Data on the chain shows that a large Bitcoin investor added holdings last week.

Bitcoin investors with 10-10,000 BTC added to their holdings

It’s new post At X, on-chain analytics firm Santiment talks about the latest trends in Bitcoin supply held by 10-10,000 BTC investors. Here is the on-chain indicator of the relationship:Supply distribution“It tells you about the total number of tokens that a particular wallet group is currently carrying.

Addresses or investors are placed in these cohorts based on the magnitude of the balance. For example, a 1-10 coin group includes all holders who own 1-10 tokens of cryptocurrency.

In the context of the current discussion, groups that are within the BTC range of 10-10,000 are of interest. In this wide range, Sharks and whales. These investors own important holdings, so their actions are often worth noting.

Now, here is the chart shared by the analytics company. This shows the trend in the distribution of Bitcoin supply for 10-10,000 BTC holders over the past few months.

As can be seen in the graph above, the supply of Bitcoin held by 10-10,000 BTC investors means that this group has registered a big jump over the past week and has purchased a net number of coins.

More specifically, cohort members collectively added 79,244 BTC to their wallets during this period. At current exchange rates, this amount translates to a whopping $8.3 billion.

From the charts, we can see that this accumulation from major investors has arrived and that BTC is down after forming a new one The best ever (ath). This could be a potential sign that these holders still believe in the rally and see this drawdown as just a DIP opportunity.

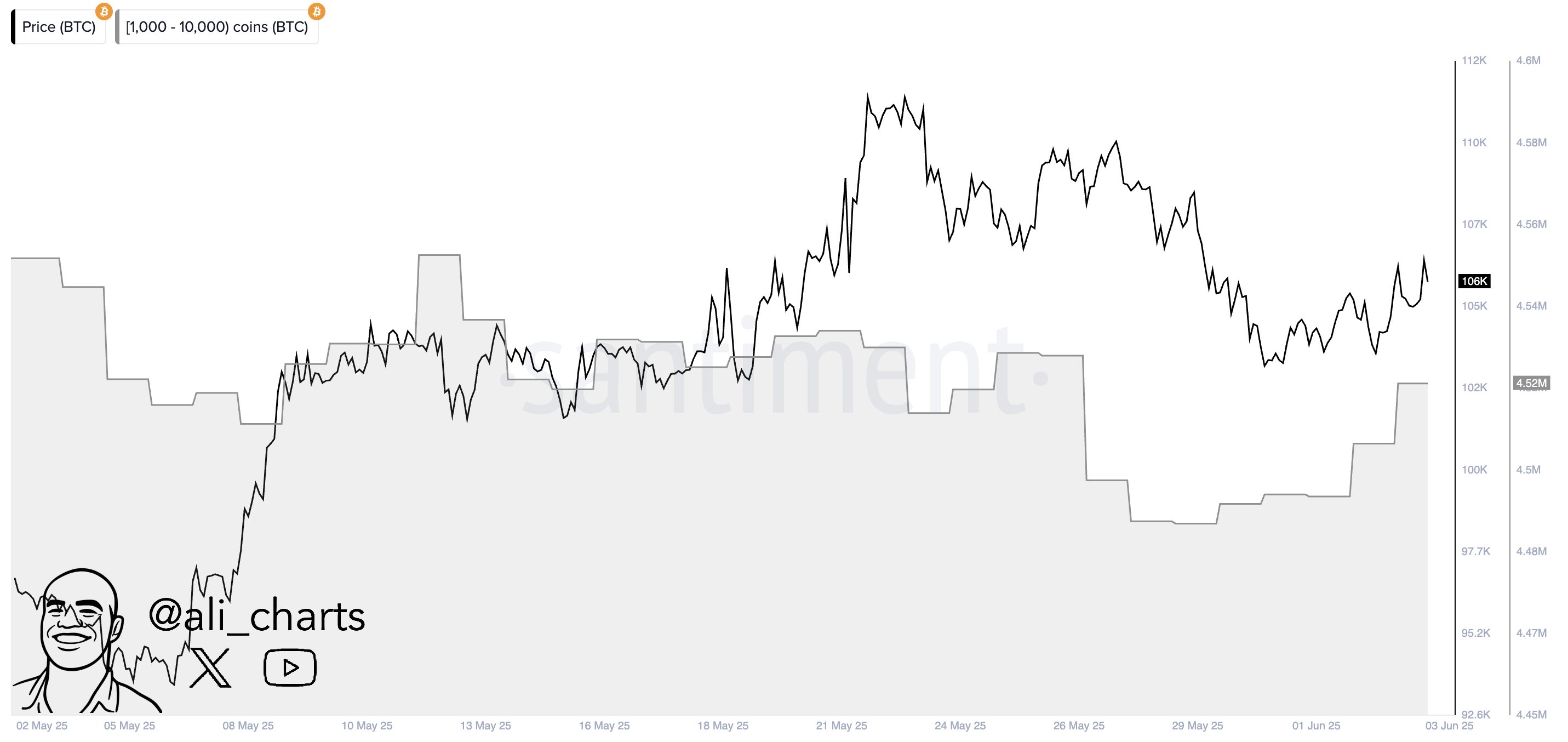

That said, the 10-10,000 range is a bit wider, so it includes big money investors, but that confuses their actions with some of the unimportant hands. Fortunately for Bitcoin, the whales (1,000-10,000 BTC) appear to agree to this buying trend, as suggested by the chart shared by analyst Ali Martinez.

As shown in the graph, cryptocurrency whales have been added to their holdings of around 30,000 tokens over the past few days. So it’s not just medium-sized customers who buy this dip.

BTC price

At the time of writing, Bitcoin has roughly $105,200 outperformed its approximately $105,200 over the past seven days.