Bitcoin It reached the highest ever It was $122,838 on July 14th, but has since fallen into the consolidation phase at the $118,000 level. The recent pause at upward momentum has not undermined market sentiment. This remains firmly bullish. Bitcoin currently sits at 68 greedy levels, according to Coinmarketcap’s Fear & Greed Index. This sentiment, combined with technology analysis of the Logarithmic Growth Curve (LGC), shows that Bitcoin is still on track due to a powerful upward movement.

Related readings

Greed returns to the market but hasn’t overheated yet

Bitcoin price action has spent most of the last 48 hours over $118,000 After the profitable wave It was made shortly after it peaked at $122,838. However, on-chain data provides an interesting overview of Bitcoin investors.

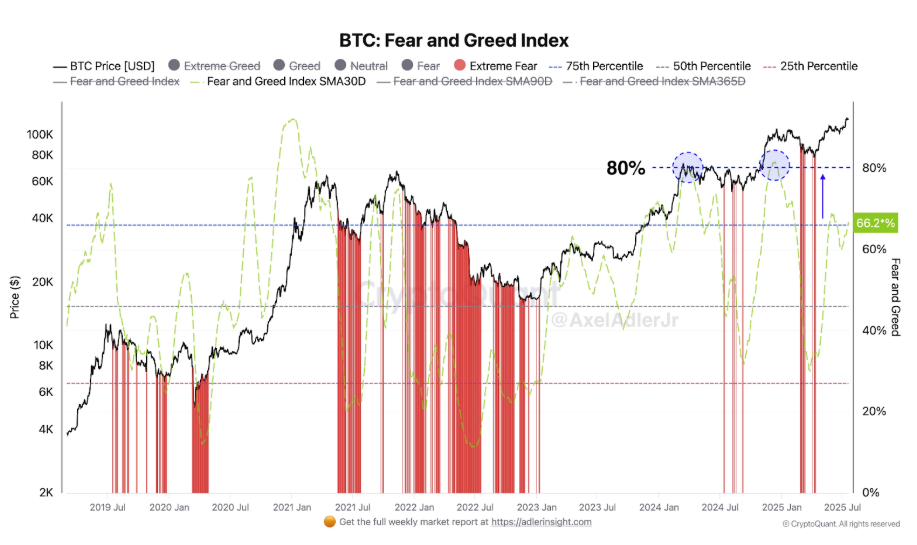

In particular, Crypto analyst Axel Adler Jr. Shared data From Cryptoquant, it shows that the 30-day moving average of fear and greedy index has returned to the optimism zone, currently at 66.2%. The sentiment surrounding major cryptocurrencies is currently in greedy territory, but this level is well below the 75% to 80% range, coinciding with the new price highs in March 2024 and December 2025.

The current 66% reading suggests that, although at the green level, there is still room for bullish emotions to grow before the market enters the euphoric phase. Essentially, this metric shows that Bitcoin consolidates and keeps pushing higher without entering an extreme greed level of 75% to 80%.

Bitcoin re-enter into the resistance zone on the growth curve

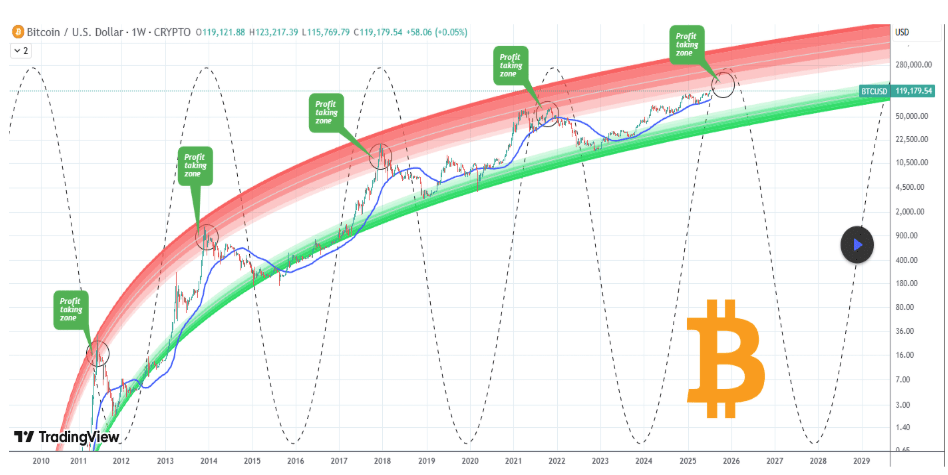

As mentioned above, Bitcoin is on break above the $120,000 price level The following peak Then there was a wave of profits. This trend has made Bitcoin price a very short time to $116,000, stabilizing around $118,000. Interestingly Technical Analysis Of the weekly candlestick time frame, Bitcoin has reached this price peak, indicating that it has reentered the first band of the logarithmic growth curve (LGC) resistance zone.

Identified as the bright pink area on the chart below, the band has always served as a profitable territory in each of Bitcoin’s past bull markets. Interestingly, Bitcoin easily tapped the area in December 2024 and January 2025, in a similar pattern to the January 2024 pattern. The first top of the previous bull cycle.

TradingView Image: Tradingshot

Essentially, this metric means that Bitcoin is at the start of the final build-up phase. The final top of this cycle will be between October and November 2025, according to Tradingshot, a Crypto analyst who posted the analysis on the TradingView platform.

Related readings

At the time of writing, Bitcoin is trading at $118,152.

Pexels featured images, TradingView charts