Bolivia has established itself as one of the countries in Latin America with the fastest adoption of cryptocurrencies, ranking among the 20 fastest growing markets in the world, according to a recent report from Chainalysis.

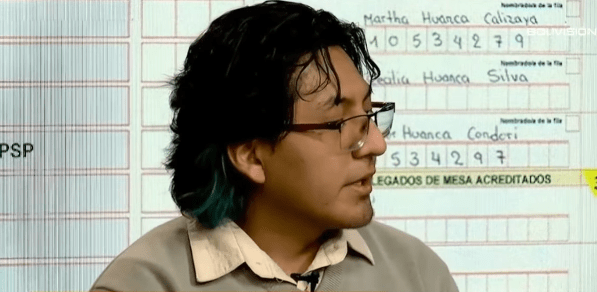

This quiet but persistent rise has sparked curiosity: What is really happening at high altitude? To understand the current state of the Bolivian ecosystem, CriptoNoticias spoke to Mauro Alejandro Chirinos, president of the Bolivian Blockchain Association (Asoblockchain) and a local community leader.

Chirinos explained that the path of cryptocurrencies is as follows: Bolivia is a long and winding country, marked by back and forth.. In 2010, Bolivia’s Central Bank (BCB) explicitly prohibited the use of payment gateways using crypto assets, with the aim of preventing fraud (a measure strengthened in 2020 by Resolution 144).

However, in June 2024, Council Resolution 082 lifted that ban. This 180-degree turn, motivated by a severe currency crisis and chronic dollar shortage, has enabled electronic trading with virtual assets. The results were immediate, with trading volumes soaring 630% from July 2024 to May 2025, reaching $294 million in the first half of 2025 alone.

Under the Luis Arce administration, Supreme Decree Nos. 5348 and 5384 (issued in January and May 2025, respectively) transferred responsibility for regulating virtual assets and fintech service providers to the Superintendent of the Financial System (ASFI), culminating in ASFI Resolution 540/2025 in July.

“This decree makes regulation by them, especially virtual asset service providers but also financial technology companies, an issue,” Chirinos explained in an interview, highlighting how the regulation explains important concepts such as digital assets, tokens, and stablecoins. Without closing any loopholes in regulations such as taxes,.

Does Binance need a local partner in Bolivia?

Chirinos said one of the main ambiguities is that foreign companies and foreign crypto exchanges must form some sort of partnership with a local entity to formally establish themselves.

However, under certain circumstances Bolivian users may be able to access it without local registration. This leaves citizens in a vulnerable position. This is because the platform is not supervised by ASFI and therefore does not offer the same guarantees or protection mechanisms as locally regulated entities. Facts that put users at risk in case of fraud, hacking, and bankruptcy.

The main ambiguity in this regulation is that foreign companies such as Binance and BitGate must form partnerships with local companies to formally establish themselves. They cannot work independently. Fintech startups enter a regulatory sandbox (a controlled testing environment) where they are registered and evaluated, but the process is not entirely clear.

Mauro Alejandro Chirinos, president of Aso Blockchain Bolivia, said:

However, foreign platforms are not required to create or form partnerships with local companies if they do not maintain them. These can operate freely accessible to Bolivian users (e.g. via app or web) as long as they do not offer joint services with local ETFs or violate anti-money laundering regulations.

According to Chirinos, this explains why the exchange looks like this: Binance remains available in Bolivia Local registration is not required, but if you want a branch office or a formal cooperation agreement, you will find yourself in the realm of forced affiliation.

Other ecosystem analysts, such as Alison Berbetty of the BlockchainCablock Bolivian Chamber of Commerce and Industry, have criticized the lack of transparency in the evaluation criteria. “What happens if the regulator doesn’t have a trained team? What are the exact criteria for passing the test? Barbetti asks.

This ambiguity is seen as a potential “discretion filter” that slows down innovation, especially for small foreign startups interested in partnering.

Taxes, Bolivian virtual currency concerns

In addition, Mr. Chirinos noted that the ASFI Regulation (Resolution 540/2025) Does not support taxes on crypto assets or fintechthis aspect remains vague. This is done intentionally within a sandbox, designed as a “test environment” to experiment with Bolivian law without any immediate tax burden, and to foster innovation.

As he suggests, the question remains how startups will declare profits during testing. Are general taxes (such as VAT or financial transaction tax) applicable to P2P transactions with stablecoins such as USDT, which account for 86% of Bolivia’s crypto operations?In the absence of a specific tax framework, they remain informal. That’s the reason. It warns of “troubling gaps” in accounting and finance.

For the new government of President Rodrigo Paz Pereira (to take office in November 2025), bridging these gaps with fiscal guidance and transparent standards could turn gray areas into solid bridges. To achieve this, Chirinos will promote mass education by 2026. Without paying attention to these factors, “working legally” remains half-baked and exposes users and entrepreneurs to unnecessary risks, he says.