The cryptocurrency market has seen a surge in institutional interest over the past few months, with BlackRock making a notable move towards Ethereum. The move sparked bullish outlook for Ethereum (ETH) prices.

On June 5th, BlackRock purchased $34.7 million worth of Ethereum (ETH), showing a major change in institutional investment patterns.

With ETH prices currently trading at around $2,572, the move sparked debate over the possible bullish outlook for the asset.

With Ethereum prices continuing to consolidate, it is eye-opening whether BlackRock’s decision can show a larger shift towards ETH adoption.

BlackRock’s $34.7 million Ethereum purchase raises institutional trust

BlackRock has made a major move in the cryptocurrency market by purchasing $34.7 million worth of Ethereum (ETH) through the Ishares Ethereum Trust.

On June 5, the company added 27,846 ETH, worth $73.21 million, bringing its total Ethereum holdings to approximately 1.49 million ETH, worth $3.93 billion.

This highlights the company’s strong belief in digital assets for the 12th consecutive day of BlackRock’s inflow into Ethereum.

These consistent purchases underscore the growing institutional interest in Ethereum. The $34.7 million worth of ETH acquired by BlackRock shows that large investors are positioning themselves for Ethereum’s potential long-term growth.

Ethereum’s market trajectory, currently priced at $2,572, is affected by a wider trend, including an increase in institutional investment in cryptocurrencies.

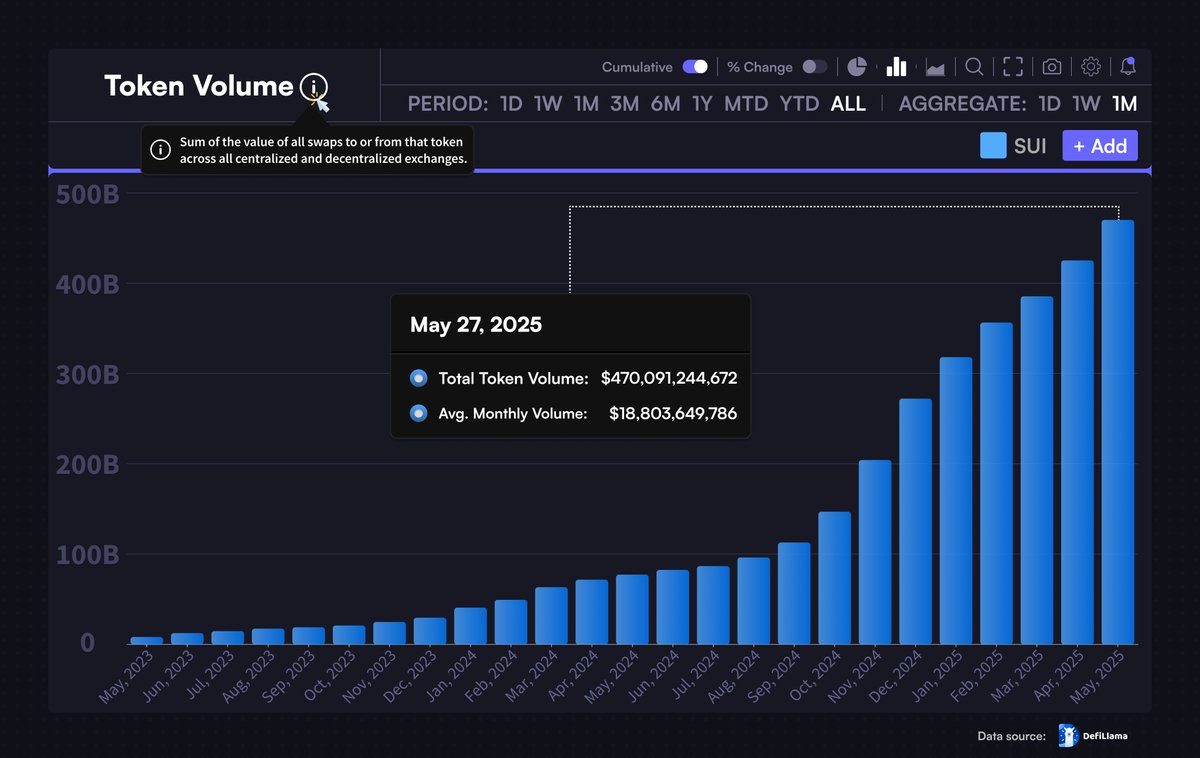

Source: x

In addition to BlackRock, other prominent institutions like Fidelity are also increasing exposure to Ethereum through exchange sales funds (ETFs).

This wave of institutional investment has contributed to the increased traction of Ethereum, which could indicate a shift in sentiment towards a more bullish outlook for assets.

Ethereum’s strong market performance amid growing institutional support

Ethereum prices have increased significantly over the past few weeks. Just above $1,900 in May, ETH has surged to its current level of $2,572.

This price range represents a solid upward trend, but analysts are closely watching how Ethereum responds to key technology levels.

