Reasons to trust

Strict editing policy focusing on accuracy, relevance and fairness

Created by industry experts and meticulously reviewed

The highest standard for reporting and publishing

Strict editing policy focusing on accuracy, relevance and fairness

The soccer price for the Lion and Player is soft. I hate each of my arcu lorem, ultricy kids, or ullamcorper football.

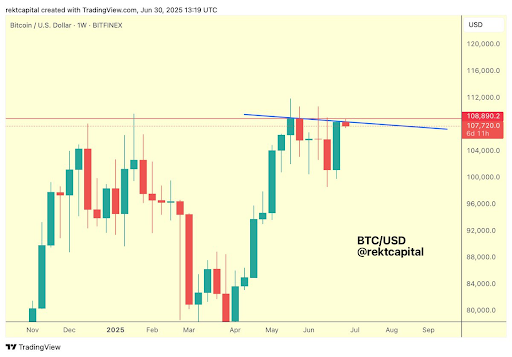

Crypto-analyst Rectangular Capital It warns about a potential crash in Bitcoin prices after flagship cryptography falls below critical resistance levels. Analysts also highlighted the level that BTC needs to play to disable this bearish setup.

Bitcoin prices risk crashing below resistance every week

in xPostRekt Capital revealed that Bitcoin prices have shut down their final major weekly resistance below $108,890. Based on this, he stated that there could be an early stage. Low resistance It could be developed for around $107,720 as BTC is at risk of crashing. Analysts added that Bitcoin needs to regain $108,890 in daily support.

Related readings

Previously xPostRekt Capital highlighted how important it was if Bitcoin prices exceeded this final major weekly resistance. He noted that BTC never achieved such a weekly end. So, if that happened last week, he insisted that it wasn’t just “historical” but also that BTC could make new uptrends possible The best ever (As).

However, it appears that Bitcoin prices have now been unable to hold well beyond the $107,720 level. BTC hit a daytime high of $107,970, but has since declined, and now risks losing a macro level of $106,800. Crypto-analyst Kevin Capital warned BTC below this level puts it in the danger zone.

On the other hand, it is based on history Bull Market CycleRekt Capital suggests that Bitcoin prices are still further to the left. in xPosthe said history suggests that Bitcoin might end the bull market in two or three months.

BTC still fuels the tanks

Despite the recent decline in Bitcoin prices, Crypto analysts Titan from Crypto declared That the flagship code still has fuel in the tank. He argued that the weekly market structure remains strong with a series of highs and higher lows. The analyst added that Relative Strength Index (RSI) It’s pushing towards that trend line.

Related readings

His accompanying charts showed that Bitcoin prices could rise as high as $140,000 between September and November this year, based on these higher and lower prices. Crypto-analyst I’ve also recently predicted Stockmoney’s lizard That BTC could reach $145,000 by September. He hinted at Dojis, formed for flagship cryptography on the current corrective channel, declaring them bullish for Bitcoin.

At the time of writing, Bitcoin prices have been trading for around $106,800 in the last 24 hours. data From CoinMarketCap.

Getty Images Featured Images, Charts on tradingView.com