position BTC was in February 2025.

Related readings

Colin said it doesn’t mean that the M2 is broken just as this development wasn’t broken in February. Instead, he argued that it simply means that market participants are not zooming out sufficiently and allow for periods that are not correlated. Analysts added that there is no correlation between them. Bitcoin Price And the global M2 money supply occurs in 20% of the time.

He then hinted The regular chart shows a strong correlation between Bitcoin prices and global M2 money supply. Colin explained that M2 is “directly predictive” for BTC and is not 1:1 price-related. Analysts also say that M2 is Specific BTC prices.

Instead, Global M2 Money Supply predicts market direction only with approximately 80% accuracy. Colin added that while the M2 is on a different Y-axis, Bitcoin’s price has a Y-axis. He also expressed his opinion that M2 could be detached from nearby BTC. Cycle top. Analysts did not provide a timeline on when the cycle top will be, but his analysis shows that the cycle top is not yet in place and the bull run is not over.

Money Supply indicates that you don’t need to worry about BTC prices

in xPostmarket expert Raul Pal suggested that the correlation between Bitcoin Price and money supply shows that there is no need to worry Current price action. He said that, by definition, almost all “news” and “story” are noise when 89% of BTC’s price action is explained by global liquidity.

Related readings

This suggests that current geopolitical risks raised by the Israeli-Iran conflict are unlikely to affect Bitcoin prices as expected. Trading company QCP Capital said recently The fact that the flagship cryptography has not yet shown full-scale panic shows just how mature the assets have.

The company said BTC’s resilient pricing action appears to be supported by a continuing institutional accumulation. Strategy and Metaplanet Buy a dip. Bitcoin ETFs also continue to record positive flows.

At the time of writing, Bitcoin prices have been traded for around $104,700 in the last 24 hours. data From CoinMarketCap.

Getty Images Featured Images, Charts on tradingView.com