Bitcoin has recently experienced a keen volatility driven by the escalation and escalation of geopolitical tensions in the Middle East. Over the weekend, the BTC fell below the $100,000 psychological level, sparking panic among investors following reports of US military strikes on Iran’s nuclear facilities. However, emotions quickly changed when news of a ceasefire agreement between Israel and Iran was destroyed and strong rallies were triggered. Bitcoin has skyrocketed above $105,000, highlighting market sensitivities to global conflict headlines.

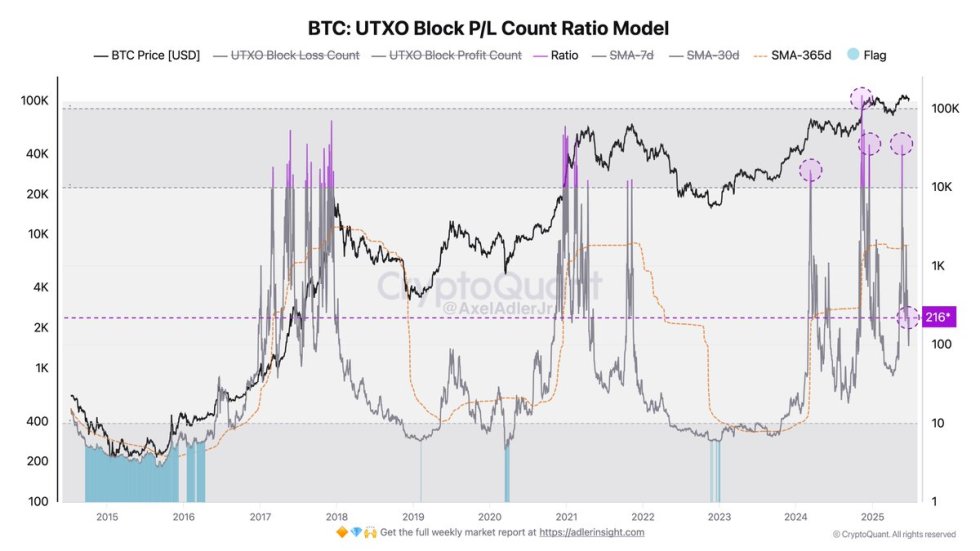

Supporting this recovery is data from Cryptoquant’s UTXO Block P/L Count Ratio model, which provides insight into investor behavior. At its $112,000 peak earlier this month, the model spiked to 34,000 points, showing a wave of profitability as many holders were sold with strength gains. Since then, the metric has plummeted to just 216 points, suggesting that profitable sales are running out, and transaction growth is at a loss.

This shift shows that sellers are largely stepping aside and buyers are beginning to take control at these lower levels. As long as Bitcoin remains strong above $10,000, the path forward could support a more stable recovery.

Eye stability of bitcoin after volatile spikes

Bitcoin has once again become a pivotal moment, surged by more than 7% in under 25 hours, regaining a price level above $105,000. Bounce has updated its bullish hopes, but Bitcoin remains firmly within the consolidation range that has defined its first price action since May. Despite the aggressive movement, the short-term direction remains unknown as global tensions, particularly in the Middle East, and tighter macroeconomic conditions continue to inject volatility into the market.

Top analyst Axel Adler shared fresh insights highlighting key changes in investor behavior. The model surged to 34,000 points when Bitcoin hit its all-time high of $112,000 earlier this month, according to Cryptoquant’s UTXO Block P/L Count Ratio model. This marked a wave of profits as many investors took advantage of peak ratings. However, the metric has since plummeted to just 216 points, indicating that profitable sales have effectively disappeared, with more participants achieving losses.

This sudden decline shows that sellers have largely left the market and created space for new buyers to accumulate at lower levels. Behavioral changes suggest that while negative risks still exist, rapid price crashes are unlikely to occur in the short term. With sales pressure cooling and long-term convictions returning, Bitcoin appears to be in a more constructive phase.

BTC surpasses key support in rebound attempts

The daily Bitcoin chart revealed a sharp bounce from a low waist of $98,200 to the area of $105,000, regaining a key support zone of nearly $103,600. This level previously served as both support and resistance since March, but is now an important battlefield for the Bulls. The price was shortly below the 50-day Simple Moving Average (SMA), but quickly recovered on top of that, updating its short-term strength.

Bounces also occur after Bitcoin tests 100-day SMA (nearly $96,000) which is historically the area of trustworthy buyers in the correction phase. But despite a bullish response, the BTC has yet to regain its $109,300 resistance level, closing multiple rallies since early June.

The latest spike in green candle volume suggests that demand is coming back at lower levels, examining on-chain data showing sellers are stepping up. Still, Bitcoin maintains a broad integration pattern, and if it can’t exceed $109,300, it continues its current scope-based structure.

To mark a true reversal of the trend, BTC must close decisively above $109,300 to break the momentum towards an all-time high. Until then, traders should expect continuous chops as macro uncertainty and geopolitical events place emphasis on short-term emotions.

Dall-E special images, TradingView chart