Coupled with these institutional influx, Ethereum’s market performance suggests that ETH could be set up for further profits, especially if it breaks significant levels of resistance.

Some analysts, including Lark Davis, have pointed out that Ethereum outperformed Bitcoin (BTC) in the second quarter of 2025.

Furthermore, recent Ethereum protocol upgrades, such as the Pectra upgrade, have improved scalability, reduced inflation, making ETH an increasingly attractive asset for institutional investors.

The overall sentiment remains bullish, but there is a mix of market signals. According to Polymarket, there is only a 27% chance that Ethereum will reach an all-time high by 2025, indicating market uncertainty.

However, the growing institutional interest and increasing influx from ETFs like BlackRock’s Ishares Ethereum Trust provide a positive outlook for Ethereum.

If prices continue to exceed key support levels, there may be room for even more price increases in the short term.

Ethereum price action and potential breakout scenarios

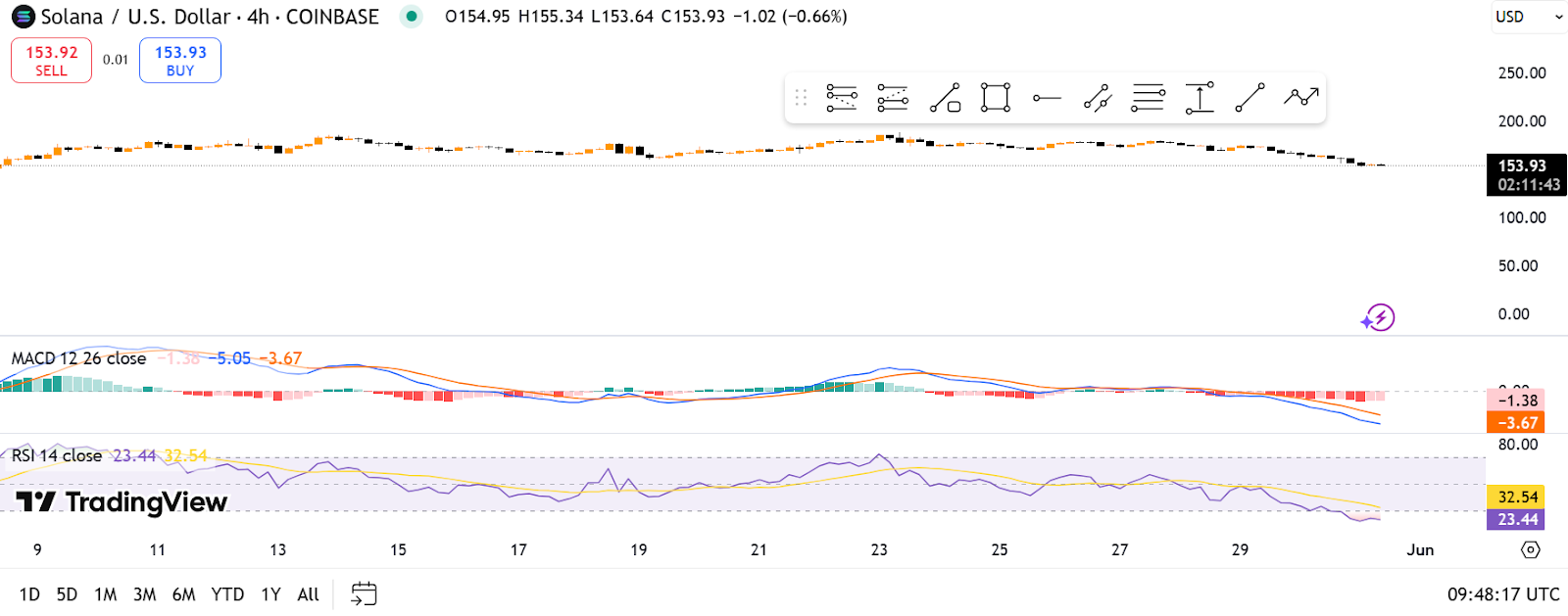

TradingView shows that Ethereum is currently trading at $2,455.9 after a slight decline of 0.03% over the past four hours period.

The recent price movement is between $2,455 and $2,468, indicating that Ethereum is consolidated within a small price range.

This means that the market is uncertain after an upward movement, and the situation may be uncertain and support range stability.

The MACD signal suggests that market trends could quickly weaken as the MACD line lies beneath the signal line.

The histogram shows a red line, confirming that there is downward pressure in the market.

The gap between lines on the chart suggests low energy, so it is unclear whether the bearish trend will continue or whether the market will reverse.

Source: TradingView

According to the stochastic oscillator, the blue line is 24.01 and the orange line is 18.83, suggesting that both are oversold.

So this could suggest that a bearish reversal could be offshore, but there is no clear crossover yet.

This allows Ethereum prices to continue to integrate before having a short-term bounce or gaining some decisive momentum in any direction.