Binance Coin (BNB) is on track to infiltrate a four-digit valuation after consolidating beyond $930. The Binance Ecosystem is one of the venues that will grow during the 2025 Altcoin season.

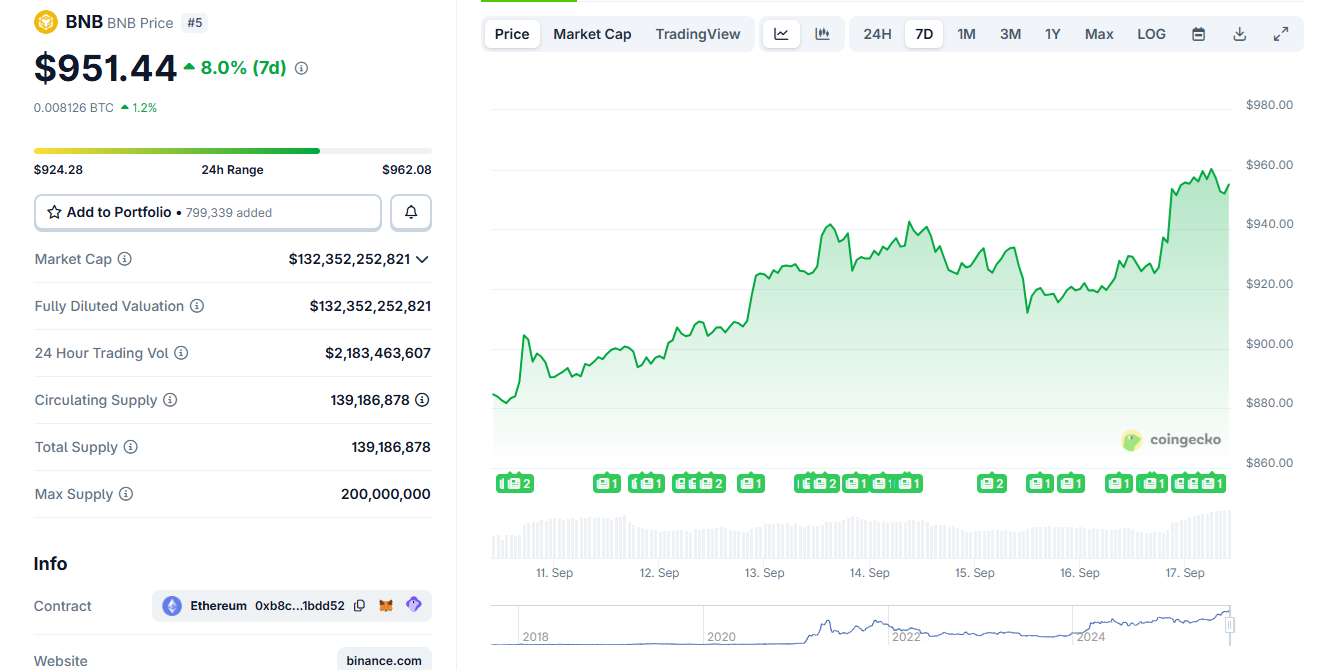

Binance Coin (BNB) is one of the outperform assets that sets expectations of climbing a four-digit rating. BNB recently peaked above $962 and later retreated to $951.44.

The BNB has marked a series of records over the past week as the Binance ecosystem demonstrated strength in both centralized and decentralized activities. |Source: Coingecko.

The token recovered following news of possible Binance’s potential to circumvent the requirement for external monitors as Cryptopolitan and resolve a lawsuit with the US Department of Justice. It has been reported Previously.

Based on the ongoing Altcoin season, BNB still benefits from the vibrancy of a growing market and could break a $1,000 milestone. BNB’s open interest has expanded to an all-time high of nearly $1.3 billion, suggesting that speculation could add volatility and cause a substantial price leap.

Over 23% of BNB activity occurs in Binance exchange, allowing tokens to respond quickly to liquidity.

Historically, BNB has gathered up to 10 times during the active Altcoin season. At this price range, tokens are expected to move at most five times. BNB, along with SOL, is expected to be able to reach a rating close to ETH based on the economy and app activity in the chain.

BNB Traders are still shy for $1,000

A $1,000 hike on BNB may not be done immediately. Currently, the token is locked in range, with a long position of around $933, suggesting a price drop is possible.

BNB’s short position is around $990 and its liquidity allocation is $1,000. The possibility of liquidating these locations is relatively small. However, general momentum suggests that BNBs will move to a higher price range based on ecosystem growth and general liquidity.

BNB is currently only open in 13 positions, not the hottest token of any high lipid whales. Seven whales are trying to shorten the BNB, all of them owing unrealized losses. However, long position traders face substantial negative funding fees to stay competitive.

Is Changpeng ‘CZ’ Zhao back to Binance?

Just as BNB hype was at its peak, the co-founder of Binance Changpeng ‘CZ’ Zhao changed the bio of his profile, sparking the proposal to return to some role.

Zhao’s impact on the crypto market cannot be denied, and its active role in Binance could further enhance the CZ effect. So far, Zhao has remained close to Binance, avoiding full support.

Place your finger on the keyboard.

Continue to build.– CZ

Zhao’s X Bio includes an @binance handle edited from ex- @binance, setting expectations for new roles or more active engagements in the future. Zhao’s decision could further improve BNB’s performance.

Previously, Zhao spoke in favor of the BNB finance company, but his presence could increase demand for BNB reserves. So far, BNB’s finances are the smallest compared to other entities.

Binance Ecosystem is also supported by YZI Labs, an investment division previously known as Binance Labs. Over 34% of YZI Labs’ investments have been sent to Binance Alpha Projects. 279.6% Returns is one of the best performances of a tier 1 fund. Access to Binance Alpha Tokens is one of the main reasons why we retain BNB. This is because the ecosystem is now expanding with hundreds of curated assets, which are now over $4 billion.