Global money supply surges, ETF growth and undeveloped retail demand could push Bitcoin up $122,000 to the past.

Trump’s 401(k) rule change opens $12T in retirement capital from crypto investment.

Bitcoin ETFs that are closer to holding gold will support lawsuits as reserve assets.

Bitcoin has earned nearly $120,000, the same level as it reached on July 23rd. Traders are wondering if there is fuel to reach its highest ever high this year.

Three main forces can achieve this. And now, the new US policy change may just give Bitcoin the biggest driving force of everything.

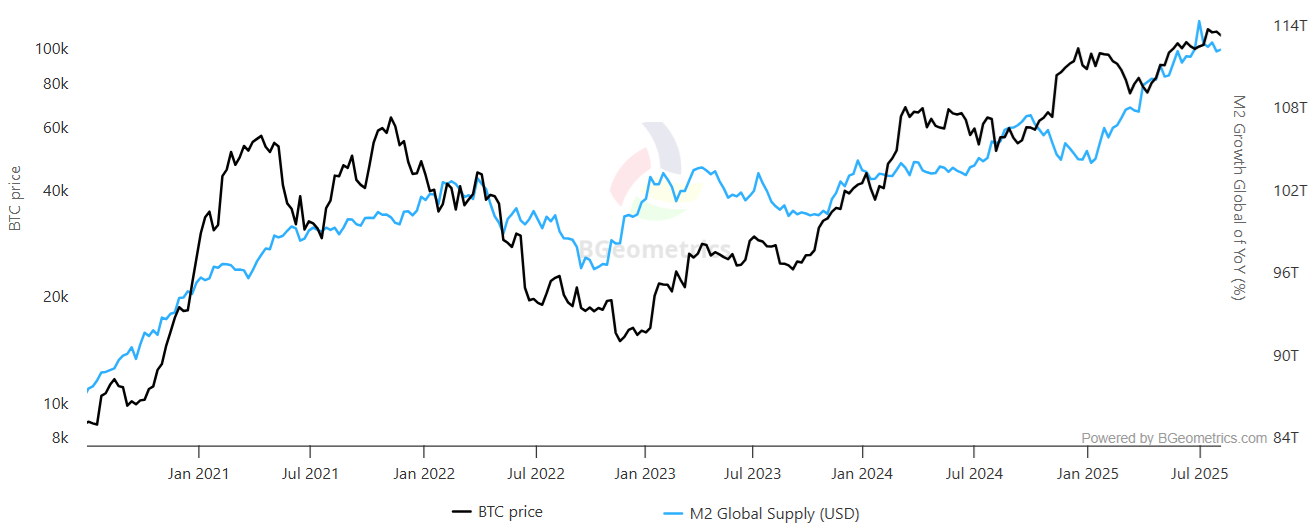

Money Supply Surges could push Bitcoin high

Global liquidity has reached record levels. In July, the 21 largest central bank M2 money supply reached $55.5 trillion. The US alone has achieved a budget deficit of $1.3 trillion in just nine months.

Such money expansion often drives investors towards hard assets like Bitcoin. Even famous stocks like Nvidia have grown in value from $2.3 trillion to $4.4 trillion in March, with no major revenue jumps.

In this type of market, liquidity is more important than traditional valuations.

Bitcoin ETFs are locked up in gold

Currently spotting US Bitcoin ETFs $150 billion In assets, compared to Gold’s $18 billion. If Bitcoin ETFs overtake gold, sending a clear message to big investors and institutions that BTC is no longer a “risk-on” asset, but a serious preparation option would be a major milestone.

Such a shift could open the door for sovereign wealth funds, more public companies and governments to add bitcoin to their holdings.

Retail investors are still missing

Here’s the surprising part: Retail investors have not driven this rally yet.

Even though Bitcoin has risen 116% over the past year, Crypto Trading apps such as Coinbase and Robinhood have not seen a surge in downloads in November 2024. So the biggest wave of small investors may still be ahead.

If retailers jump in in 2025, history suggests that Bitcoin climbing can speed up quickly.

$12 trillion retirement shift

This week, US President Donald Trump signed an executive order that allowed cryptocurrency and other alternative assets in his 401(k) retirement account.

“I did it right, this Trillions of locks can be unlocked in Resignation capital for Bitcoin Other Compliant Assets,” said Michael Heinrich, co-founder and CEO of 0G Labs. Bitise Cio Matt Hougan called it “transformational for the industry.”

The US retirement pool is worth around $12 trillion. If similar rules extend to IRAS, 403(b) and 457(b) plans, the total could exceed $30 trillion.

What’s next?

Bitcoin still faces challenges, but the 2025 setup is hard to ignore.

Record money supply, ETFs are locked in gold, retailers are still on the sidelines, and with retirement capital currently playing, Bitcoin may still be seeing one of the strongest years.